Pepe price prediction: Is the meme poised for more gains after rallying 48%?

- Pepe rallied 48% in 24 hours, setting a new all-time high.

- The rally faced resistance at the 61.8% Fibonacci extension level.

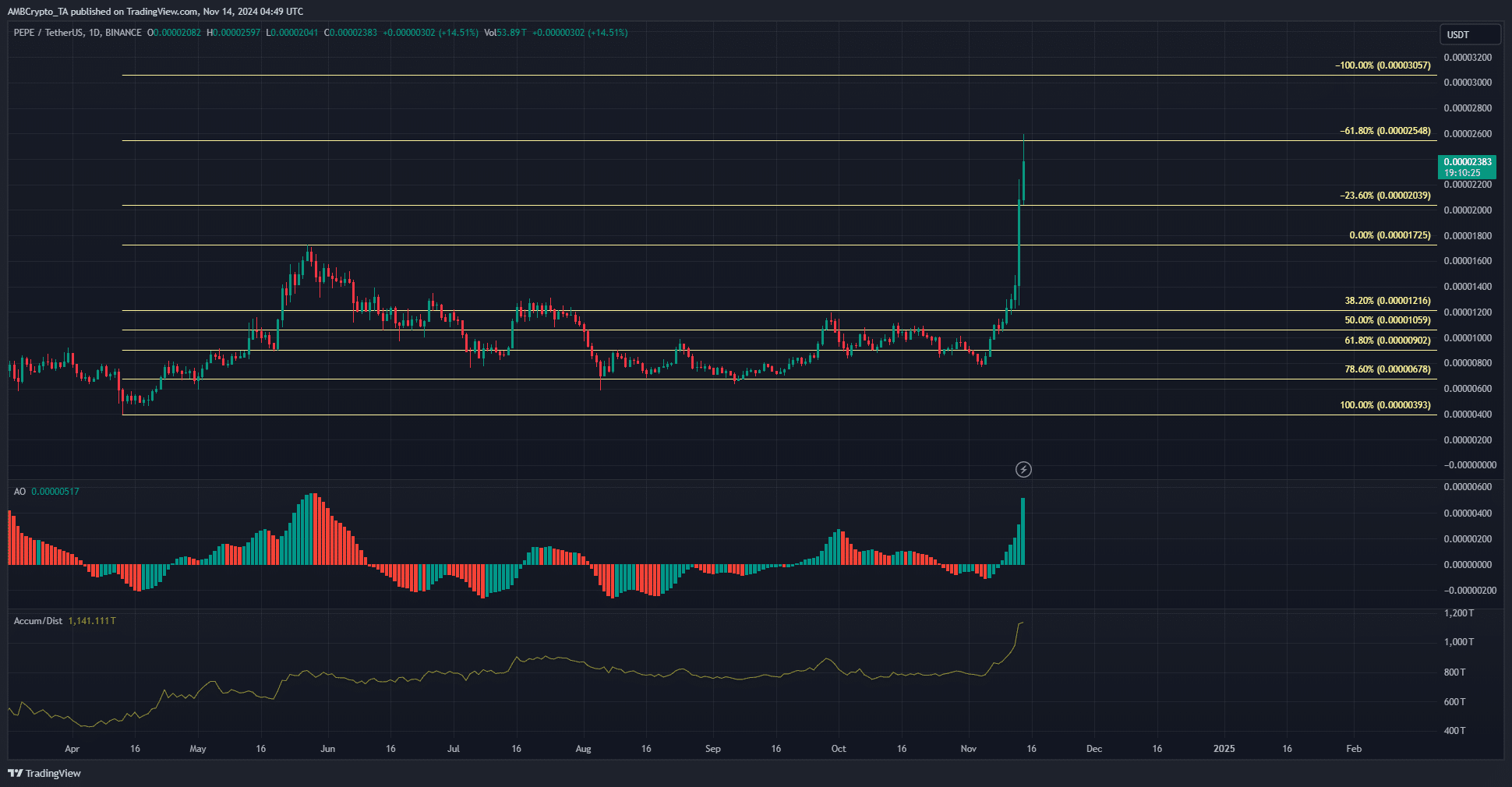

Pepe [PEPE] has intense bullish momentum rivaling what it saw in May. The meme coin surged past local resistance levels to set a new all-time high at $0.00002597. The token gained rallied 47% on Wednesday, the 13th of November.

Pepe saw increased buying activity on decentralized exchanges (DEX) earlier in the week. Traders and investors anticipated a “meme coin supercycle” and the vast Dogecoin [DOGE] gains could be rotated into PEPE in the coming months.

Bulls face a temporary roadblock at the 61.8% extension

A set of Fibonacci retracement levels was plotted based on the Pepe rally in April and May. In the months since then, the 61.8% and 78.6% retracement levels have served as solid support levels.

Ten days ago, a deviation below the 61.8% level at $0.000009 set up the rally that vaulted the price to new highs. The long-term Pepe price prediction is extremely bullish. There is speculation that it can catch up to Dogecoin in terms of market cap during this cycle.

That might be too optimistic since DOGE is the most popular meme and has been for years. However, bull market sentiment can get wildly bullish, and $40 billion or more as Pepe’s market cap is not far-fetched.

