Pepe

PEPE prices at risk? Here’s what the week holds for the memecoin

PEPE has plunged. Are traders at fault or did the hype just run its course?

- PEPE was the best-performing memecoin last week. At press time, it was among the worst-performing.

- Bears appeared to be in control, but indicators suggest that the decline is likely temporary.

Everyone’s favorite memecoin is currently in a bit of a bind. PEPE

, the Solana-based memecoin that made a lot of people millionaires last week, has been dropping, not so slowly for about three days now.At press time, it has tumbled by over 8% in the last twenty-four hours just as the community was starting to cheer for memecoin season. What is going on? Why is PEPE backsliding?

Reasons for PEPE’s descent

PEPE rallied by over 500% at some point last week. But it wasn’t an isolated trend. Meme stock legend Keith Gill made a comeback on social media, sending both meme stock markets and memecoin markets into a frenzy.

Traders lost it. Investors jumped in. But just as it came, the hype went away, along with Gill. Now the coins and the stocks have cooled down by a mile, with PEPE’s daily chart painted in red.

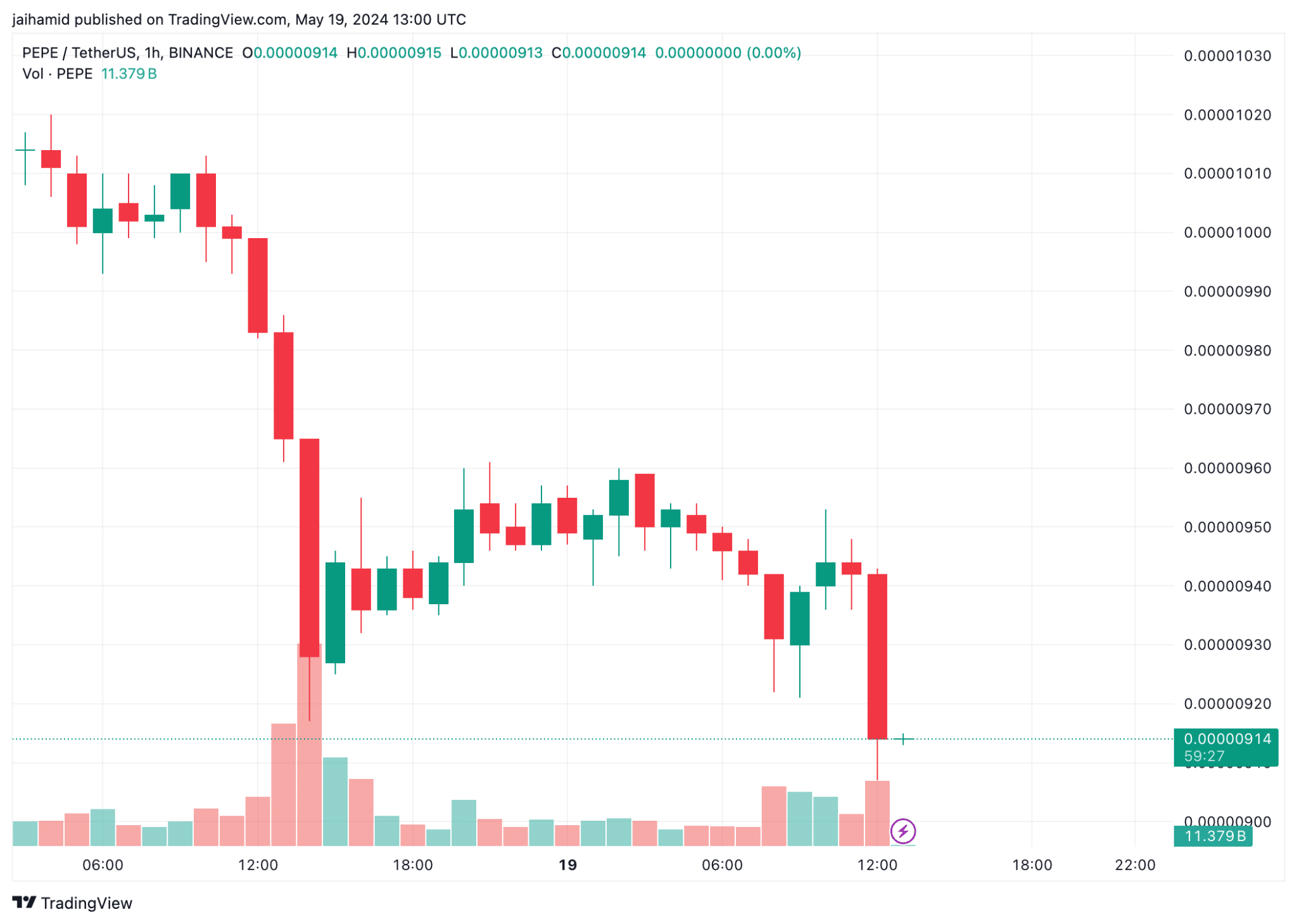

The PEPE/USDT chart shows a notable bearish trend throughout the session, with price action marked by a series of red candles. Such a sharp decrease, supported by high volume, typically indicates that bears are in control.

This could potentially drive the price down further unless there is a significant change in market dynamics or external influences that could encourage the bulls to flip the script.

Data from Coinglass showed that the trading volume for PEPE has increased by 14.02% to $697.64 million, suggesting a heightened trading activity and possibly a growing interest in PEPE among traders.

However, the open interest has seen a decrease of 10.09%, standing at $105.29 million, which might indicate that some traders are closing their positions, focused solely on taking profits.

What to expect from PEPE this week

If PEPE holds above the 0.00000900 support and sees increasing buyer volume, along with a bullish MACD crossover and an RSI recovery above 30, there could be a potential for a short-term price recovery.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The RSI was below the 30 mark at press time, meaning that PEPE is in an oversold condition.

Should these indicators align positively, PEPE could see a recovery in the near future, testing higher resistance levels. All in all, the memecoin seems to be in consolidation mode, so the decline could be just temporary.