PEPE poised for a breakout: Can the memecoin rally to new highs?

- Pepe’s breakout targets $0.00002187 resistance, with bullish patterns signaling potential upward momentum.

- Technical indicators and liquidation data highlight strong bullish sentiment, supporting a possible rally.

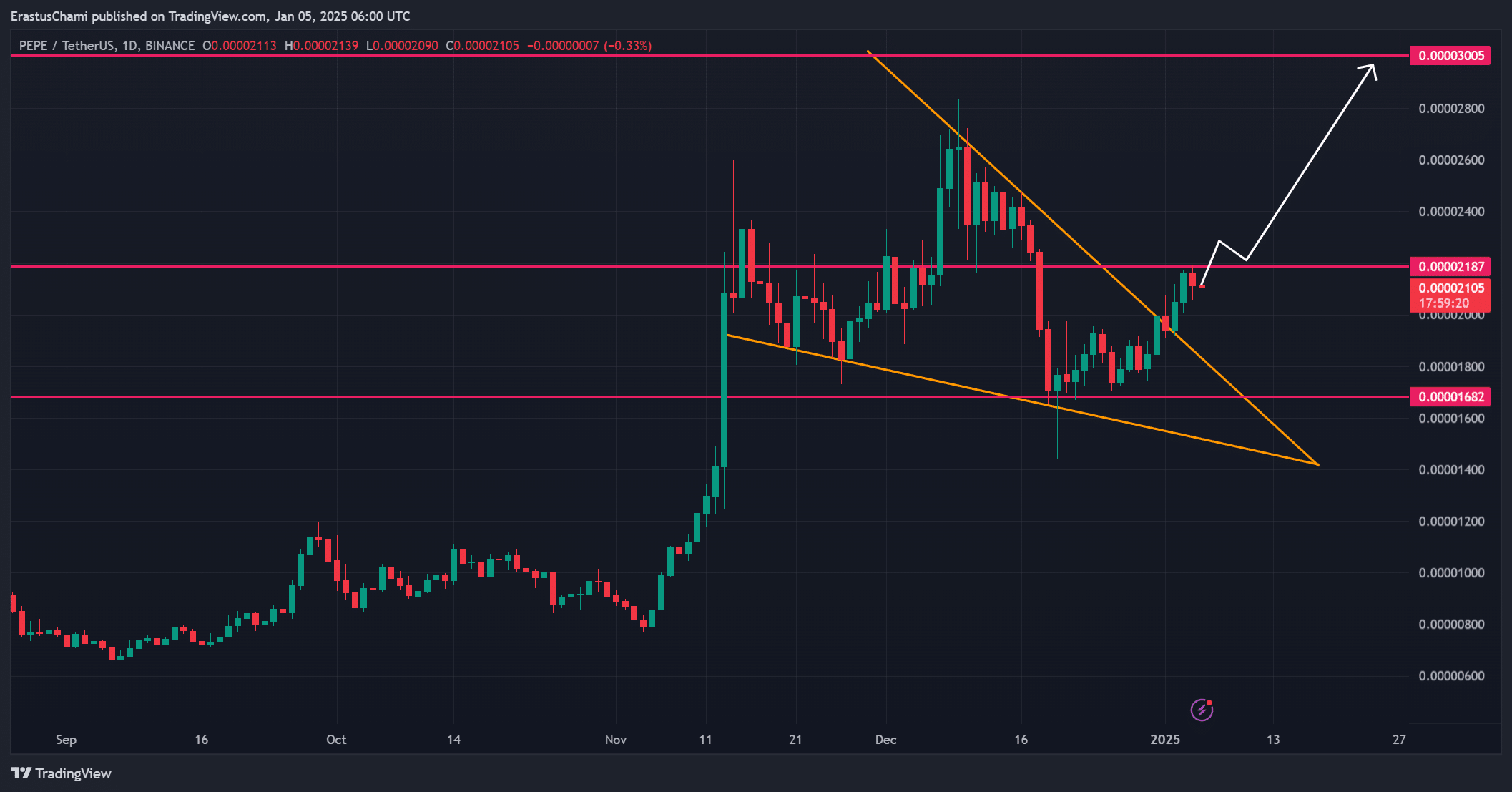

Pepe [PEPE] has emerged from a descending symmetrical triangle, a technical pattern often associated with breakout potential in crypto markets.

Trading at $0.00002102, down by 1.18% at press time, the token was showing signs of strength despite minor retracements.

The question now is whether Pepe can sustain its upward momentum and rally to new heights in the coming days.

PEPE’s price action shows potential

Pepe’s price action (PA) reflected a strong recovery as the token consolidated near critical resistance at $0.00002187.

