PEPE price prediction: Is a 33% rally on the cards?

- PEPE’s recovery faced an overhead obstacle at $0.00009.

- Further recovery prospects beyond $0.00009 depended on Bitcoin’s move.

Pepe [PEPE] was part of the top memecoins leading the recovery after the recent market carnage. The frog-themed memecoin depreciated by over 40% between late July and the 5th of August.

However, as of press time, the meme coin was up 17% between the 6th and the 7th of August. Given the massive interest the memecoin narrative was getting at the time of writing, the rally could extend.

On the 7th of August, Coinglass data showed that memes ranked second to the Solana ecosystem on Open Interest (OI) rates, with +9%.

In short, memes attracted significant liquidity, which could boost PEPE’s ongoing recovery.

But there was one problem.

Can PEPE clear its overhead obstacle?

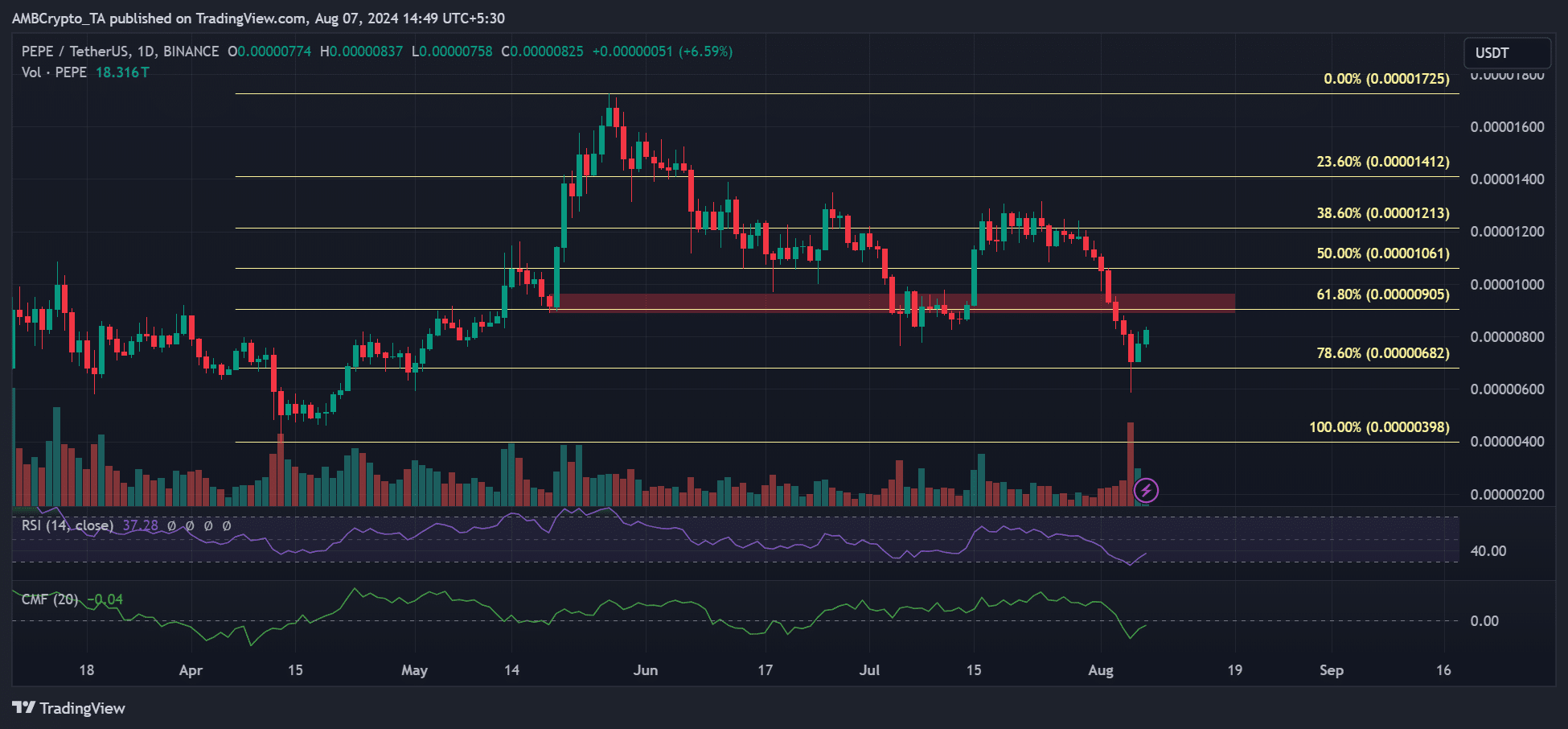

The price area around $0.0000905 could be a key roadblock for the recovery. The level was a confluence of a breaker block (marked red) on the daily chart and the 61.8% Fibonacci retracement level.

