PEPE or BOME – Which memecoin should you invest in this week?

- BOME and PEPE’s prices increased by over 8% and 10%, respectively.

- Metrics looked bearish on both memecoins.

As the market sentiment changed gradually, Book of Meme [BOME] and Pepe turned bullish as they registered promising growth. Therefore, AMBCrypto planned to have a closer look at these memecoins to see whether this uptrend would last longer.

BOME and PEPE bulls are buckling up.

CoinMarketCap’s data clearly revealed how these two memecoins gained bullish momentum. BOME’s value surged by more than 8% in the last 24 hours. At the time of writing, the meme coin was trading at $0.01195 with a market capitalization of over $659 million.

On the other hand, PEPE registered double-digit growth as its value shot up by more than 10%. At press time, PEPE was trading at $0.000007226 with a market cap of over $3 billion, making it the 40th largest crypto.

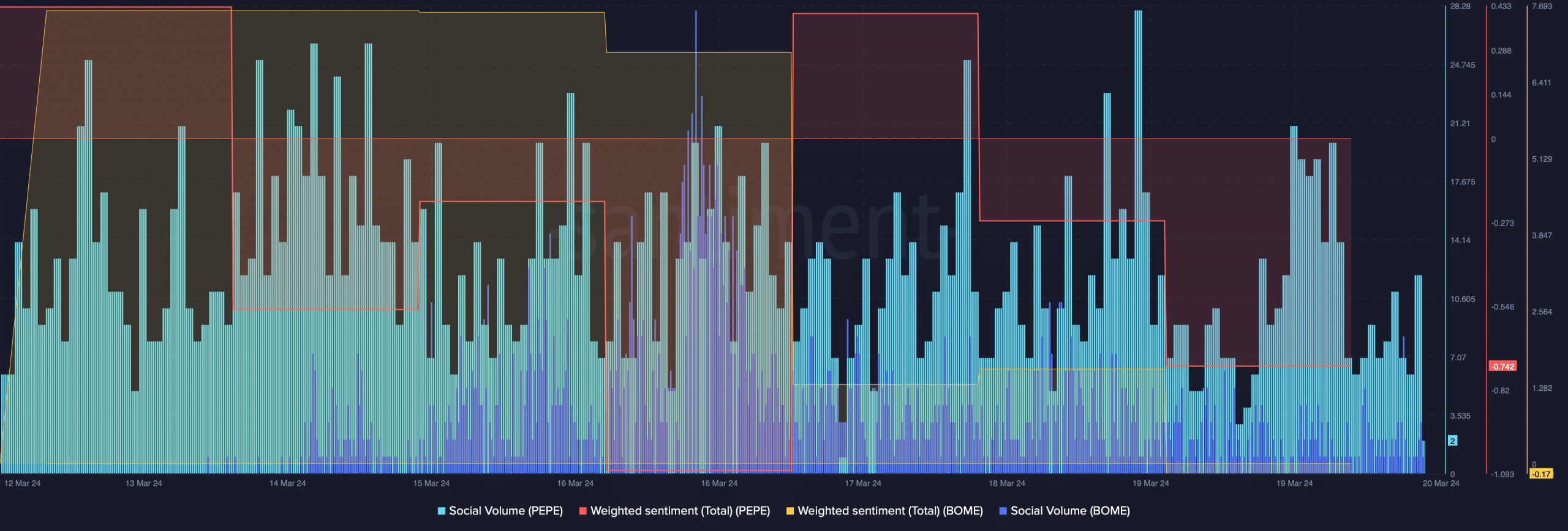

Thanks to the price uptick, PEPE’s social volume went up in the last few days. However, BOME’s metric moved the other way as its socal volume went down.

It was surprising to see that despite the recent price uptick, both PEPE and BOME’s weighted sentiment remained low, meaning that bearish sentiment around them was dominant in the market.

What to expect from BOME and PEPE?