Breaking above this level could confirm a bullish breakout, setting the stage for a potential rally toward $0.000030, the next significant resistance.

Additionally, the symmetrical triangle breakout highlighted reduced selling pressure and growing buyer interest.

However, failure to surpass $0.00002187 could lead to another consolidation phase, testing support levels at $0.00001682.

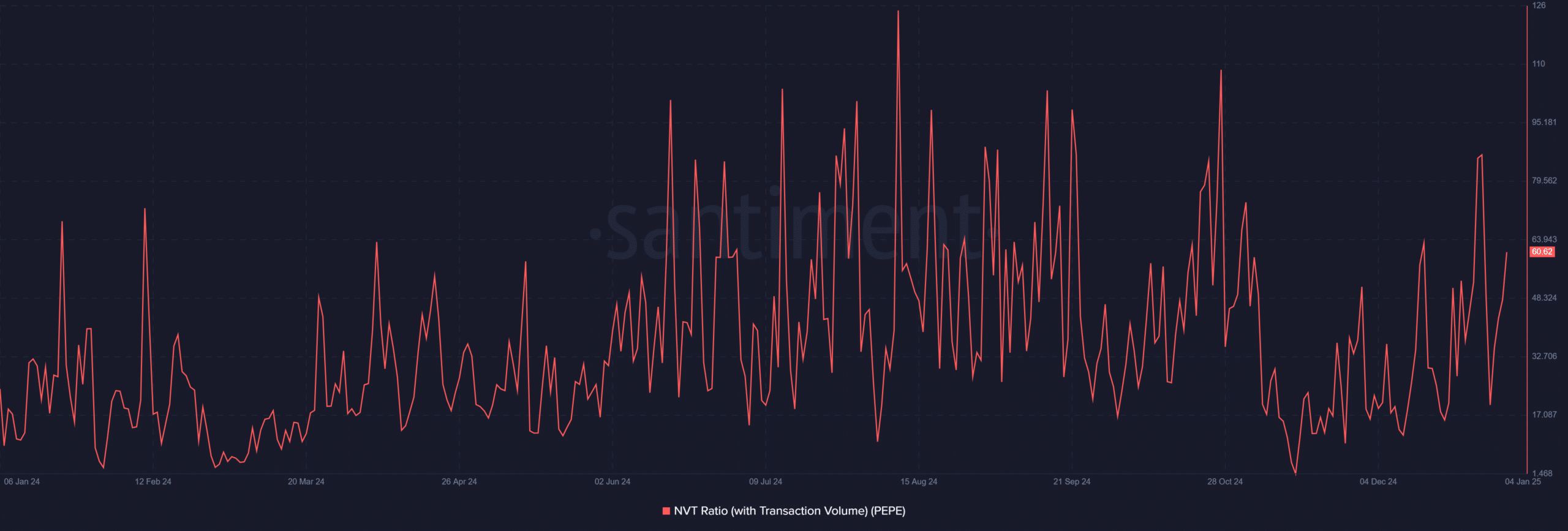

NVT ratio points to growing market confidence

The network value to transaction (NVT) ratio has risen from 48 to 60.62, indicating increasing on-chain activity relative to the token’s market valuation.

This suggested renewed investor confidence as transactional activity supported the price recovery.

A higher NVT ratio often reflects sustained interest in the asset, which could bolster bullish sentiment. However, for the price to move higher, the ratio must remain consistent with rising transaction volumes.

