PEPE – How likely is a 35% rally for this memecoin’s price?

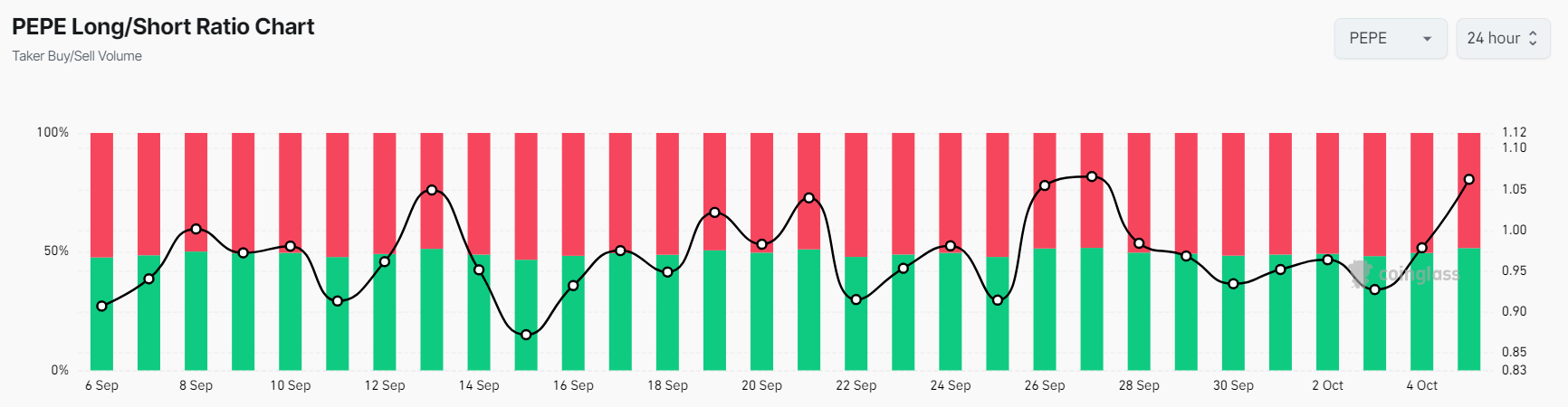

- PEPE’s Long/Short ratio, at press time, stood at 1.062, indicating a strong bullish market sentiment

- Futures Open Interest jumped by 15% in the last 24 hours

It appears that the popular memecoin PEPE is poised for a significant price rally after it formed a bullish pattern. Its on-chain metrics are now flashing bullish market sentiments too.

This bullish reversal comes after PEPE registered a price decline of over 28% in recent days. Owing to the same and a set of contributing factors, PEPE might soon register an uptrend on the charts.

PEPE technical analysis and key levels

According to AMBCrypto’s technical analysis, PEPE successfully retested its descending trendline breakout. It thus formed a bullish engulfing candlestick at the 200 EMA and support level of $0.0000085 – A bullish sign for PEPE holders.

Based on recent price performances, there is also a strong possibility that PEPE could soar by 35% to reach the 0.0000125 level in the coming days.

Additionally, the memecoin is trading above the 200 EMA, indicating an uptrend, with its Relative Strength Index (RSI) showing potential for an upside rally too.

Bullish on-chain metrics

PEPE’s positive outlook can be further supported by its on-chain metrics. Coinglass’s PEPE Long/Short ratio, for instance, had a reading of 1.062 at press time. This pointed to a strong bullish market sentiment among traders.

Also, its Futures Open Interest jumped by 15% in the last 24 hours and 7.65% in the last four hours. This rising Open Interest underlined traders’ belief and confidence in a price surge in the coming days.

Investors and traders often use a combination of rising Open Interest and long/short ratio above 1 when betting on long positions. Right now, 51.51% of top traders hold long positions, while 48.49% hold short positions.

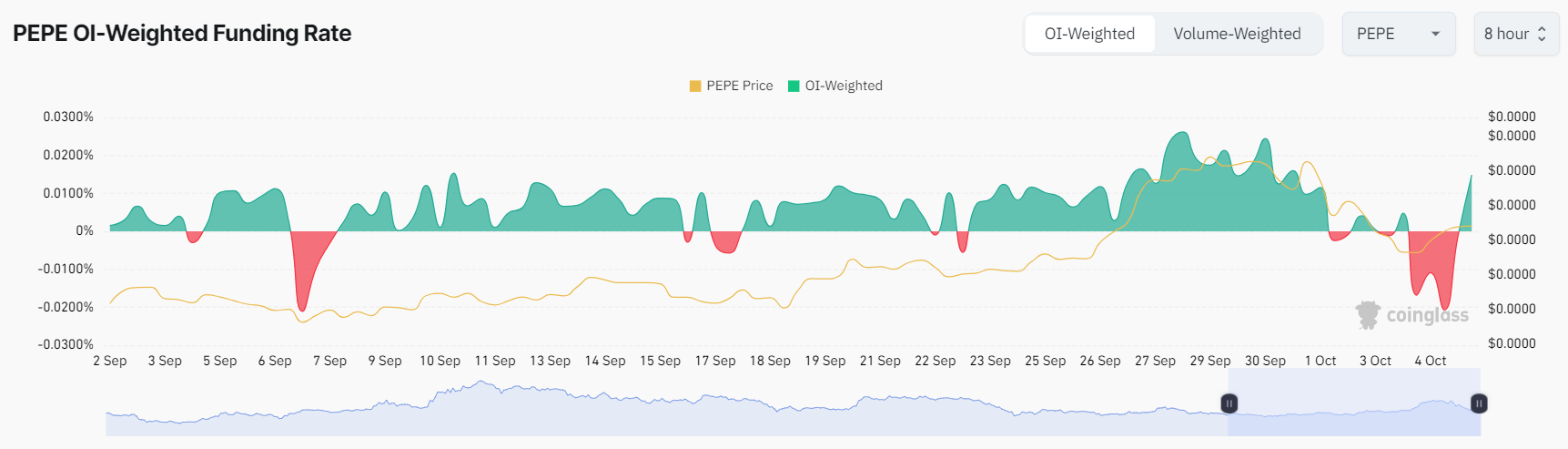

Additionally, PEPE’s OI-weighted funding rate was positive, with its value at 0.0149%. What this meant was that longs have been paying shorts – Another bullish sign.

Current price momentum

At press time, PEPE was trading near $0.0000094, following a hike of over 4.5% in 24 hours. Over the same period, its trading volume dropped by 7.5%, indicating lower participation from traders and investors.

Besides PEPE, other major memecoins like Dogecoin (DOGE), Shiba Inu (SHIB), and dogwifhat (WIF) also saw positive rate changes in the last 24 hours. Needless to say, the last few trading sessions have been good for the market’s memecoins.