The Fib retracement tool (yellow) was placed between May highs and April lows. Based on the tool, the recent dump stopped at 78.6% Fib level.

The recovery must mount above the 61.8% Fib level to show bulls’ conviction to extend the rally.

A retest of the overhead resistance at the 61.8% Fib level will effectively cap the recovery gains at 33% from the 78.6% Fib level.

However, clearing the 61.8 Fib level resistance could be a challenge given the weak readings on RSI (Relative Strength Index) and CMF (Chaikin Money Flow) as of press time.

This meant that buying strength and capital inflows recovered, but weren’t strong enough.

XRP buying volumes increase, but…

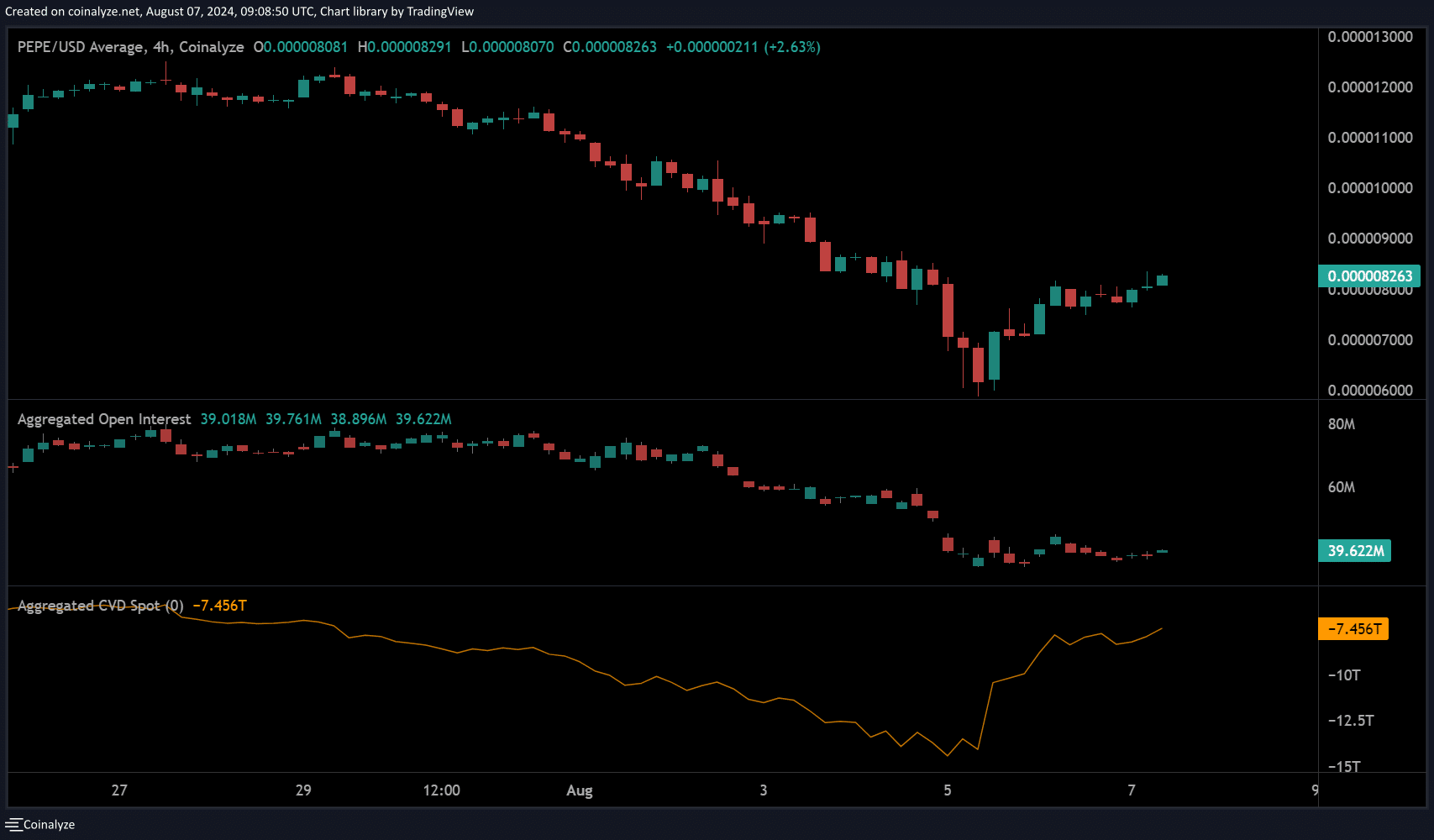

The above recovery was supported by higher buying volumes than sell orders, as shown by the uptick in spot CVD (Cumulative Volume Delta).

