PEPE falls to key level: Can bulls reverse losses

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Pepe [PEPE] has been firmly under the bears’ control for a while now. It has consistently made lower lows on the charts throughout May.

However, price action hit a critical level, which could improve recovery chances, especially if Bitcoin [BTC] crosses $28k.

Will PEPE rebound at this support?

On the four-hour chart timeframe, based on Binance Exchange data, PEPE’s price slump eased at $0.00000105 – $0.00000141 (cyan). This zone is a bullish order block (OB) on the 12-hour chart, formed on 12 May.

So far, price reaction at the bullish OB has been positive since 24 May, as shown by the lower candlestick wicks. It suggests that PEPE sees considerable buying pressure at this level, which could make it a key demand zone for a likely price reversal.

However, the price is constricted on one side by the trendline resistance (orange) and on the other by the bullish OB.

If bulls clear the trendline resistance persists, PEPE could attempt to rally to the 50% Fib level of $0.00000160. Although such a move wouldn’t reverse all the May losses, it will offer little leverage.

Conversely, sellers could continue with their control if the trendline resistance persists. Such a move could see PEPE ease at the 23.6% Fib level of $0.00000131 or $0.00000105.

Meanwhile, the OBV improved slightly, indicating little demand. The RSI rose too but retreated below the neutral level as of press time, highlighting buying pressure eased.

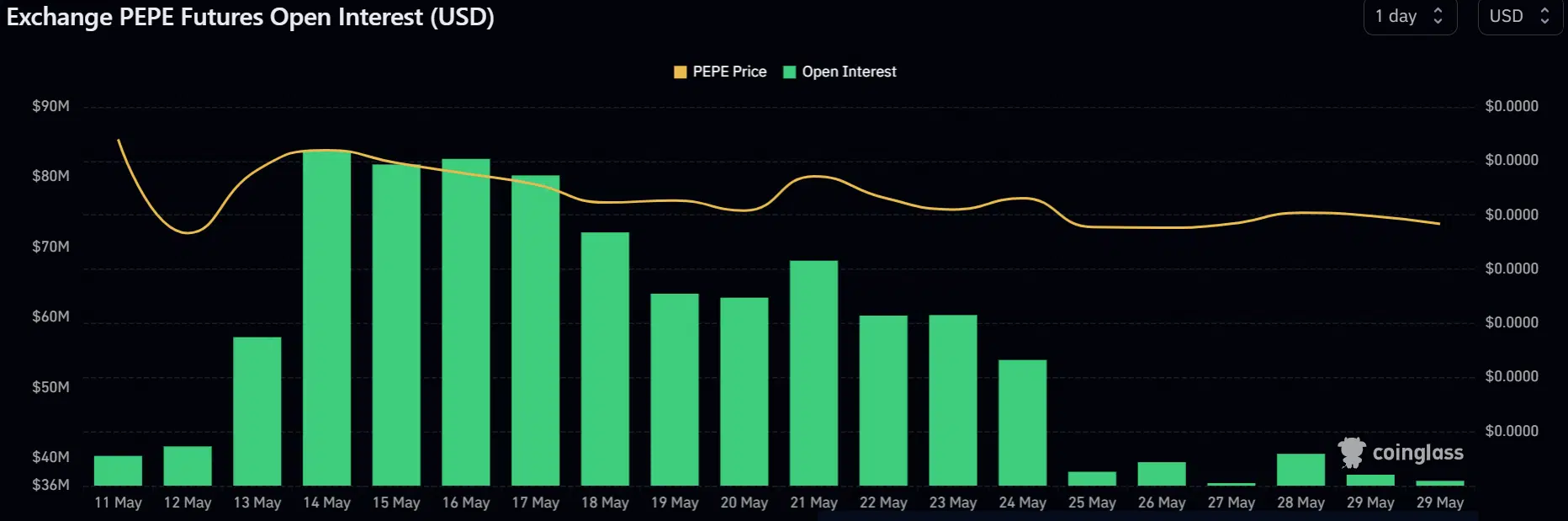

Open interest rates remain low

Is your portfolio green? Check out PEPE Profit Calculator

Given the declining open interest (OI) rates, near-term bulls could face more challenges. PEPE’s OI has dropped from over $80 million in mid-May to around $40 million in the past few days. That translates to a 50% drop in OI that could undermine a strong recovery and bullish momentum.

However, the volume-weighted funding rates were positive in the past few days and could offer bulls little hope, especially if BTC crosses $28k.