To check whether these meme coins will sustain this growth, AMBCrypto analyzed their metrics. We found that BOME faces a strong resistance near the $0.013 mark.

This was the case, as a high number of BOME will be liquidated when the price touches that level, suggesting a possible correction at that mark.

Though the liquidation heatmap indicated a short bull rally, derivatives metrics told a different story. AMBCrypto’s analysis of Coinglass’ data revealed that BOME’s funding rate dropped sharply.

This meant that derivatives investors were not buying the meme coin. Its open interest also somewhat dropped, which can put an end to the memecoin’s bull rally.

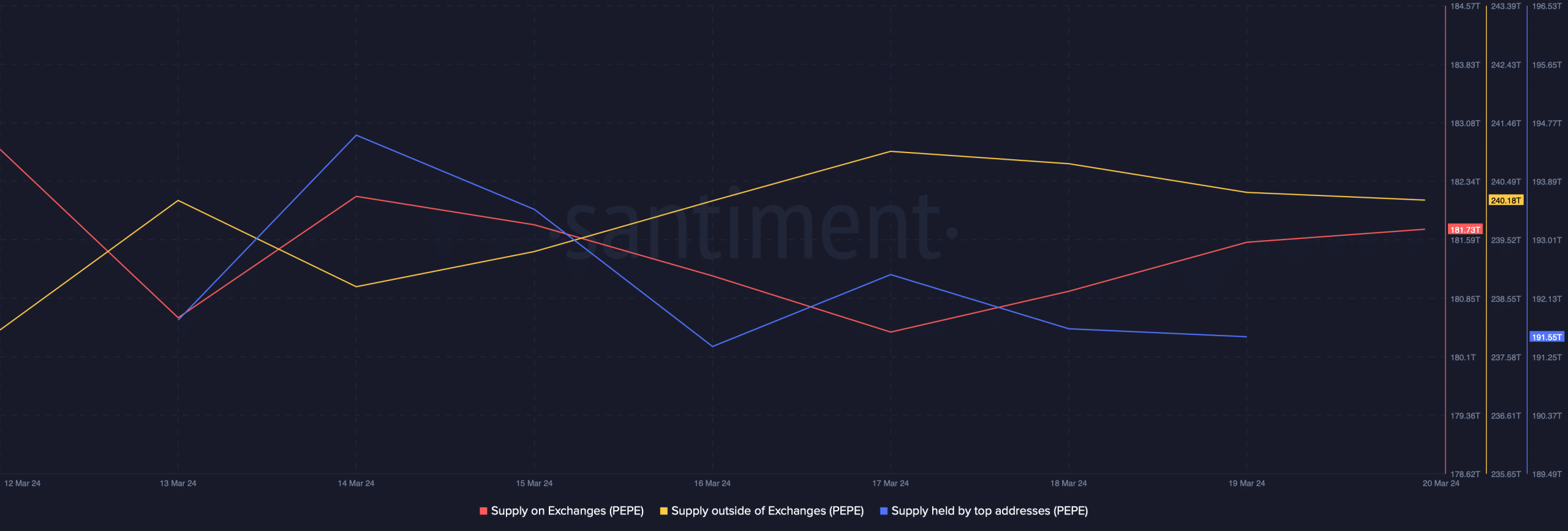

We then took a look at PEPE’s state. As per our analysis, selling pressure on the memecoin was rising. This was evident from the slight drop in its supply outside of exchanges and a marginal rise in its supply on exchanges.

Read PEPE’s Price Prediction 2024-25

Additionally, whales were actually selling PEPE, hinting at a price correction soon.