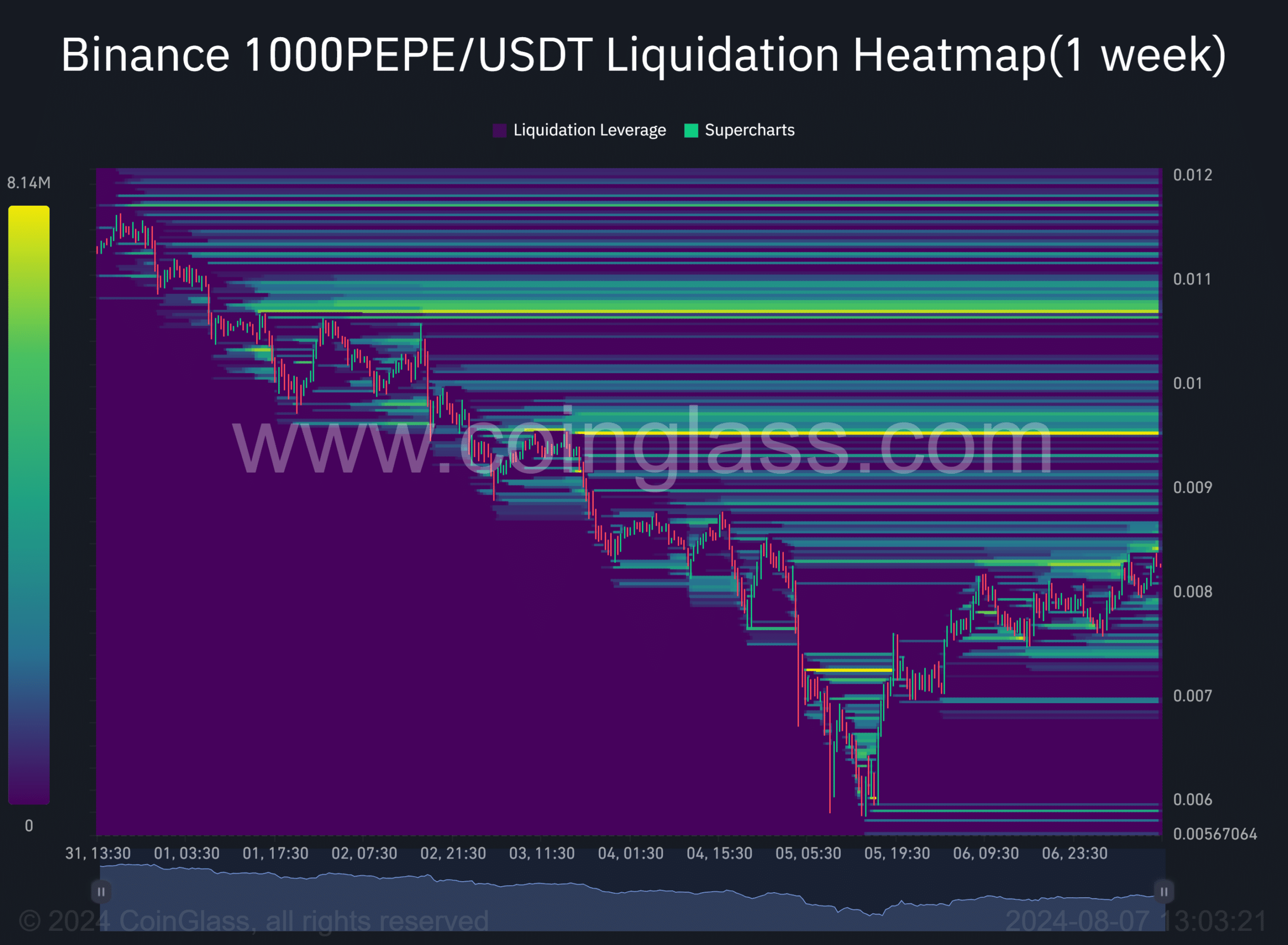

How far can the buying volumes and the price recovery last? According to liquidity data from Coinglass, the next liquidity cluster was at $0.000090.

Read PEPE’s Price Prediction 2024 – 2025

Interestingly, the cluster level was similar to the overhead resistance seen on the charts.

As a result, a liquidity grab could bolster the recovery to the 61.8% Fib level. However, buyer exhaustion could set in for PEPE if BTC doesn’t progress beyond $60k.