Short-term Pepe price prediction

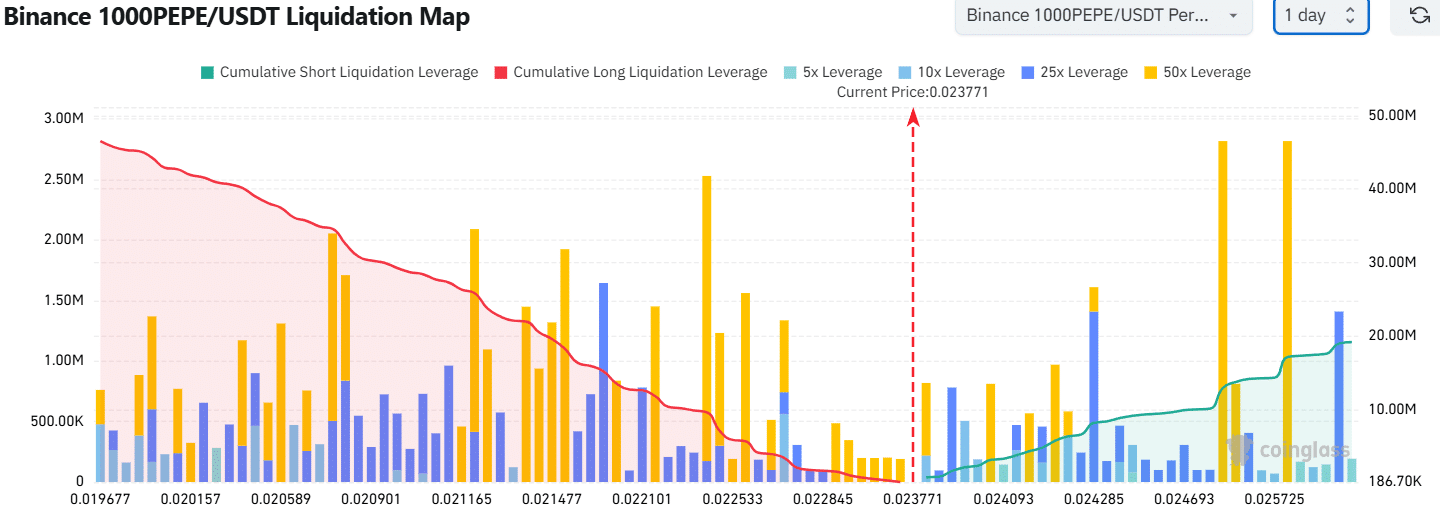

Source: Coinglass

The 1-day liquidation map highlighted the $0.0000247 and $0.0000224 as the closest high liquidity levels. With Bitcoin [BTC] back above $90k, the short-term sentiment was bullish and a move higher was slightly more likely.

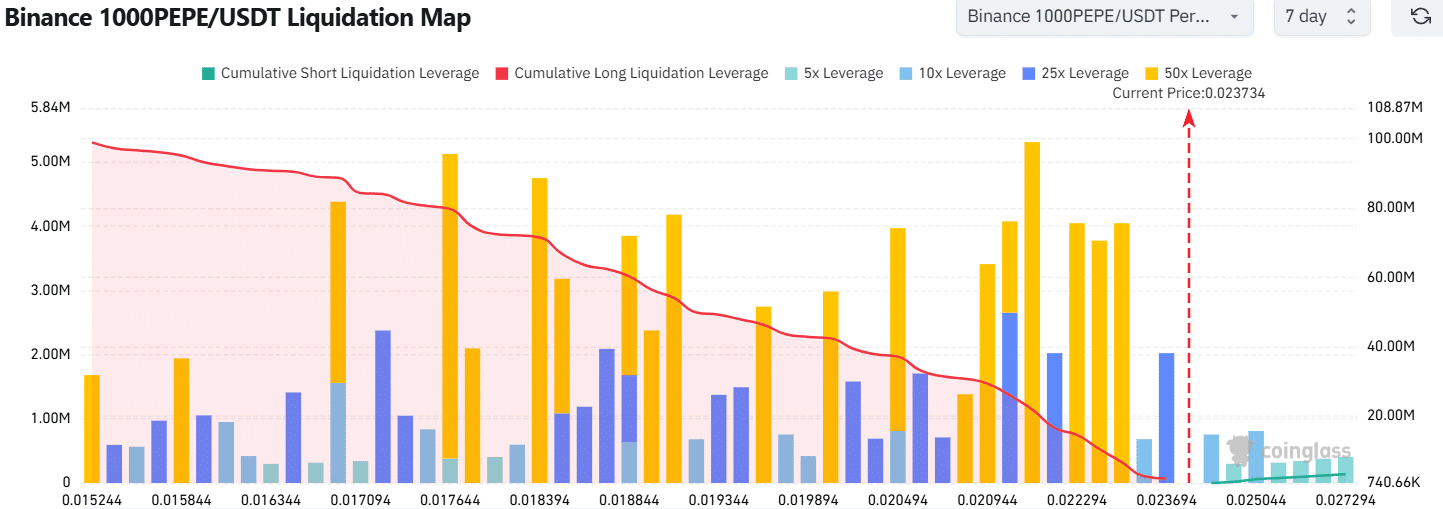

Source: Coinglass

Traders should be prepared for a deeper dip despite the short-term sentiment. There was a cluster of sizeable liquidation levels from $0.0000209 to $0.0000232.

Therefore a retest of this zone would be a buying opportunity as the token would likely turn bullish after a sweep of this liquidity.

Read Pepe’s [PEPE] Price Prediction 2024-25

News of the Coinbase listing is expected to spur PEPE to new highs but could end up tapering bullishness in the short term, giving the token time to consolidate.

Traders should be prepared for both scenarios and manage risk accordingly, while investors just need to HODL for a few months.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

![Sonic [S] needs to break THIS level to reach $1 - Can it happen?](https://ambcrypto.com/wp-content/uploads/2025/02/Editors-15-400x240.webp)