PEPE faces bearish winds: A look at the end-of-August sell-off

- Pepe has not rid itself of the bearish price momentum of the past week.

- The metrics showed a wave of selling toward the end of August.

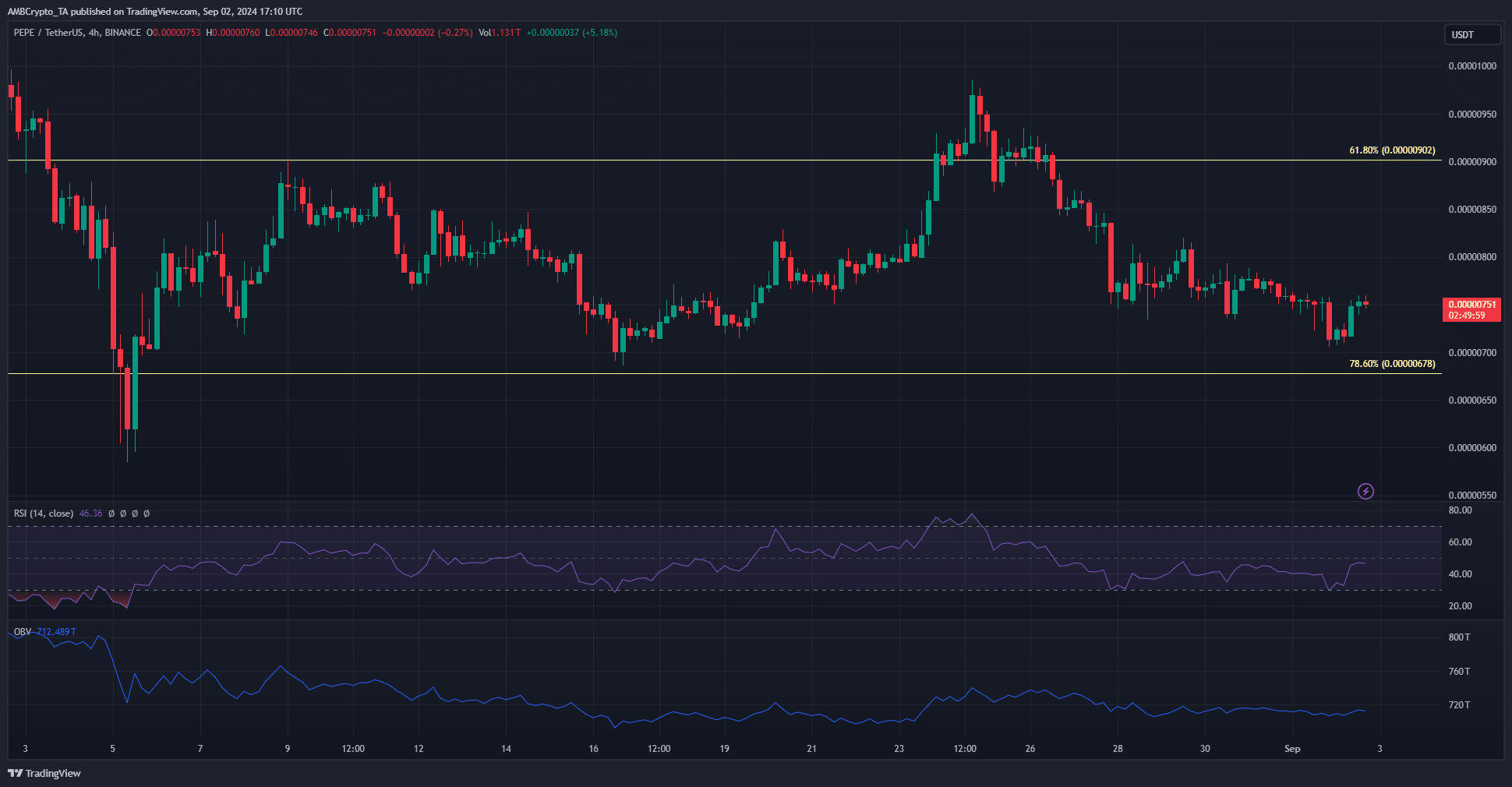

Pepe [PEPE] was trading within a bullish flag on the higher timeframes and was undergoing a period of consolidation that could last two or three more weeks.

The bearish momentum has slowed down but was not yet replaced by bullish momentum on the daily timeframe.

The 4-hour chart revealed that the momentum was even closer to flipping bullishly. The OBV needs to start making new highs to indicate strong buying pressure.

AMBCrypto examined some on-chain metrics to gauge the crowd engagement and what could come next.

