Analysis

PEPE price prediction: Bitcoin to help memecoin across THIS level?

The BTC rally from $61k to $64k gave PEPE bulls confidence to force a move.

- Pepe does not yet have a bullish market structure on the daily timeframe.

- The 50% price bounce was encouraging, but a Bitcoin price dip can affect the sentiment badly.

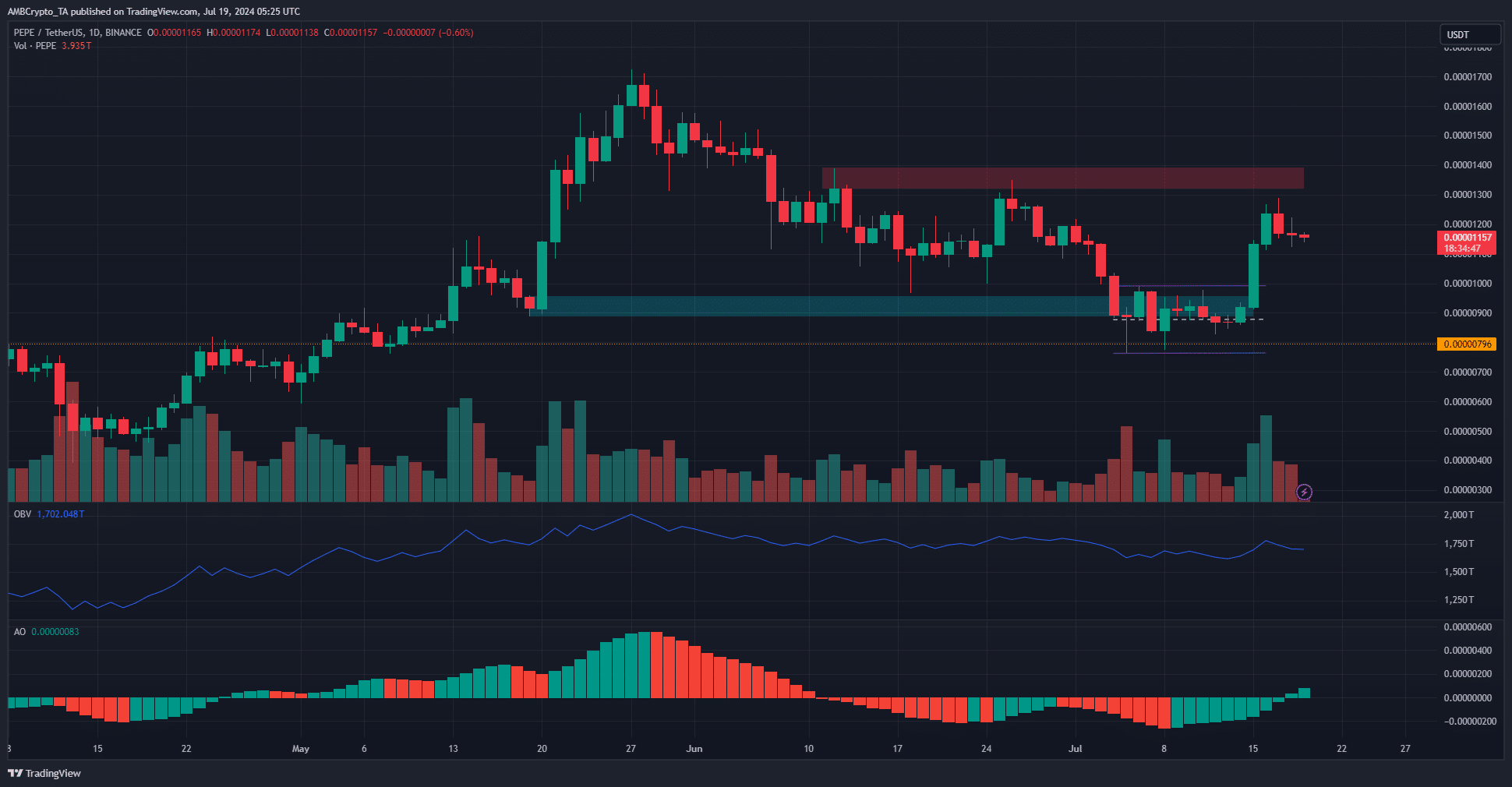

Pepe [PEPE] broke out of the range it formed earlier this month. The on-chain metrics of the memecoin had not inspired confidence a few days ago, but against expectations, Pepe managed to hold on to recent gains.

The momentum has shifted bullishly on the daily timeframe, but the uptrend was not yet re-established. Pepe price prediction based on the liquidation chart showed a take-profit level that needs to be flipped to support.

The range breakout was a sign of bullish intent

Until the convincing Bitcoin [BTC] move past the $61k resistance on the 15th of July, the memecoin had been trading just above the former mid-range mark at $0.0000088.

The BTC rally from $61k to $64k gave PEPE bulls confidence.

The volume surged on the 15th of July and the momentum began to shift. At press time, the Awesome Oscillator was above the zero level to show strong bullish momentum.

On the other hand, the OBV was yet to break June’s highs.

The resistance zone at $0.0000132-$0.000014 is also a place where the recent lower highs on the daily chart occurred in June. Therefore, a move to these levels is expected.

PEPE price prediction — Full steam ahead?

Source: Hyblock

The liquidation heatmap showed that the deep losses in early July swept the large liquidity pool at $0.000008.

The bulls were able to defend this level, but there is some untested liquidity just below $0.000008.

Read Pepe’s [PEPE] Price Prediction 2024-25

To the north, the $0.000014 region is of interest and concurs with the price action analysis.

Whether the bulls can flip $0.000014 over the next few days would likely determine if the token can continue its rally, or would retrace most or all of its recent gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.