Analysis

What do PEPE, FLOKI price predictions say?

The A/D indicator resumed its uptrend as PEPE’s prices rose above this level.

- PEPE and FLOKI have a long-term bullish outlook

- The coming week could see the meme coin markets climb higher.

Pepe [PEPE] posted gains of 17.53% at press time. The weekend was favorable for FLOKI [FLOKI] too, but the meme coin

only posted gains of close to 8% in the past 48 hours.The gains of Dogecoin [DOGE] last week could set up a bullish week for the rest of the meme coin market. Of the two coins AMBCrypto analyzed here, PEPE had a more bullish short-term outlook.

PEPE price action posts a bullish continuation

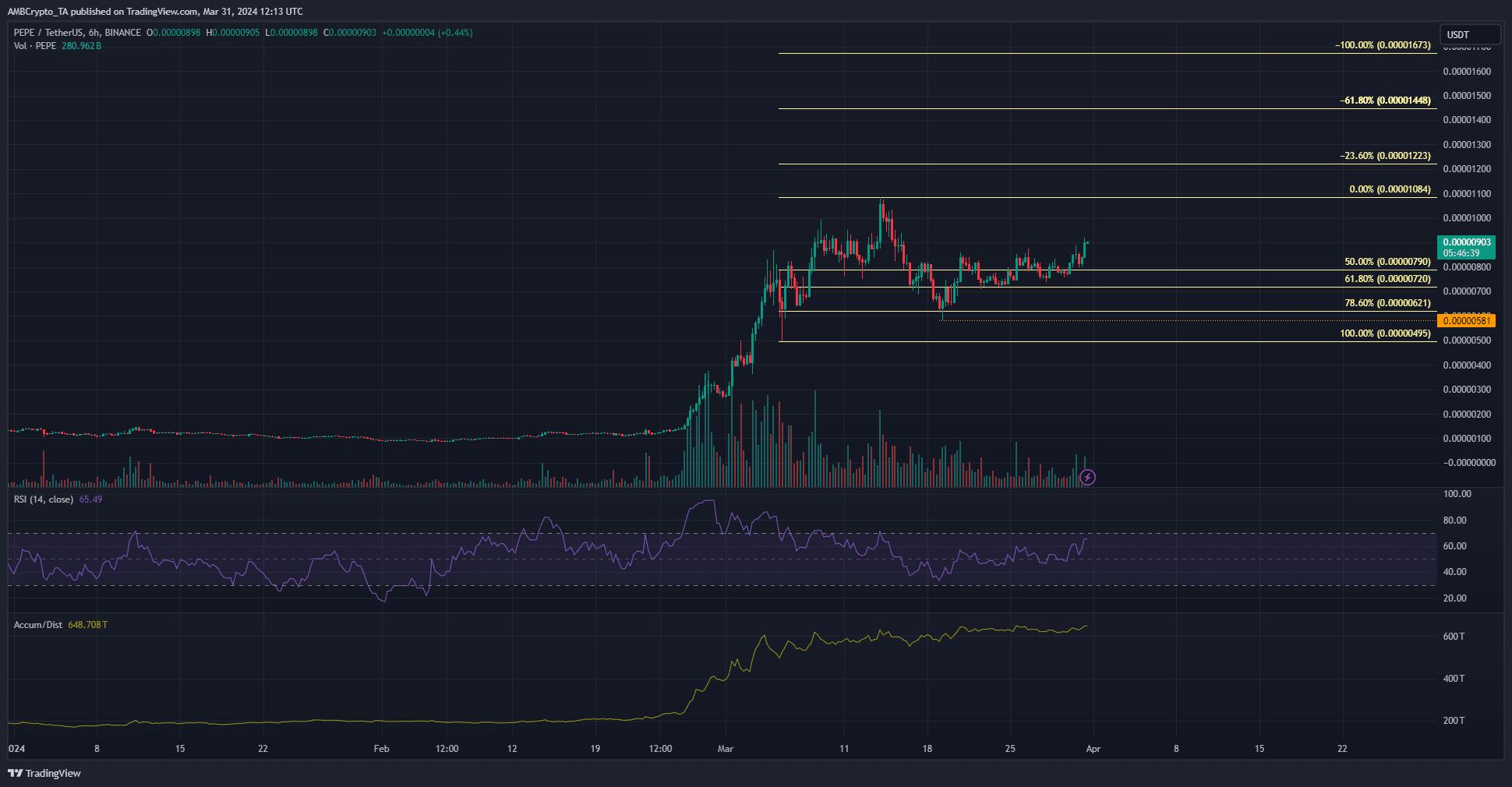

PEPE retraced from its all-time highs at $0.00001084, but did not approach the swing low set at $0.00000581.

Instead, the buyers gained some momentum and forced prices past the local resistance at $0.0000085.

The A/D indicator resumed its uptrend as PEPE prices rose above this level. It indicated demand was present behind the move. The RSI also climbed past the 60 mark to denote strength.

Given BTC could face significant resistance near $72k, it was unclear whether PEPE would manage to carve for itself another northward run like it did in late February.

Source: Coinalyze

The metrics on Coinalyze were encouraging. The spot CVD trended higher since the 19th of March, reflecting demand. It also corroborated the findings from the A/D indicator.

The Open Interest slowly trended higher since the 25th of March and saw a large jump higher as the local resistance was breached.

It was a signal that speculators were willing to go long on PEPE’s short-term breakout.

FLOKI was slower off the mark

FLOKI bulls were more hesitant than Dogecoin and Pepe. The CMF indicated a healthy influx of capital into the FLOKI market. The RSI also remained above neutral 50 on the 6-hour chart.

Like PEPE, it has a bullish market structure. Additionally, the 61.8% Fib retracement level saw a good reaction from the bulls. In the short term, volatility was likely.

The higher timeframe bias was strongly bullish.

Source: Hyblock

The Cumulative Liquidation Levels were mildly negative, showing a move upward to flush the short positions. Prices are attracted to significant pockets of liquidity.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The $0.00027 was estimated to have close to $10 million in liquidation.

As a support zone, the $0.000235 level was also an area of interest. We may see a sharp move upward to liquidate the low-leverage short positions near $0.00027 before a downturn.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.