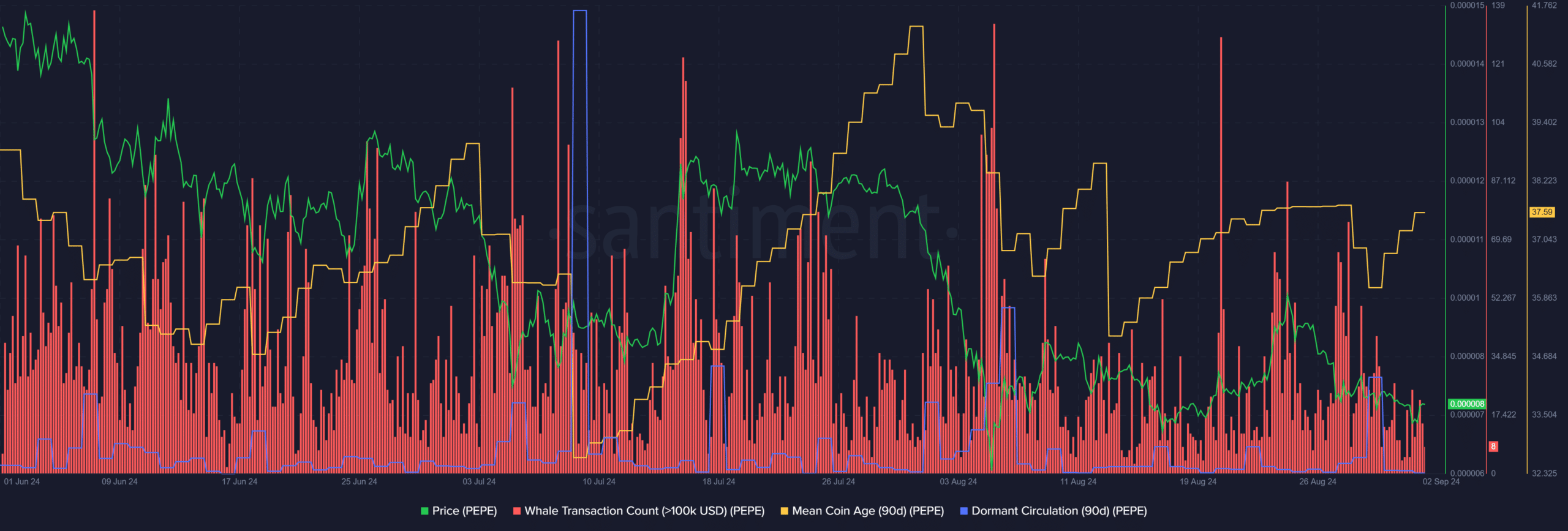

Pepe whale transactions indicated some panic in recent days

Source: Santiment

In the second half of July, the mean coin age was trending higher to show network-wide accumulation of the meme coin. During that time, Pepe whale transactions were heightened and indicated potential whale accumulation.

However, on the 5th of August, the deep price correction was accompanied by a huge increase in whale transactions. This indicated panic in the market.

A similar scenario but much smaller in magnitude played out on the 28th and 29th of August.

The mean coin age fell lower and the whale transactions rose to show increased selling pressure from the larger market participants. This was accompanied by a dormant circulation spike on the 30th of August to indicate a wave of selling behind Pepe.

Bearish weighted sentiment and network participation

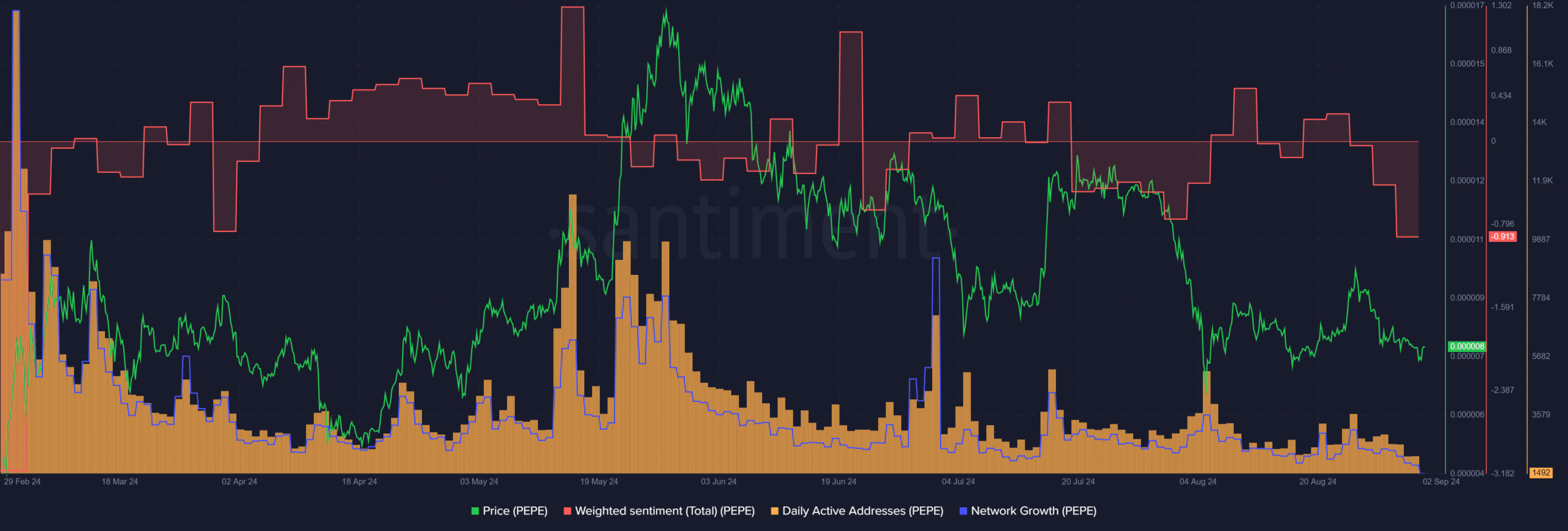

Source: Santiment

Investors would be hoping that the recent wave of selling might be the last one for a while to come. Even if prices halt at the $0.0000071 support zone, the network activity is discouraging.

Both the daily active addresses and the network growth metric declined over the past week alongside the price.

Is your portfolio green? Check the Pepe Profit Calculator

This showed reduced market participation and shrinking PEPE adoption.

The weighted sentiment also dropped dramatically to reflect bearish sentiment in online engagement. Overall, the short-term price action might be shifting its trajectory but the network metrics were uninspiring.