PEPE potential: How a whale timed the market for maximum gains

- PEPE’s open interest has increased by 9% in the last 4 hours, suggesting growing investor interest.

- PEPE could experience a 40% rally to $0.000021 if it closes a daily candle above the $0.0000090 level.

The cryptocurrency market experienced massive selling pressure on 12th August following a significant decline in Bitcoin [BTC].

Amid this downturn, a whale found a perfect buying opportunity in Pepe [PEPE], the world’s third-biggest meme coin, and purchased nearly 120 billion tokens.

PEPE whale buys the dip

However, this is not the first time that this whale has purchased a significant amount of PEPE. The memecoin experienced a notable price decline on 5th August and 11th August, and on both these occasions the whale bought the dip.

According to the on-chain analytic firm Spotonchain, on these two occasions, the whale spent a notable total of $3.13 million USDT to purchase 420 billion PEPE tokens.

It seems like this whale is trying to buy the dip whenever the market falls. Additionally, the whale has now made a decent profit of $170k.

PEPE price-performance analysis

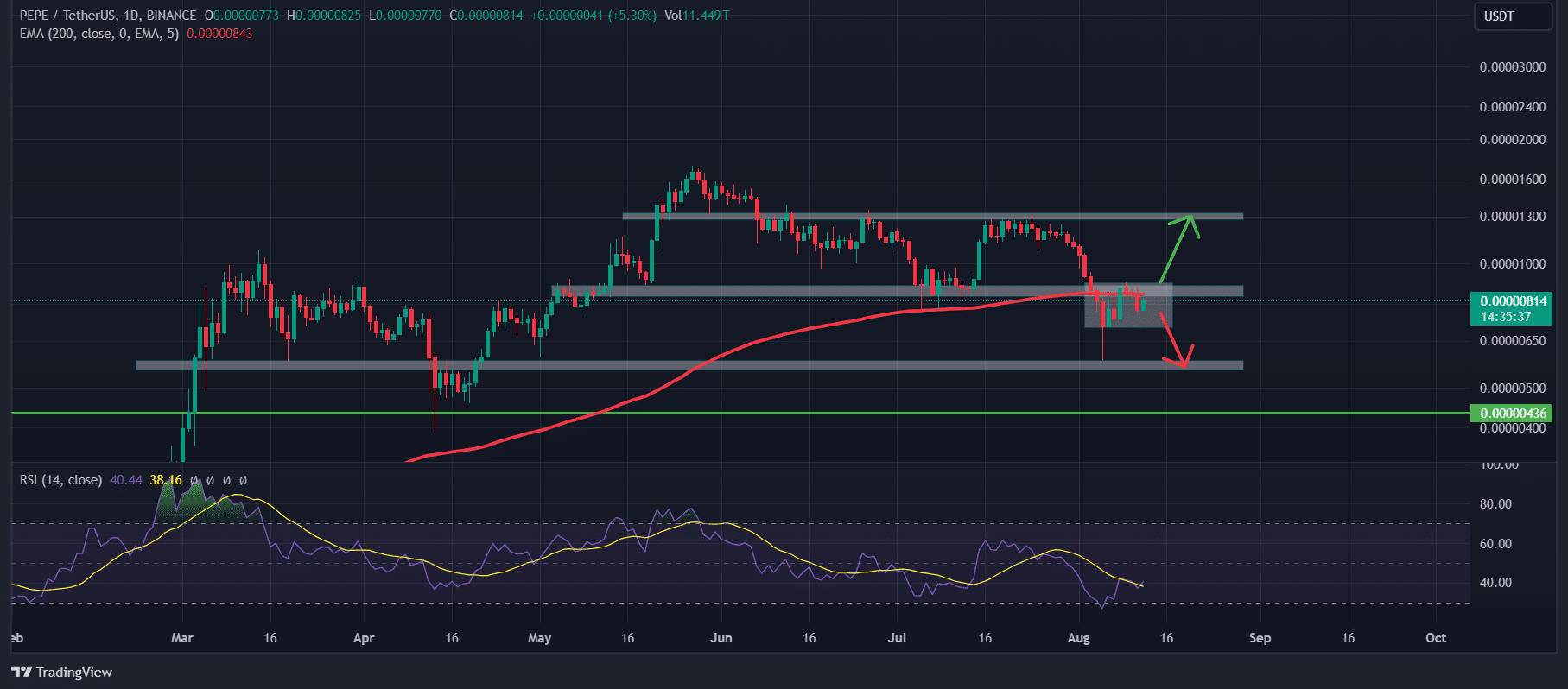

At press time, PEPE was trading near $0.00000817 and experienced a 5.7% price decline in the last 24 hours.

