PEPE nears key level: What does a 13% increase mean for holders?

- PEPE’s price and volume surge indicate renewed market interest.

- Profitable addresses and bullish sentiment rose as well.

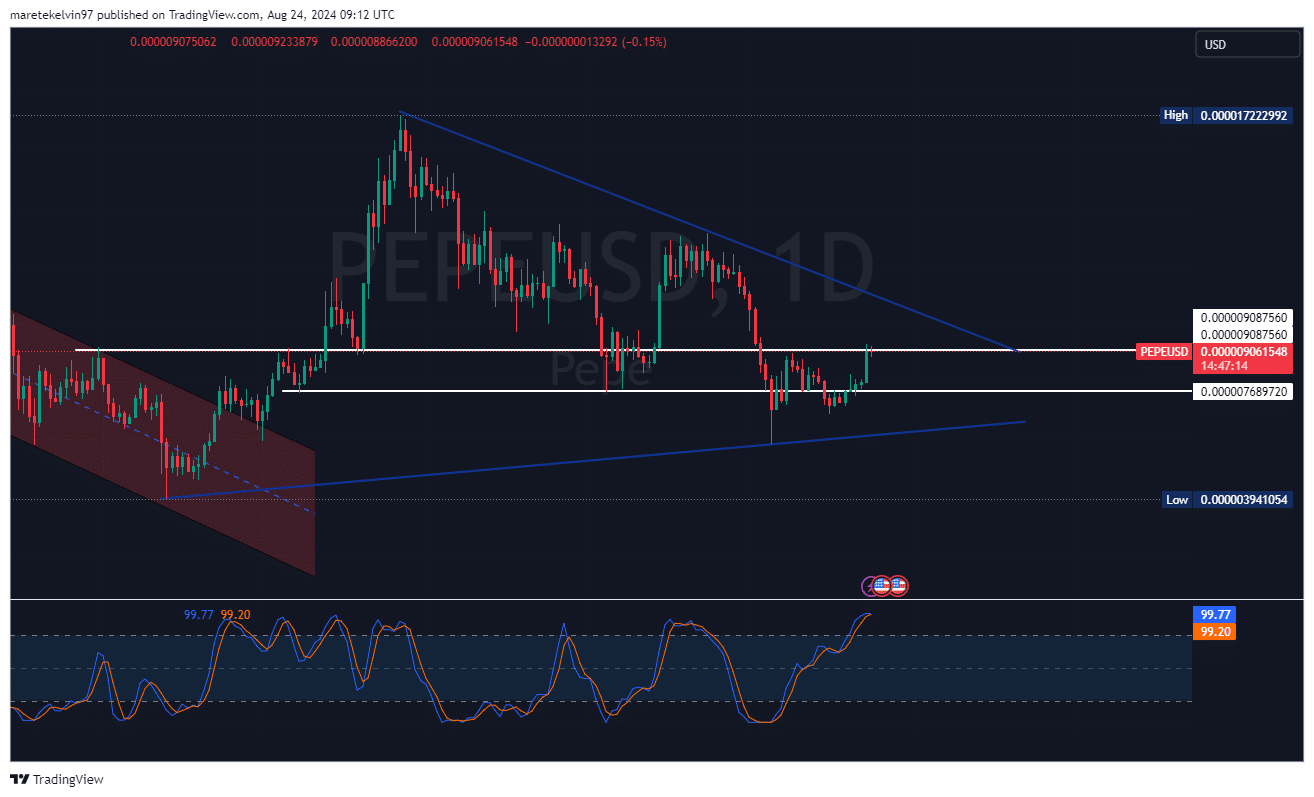

Pepe [PEPE] witnessed a 13% rally a day ago, catching the attention of market participants. As of writing, the coin was testing a critical support level around $0.00000076, a level that has historically provided strong resistance.

The big question is whether it can hold this level and potentially set the stage for another upward surge.

Can PEPE hold the line?

The current price action for PEPE suggests an important stage. The price is nearing a down-trending line on the daily chart that had been impenetrable for several weeks.

A breakout above this trendline could trigger another rally, but if the support level fails, it might lead to a sharper decline.

The market participants are at a crossroads on whether or not they can anticipate for any pullback or growth in PEPE

