PEPE gains 57% in 7 days, but bulls wait for something else

- PEPE has a strongly bullish market structure and consistent buying pressure.

- The retracement sidelined bulls are waiting for might not go as low as they would like.

Pepe [PEPE] was in a strong uptrend and has comfortably outperformed the other well-known large-cap meme coins.

In the past week, it has gained 57.6%, compared to Shiba Inu’s [SHIB] -0.01% or Dogecoin’s [DOGE] 11.6%.

It has its sights set firmly on the next Fibonacci extension level, but in the long term, it could go much, much higher. Could PEPE catalyze the next altcoin run?

The strong bullish structure could give bulls a chance to re-enter

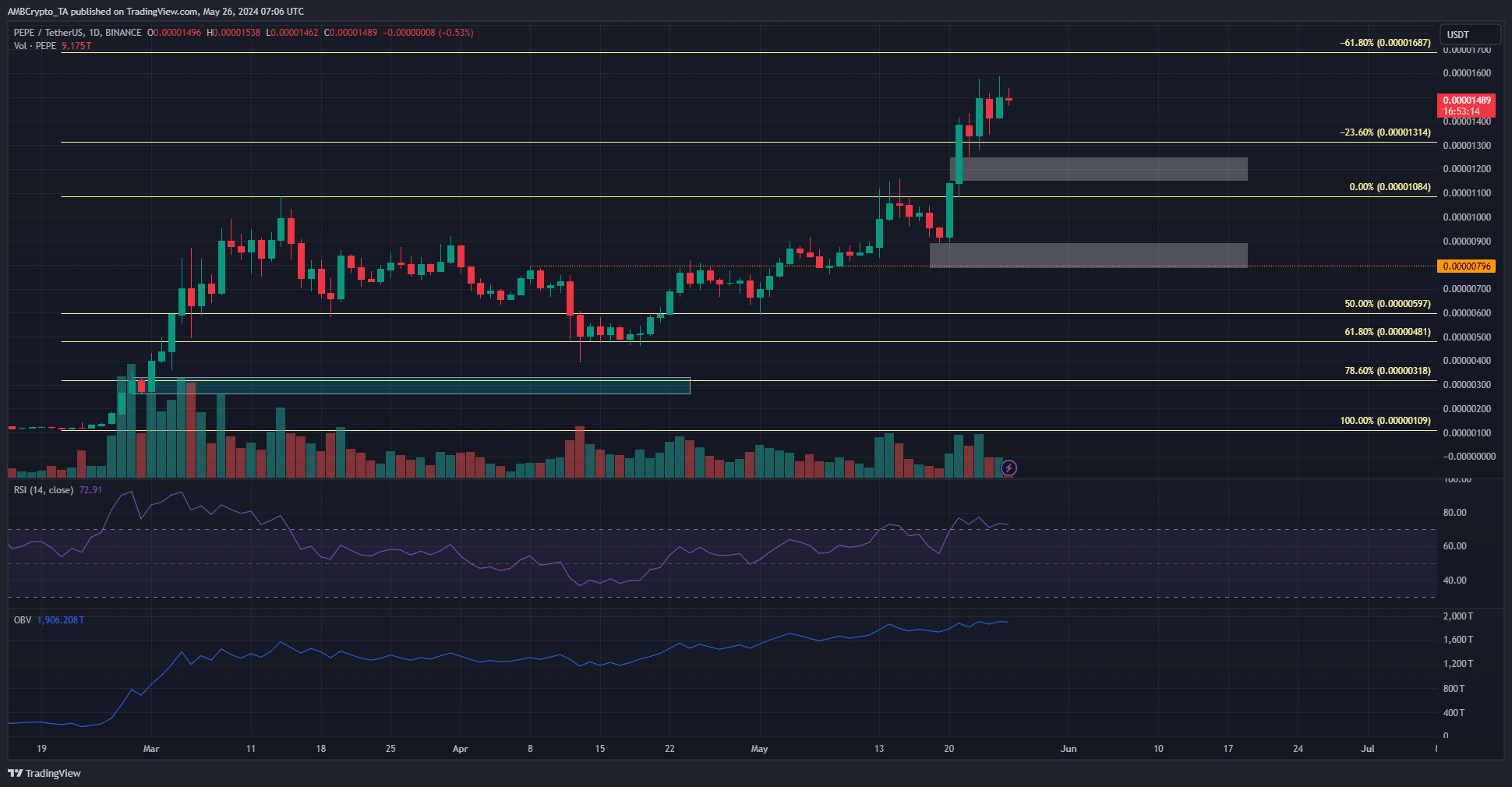

The one-day chart has been bullish since early May, when prices breached the $0.00000796 resistance.

In the past week, the imbalance left behind at $0.0000122 might be a short-term bearish target if prices seek liquidity.

The 61.8% Fibonacci extension level (pale yellow) at $0.0000168 was a place where selling pressure might elevate as PEPE holders realized profits.

The RSI on the daily chart was at 72, which underlined the strength of the past two weeks’ momentum.