However, during the price decline, PEPE’s trading volume increased by 50% over the same period. This increase in trading volume suggests higher participation from traders and buyers.

In the last 24 hours, PEPE’s open interest was down by 5.5%. However, due to increased participation and traders’ interest in buying the dip, it has risen by 9% in the last 4 hours and 6.5% in the past hour, according to the on-chain analytic firm CoinGlass.

According to expert technical analysis, PEPE looks bearish as it fell again below the 200 Exponential Moving Average (EMA) on a daily time frame.

The price of PEPE below the 200 EMA suggests a bearish signal. Whereas, another technical indicator the Relative Strength Index (RSI) is showing a sign of reversal as it is an oversold zone.

PEPE could experience a massive 40% rally to $0.000021, only if its daily candle gives a closing above the $0.0000090 level.

Meanwhile, if fear continues to dominate the market, there is also a chance that PEPE could fall another 25% in the coming days.

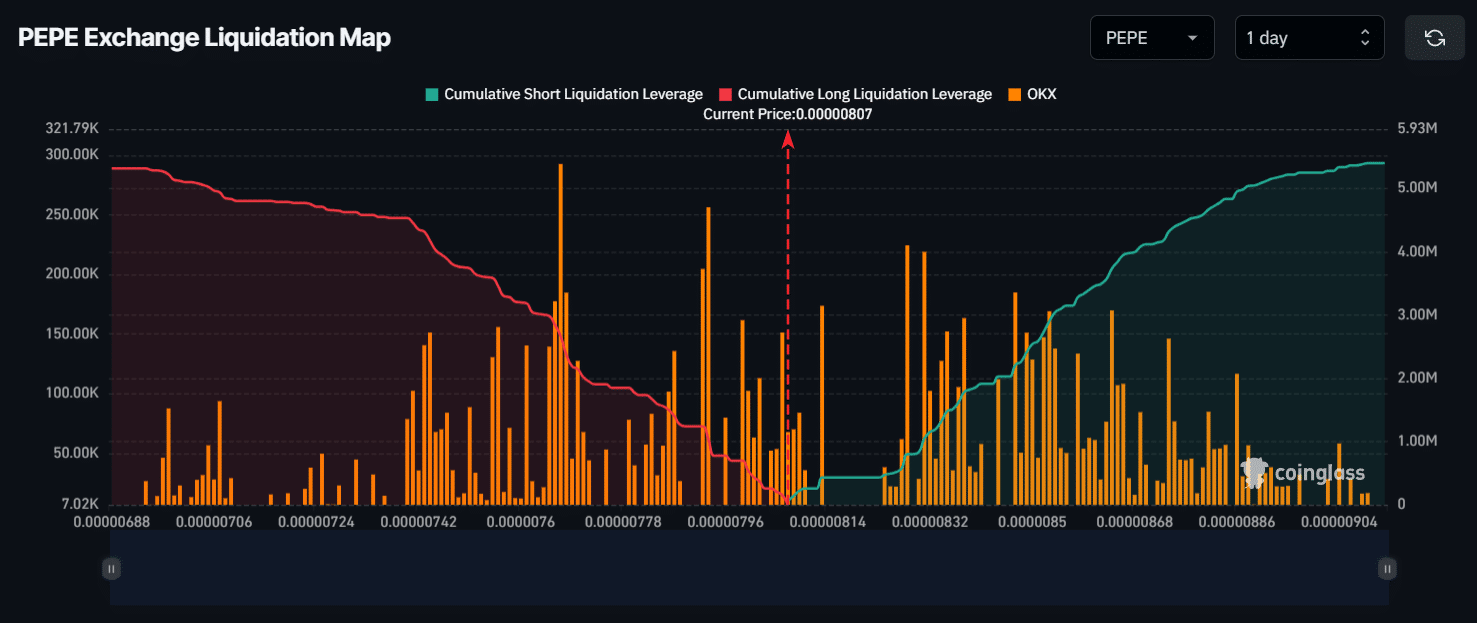

Major liquidation levels

As of now, the major liquidation levels are near $0.00000767 on the lower side and $0.00000828 on the upper side.

Read PEPE’s Price Prediction 2024 – 2025

If this sentiment continues and PEPE falls to $0.00000767, nearly $2.67 million worth of long positions will be liquidated.

Conversely, if sentiment changes and PEPE’s price rises to the $0.00000828 level, nearly $800k worth of short position will be liquidated, according to data from Coinglass.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)