Pepe [PEPE]: Searching for the bottom amidst fading euphoria

- Pepe [PEPE] memecoin experienced a decline in value and trading volume.

- Social activity indicated that the coin may not have reached its lowest point yet.

The Pepe [PEPE] meme coin took the cryptocurrency community by storm, attracting a wave of investors. However, recent trends indicated a downward trajectory for the token, although certain metrics suggested that the lowest point had not yet been reached.

How much are 1,10,100 PEPEs worth today?

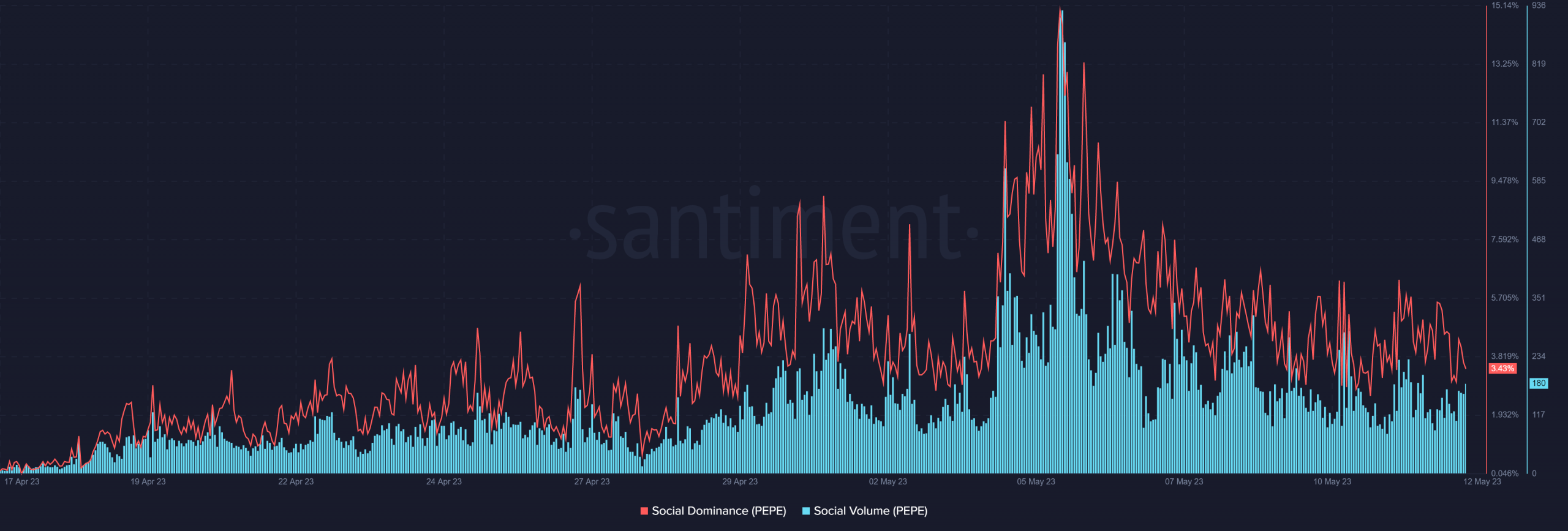

According to the social dominance and volume data from Santiment, PEPE continued to generate activity. On 5 May, the coin experienced a remarkable surge in social dominance and volume, reaching an all-time high. Since then, however, there has been a decline.

As of this writing, the social volume stood at 65, significantly lower than the peak of 863 on 5 May. Additionally, the social dominance score dropped from 12% of crypto space discussions on 5 May to 3.3%.

These metrics indicated that the meme coin was still garnering attention despite its price plunge. Also, it suggested that the bottom was not yet in.