The OBV was also swiftly climbing higher to reflect consistent buying volume.

The trading volume each day did not skyrocket like it did in late February, but that might not be a concern due to the consistency of the bulls in May.

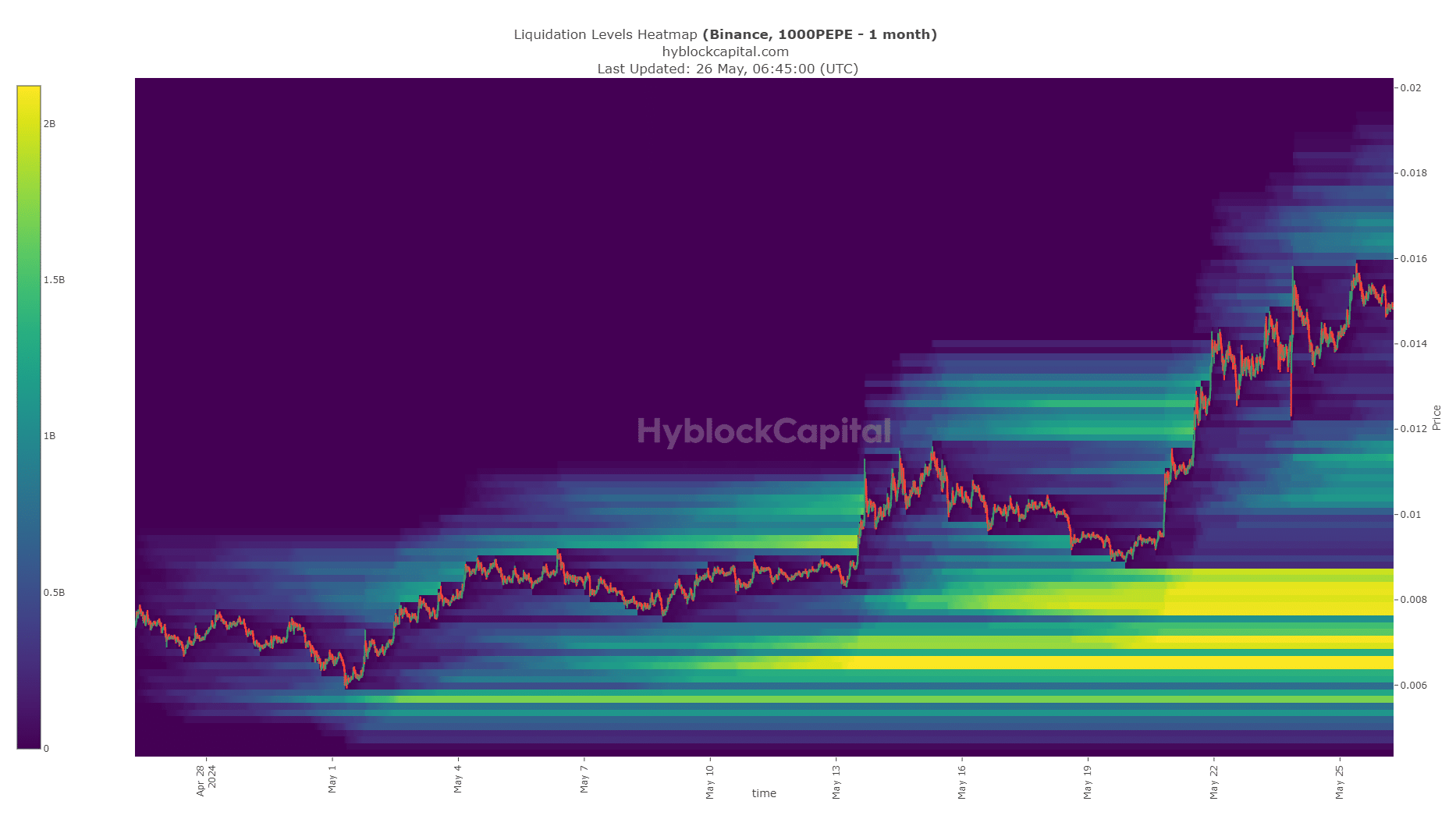

The magnetic zones for PEPE might not be able to reel the prices toward them

Source: Hyblock

The past month’s liquidation levels were clustered around the $0.000008 zone, which was also marked on the 1-day price chart as a liquidity pool.

The $0.00000645 and $0.000007 levels also have a huge pool of long liquidations in store. However, these prices are 50% below the current market prices.

A retracement to these zones might not occur yet. The market sentiment was firmly bullish, especially behind PEPE. It could climb higher to entice more long positions with higher leverage from impatient bulls.

Hence, a move to the Fib extension at $0.0000168 would likely occur before any retracement.

Read Pepe’s [PEPE] Price Prediction 2024-25

In the event of a retracement, the $0.0000105-$0.0000103 area might repel the first wave of sellers before a deeper retracement.

Traders should be prepared for the possibility that prices might not fall below $0.0000113 for many weeks, especially if Bitcoin [BTC] begins another move higher and takes PEPE along with it.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.