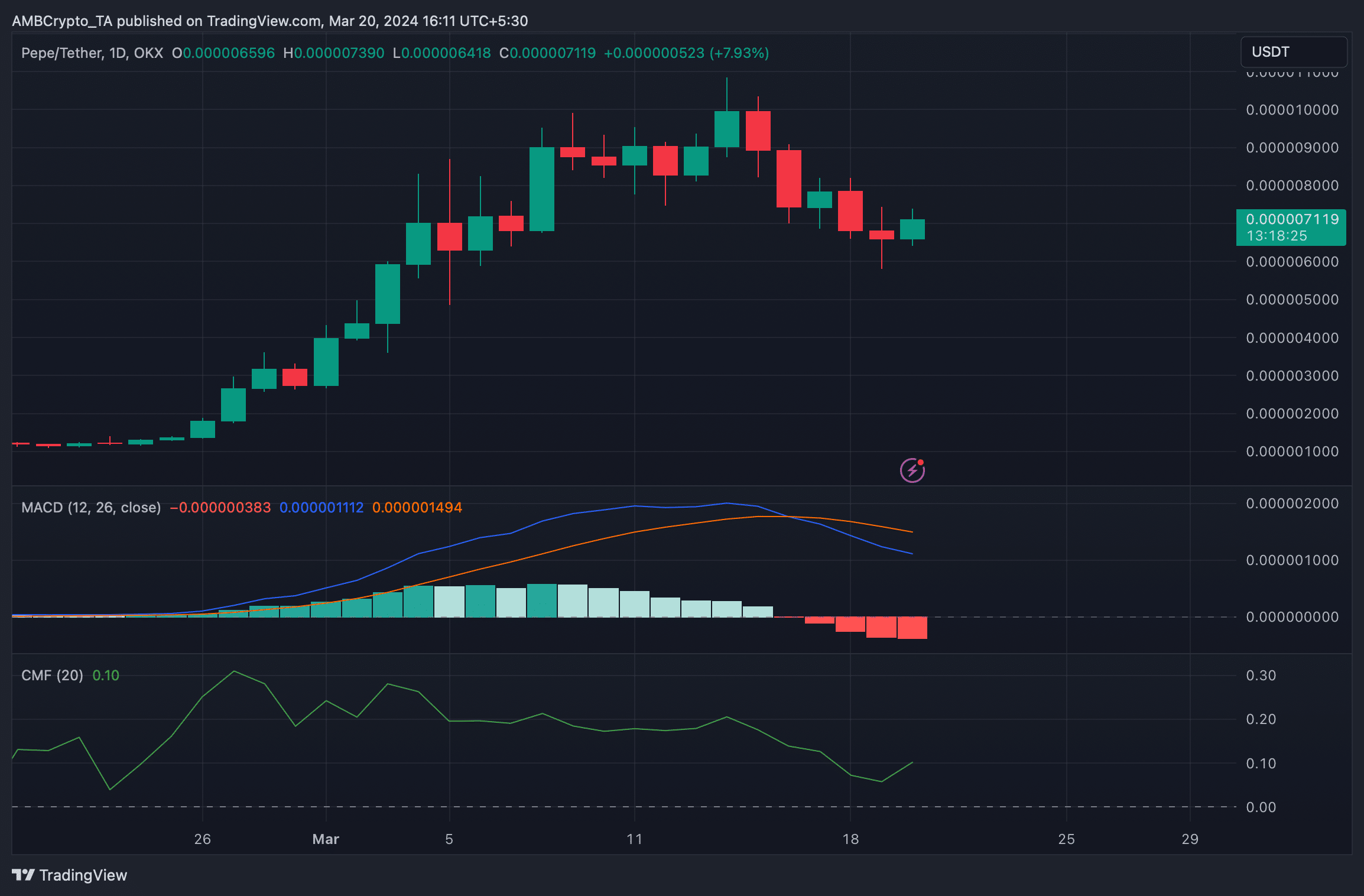

The technical indicator MACD also supported the sellers, as it displayed a bearish crossover. Nonetheless, the Chaikin Money Flow (CMF) registered an uptick, which indicated that there were chances of PEPE continuing its bull rally.