Massive downtrend in price and market cap

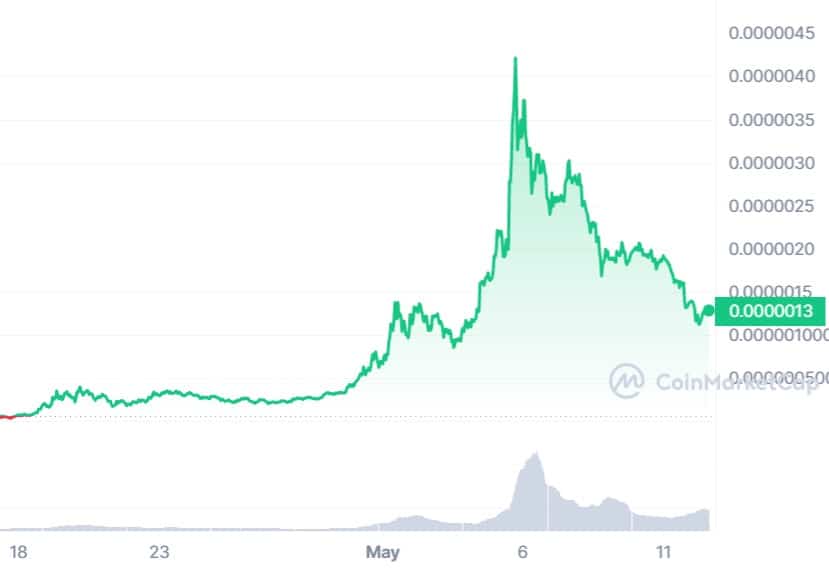

According to CoinMarketCap, PEPE has experienced a significant decline in value, losing approximately 60% over the past seven days. It also lost more than 20% within the last 24 hours.

Additionally, there had been a notable decrease in trading volume. The 24-hour volume dropped to around $760 million from the over $2 billion recorded on 5 May. Despite these declines, the year-to-date data revealed a remarkable gain of over 2000% since the coin’s inception.

Realistic or not, here’s PEPE market cap in BTC’s terms

Furthermore, it reached its peak market cap of over $1.6 billion on 5 May, with a trading volume exceeding $1.72 billion. However, its market cap diminished to approximately $497 million at press time.

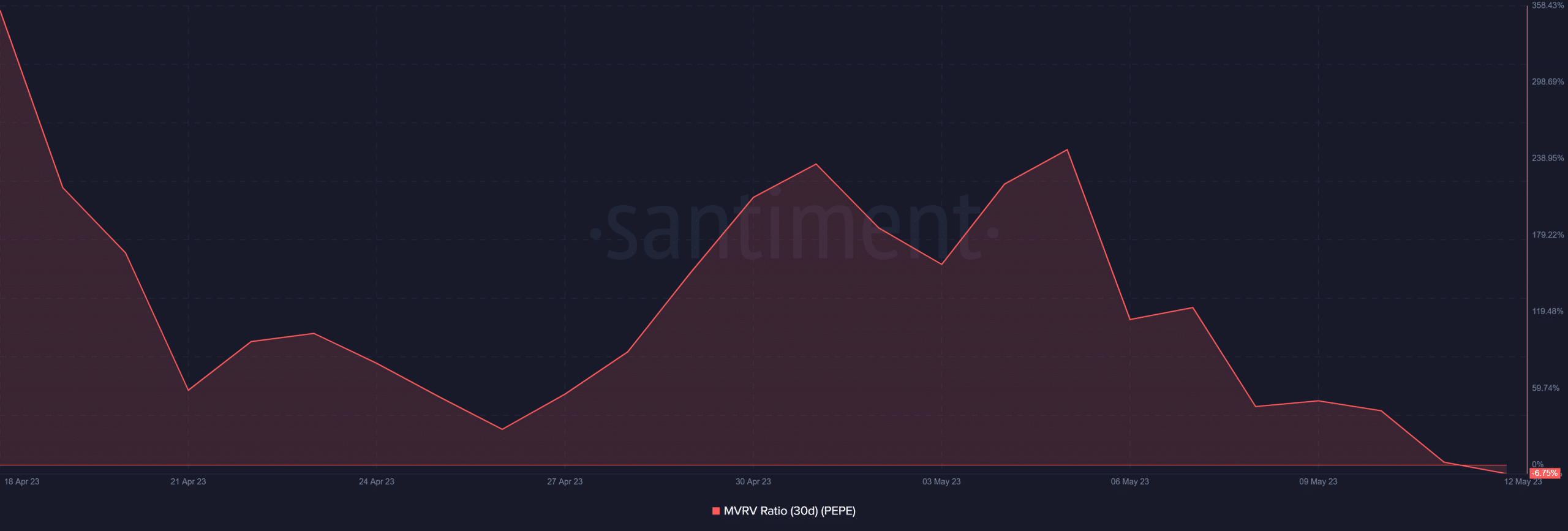

A dip to the undervalued zone

Throughout its brief existence, the token has experienced fluctuations in the Market Value to Realized Value (MVRV) ratio valuation. As of this writing, according to Santiment’s 30-day MVRV data, it stood at around -6%, marking a significant shift from its extended period in the overvalued area.