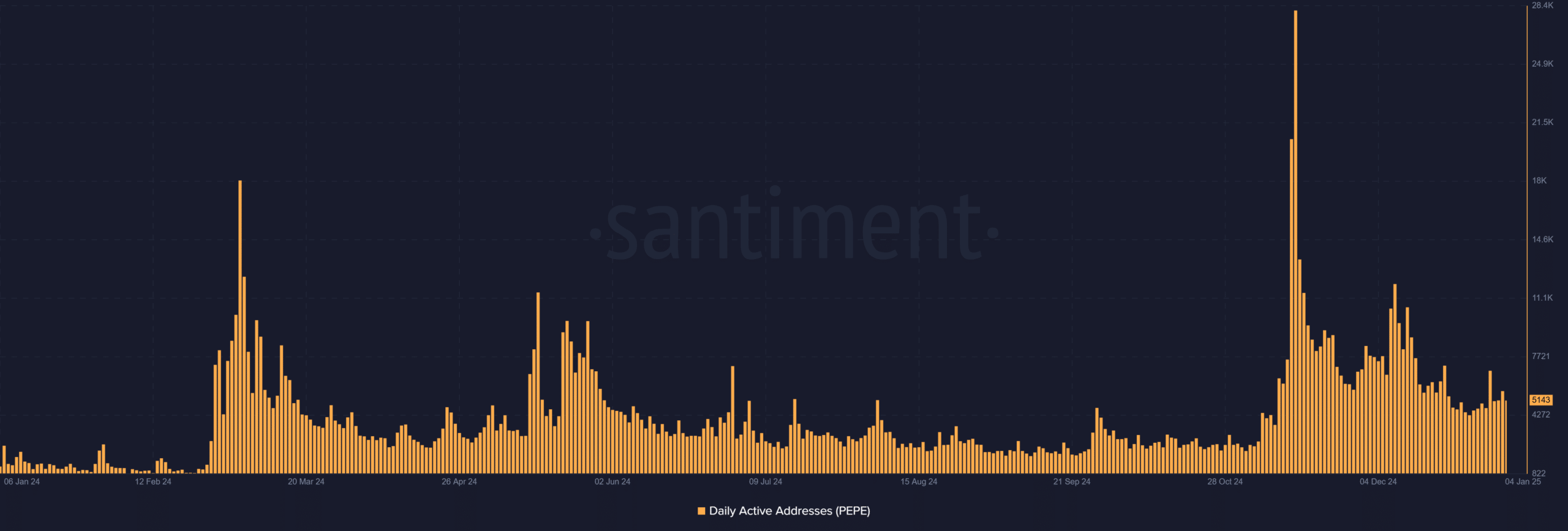

PEPE daily active addresses show steady engagement

Daily active addresses were recorded at 5,143, reflecting moderate but steady participation from users. This stability indicates that a committed user base is actively engaging with Pepe, even during periods of price consolidation.

If the token’s price continues to rise, a surge in daily active addresses could add further validation to the breakout potential. Therefore, increased user activity in the coming days will be critical in sustaining upward momentum.

