Pepe

PEPE price prediction: 20% rally or 25% pullback, what’s next?

PEPE’s new ATH has set it into a price discovery territory – will it rally further or cool off?

- PEPE hit a new all-time-high (ATH) and outperformed BTC.

- Bulls had market leverage, but a short-term pullback couldn’t be overruled.

The meme coin ‘supercycle’ narrative is becoming more evident in this market cycle. Memes’ performance on the price charts has been explosive.

In the first half of May, Pepe [PEPE] outperformed Bitcoin [BTC], gaining +65% against BTC’s 2% rally.

More than half of PEPE’s May rally happened in the past two days, following GameStop stock’s (GME) wild rally.

The explosive rally pushed PEPE into a new all-time high (ATH) of $0.00001146, but can bulls push further?

PEPE price prediction: Bulls possible playbook after new ATH

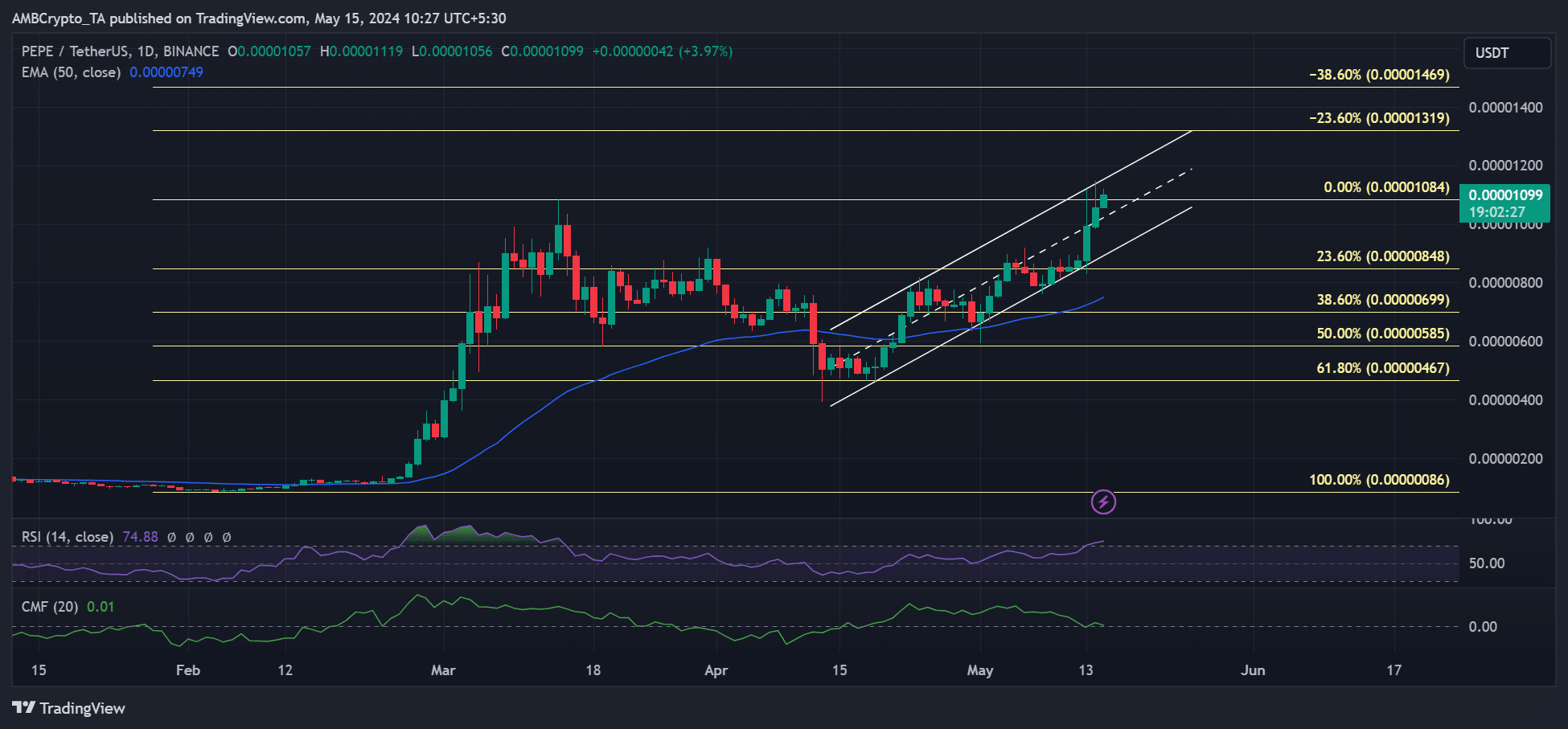

A Fibonacci retracement tool (yellow) between the 2024 lows and the previous all-time high ($0.00001084) on the daily chart.

The frog-themed meme has been in a slow but steady recovery in Q2, from mid-April, as shown by the ascending channel (white).

The upswing to a new ATH reversed all losses in Q1 and part of Q2. This meant that most holders had unrealized profits and could book the gains.

PEPE had seen two price rejections at the range-high of the ascending channel (white), indicating some traders, including whales, have booked profit.

However, PEPE still had a bullish market structure, so an extra upswing to $0.000013 could yield 21% more gains. But if more holders choose to profit at the current market price, PEPE price action could pull back.

In such a scenario, the channel’s mid-range and range-low, alongside the 23.6% Fib placeholder, could be crucial for late buyers.

Pepe price prediction: Why a 25% pullback can’t be overruled

Although bulls had the upper hand at press time, an unforeseen bearish scenario could drag PEPE 25% based on liquidation levels.

According to Hyblock Capital’s 7-day liquidation heatmap, the $0.08 area was a key magnetic zone (orange).

So, a massive drop could push the price into the $0.08 area, coinciding with the 23.6% Fib placeholder on the price chart. That’s a potential 25% drop from press time levels.

However, Coinglass’s Long/Short Ratio data showed that PEPE’s market sentiment was still bullish. Many traders have been going long on PEPE since the 7th of May.

Is your portfolio green? Check out the PEPE Profit Calculator

The percentage of traders going long jumped from 47% on 7 May to 50.6% as of 15 May (mid-morning Asian trading session), which meant that short-term market sentiment was bullish.

So, PEPE could rally an extra 20% if bullish sentiment persists. However, a 25% pullback can’t be overruled if market conditions turn bearish.