Source: TradingView

PEPE shows signs of strength

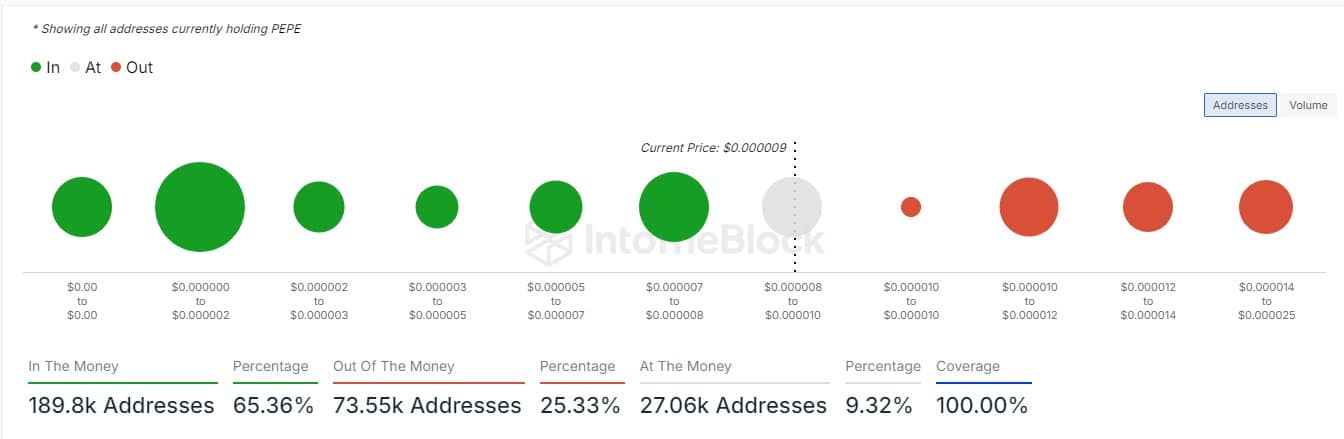

Adding to this suspense are the active addresses, which indicate an increase in the holders proportion. 65% of PEPE holders are “in the money,” meaning they bought in at a lower price and are sitting on gains. This 189.8k in profit indicates a strong base of holders confidence.

This creates some stability given that these holders are not looking to sell quickly, more so if they believe that further gains might be achieved. The proportion of holders who have made money could be an important factor in determining what happens next for PEPE

Source: IntoTheBlock

Market sentiment holds strong

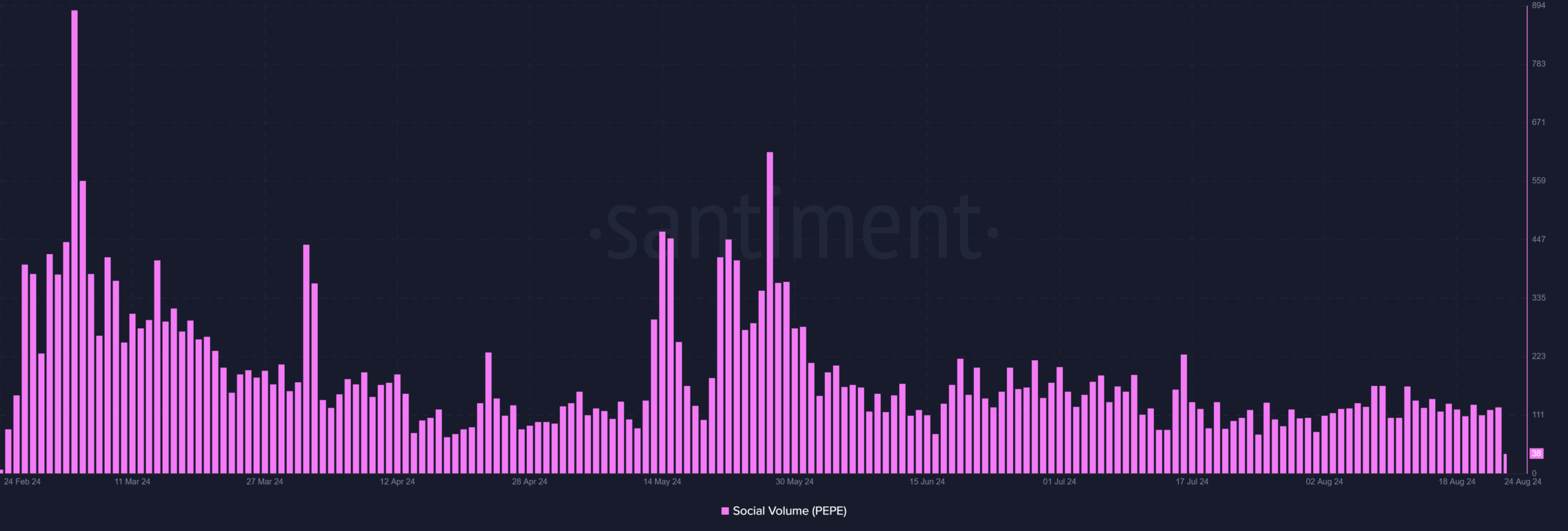

Even as PEPE tests this key level, market sentiment remains relatively positive. According to Santiment data, social media activity relating to the meme coin suggests there is still interest.

This interest often leads to buying pressure building up against the sellers. With this heightened interest in place, its prices may rally to test a symmetrical triangle resistance level.

Source: Santiment

Read PEPE’s Price Prediction 2024-2025

PEPE stands at a critical level, with its next move being closely watched by investors. The combination of a strong base of profitable holders and sustained social interest could pave the way for another rally.

However, mixed technical indicators suggest caution. The coming days will be crucial in determining whether it will continue its upward rally or face a pullback.

.