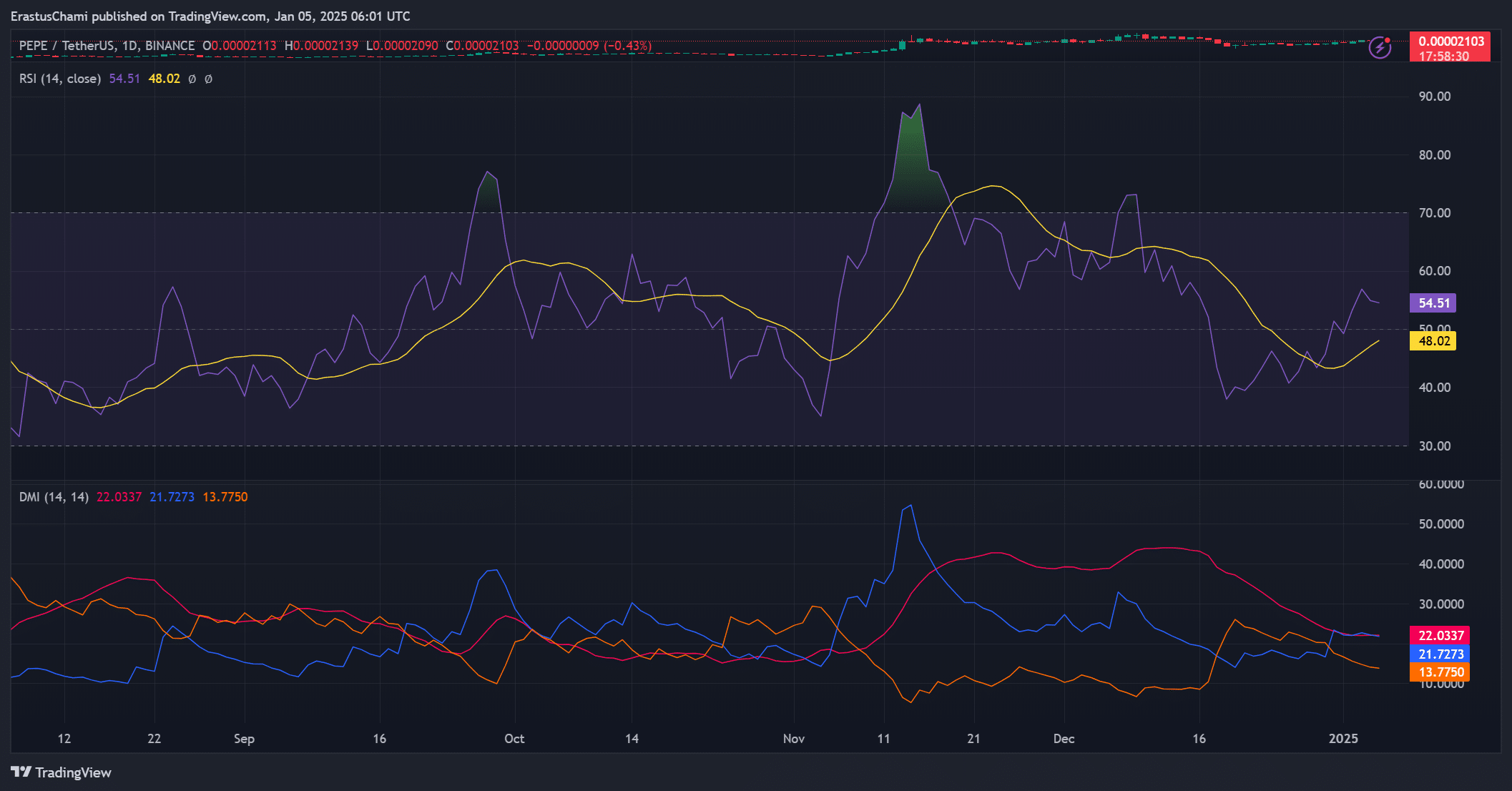

Technical indicators support bullish momentum

Pepe’s technical indicators suggested a turning point in market dynamics.

The relative strength index (RSI) stood at 54.51, indicating moderate bullish momentum and leaving room for further upward movement without overbought conditions.

Besides, the directional movement index (DMI) revealed that the +DI was at 21.7, -DI was at 13, and the average directional index (ADX) was at 22.

These figures suggested a strengthening trend, with buyers gaining control over the market. However, for the rally to materialize, ADX must continue rising to confirm trend strength.

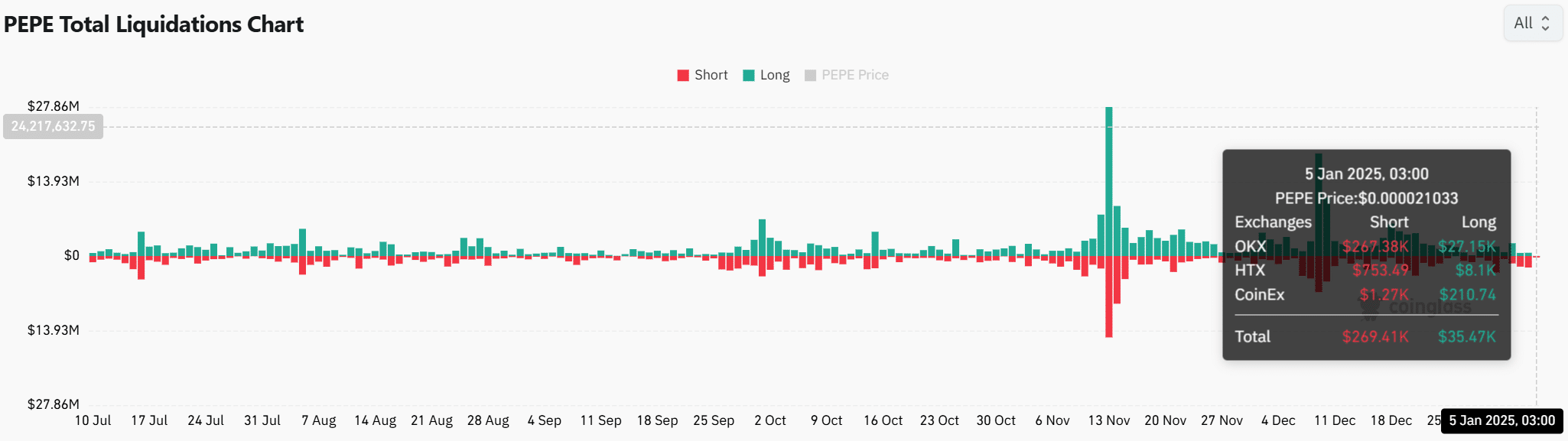

Liquidation data signals bullish sentiment

Liquidation data showed $269.41K in short positions wiped out compared to $35.47K in longs, reflecting growing confidence in an upward move.

This bullish bias among traders provides additional support for a potential breakout. However, continued buying pressure will be necessary to sustain these gains and prevent a price pullback.

Read Pepe’s [PEPE] Price Prediction 2025–2026

Conclusion: PEPE is ready to test new highs

Pepe’s breakout from the descending symmetrical triangle, coupled with improving on-chain metrics and bullish technical indicators, positions it for a potential rally.

If the token can surpass the $0.00002187 resistance, it could pave the way for a move toward $0.000030. Therefore, Pepe seems primed for upward momentum, provided market conditions remain supportive in the near term.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)