PEPE prices up 12% from this support level – Is it all good news?

- PEPE maintained a bullish structure as it consolidated within the golden pocket.

- The high concentration of liquidation levels to the south might see a 14%-20% drop in coming days.

Pepe [PEPE] bulls managed to make some gains over the past couple of days. The $0.0000062 support zone was retested again and saw a positive reaction.

Yet, the trading volume was dropping, as was the Open Interest.

AMBCrypto’s analysis showed that the number of new addresses has fallen in the past few days. The daily active addresses have also declined, which could see the demand fall as well.

Is the falling volume a concern?

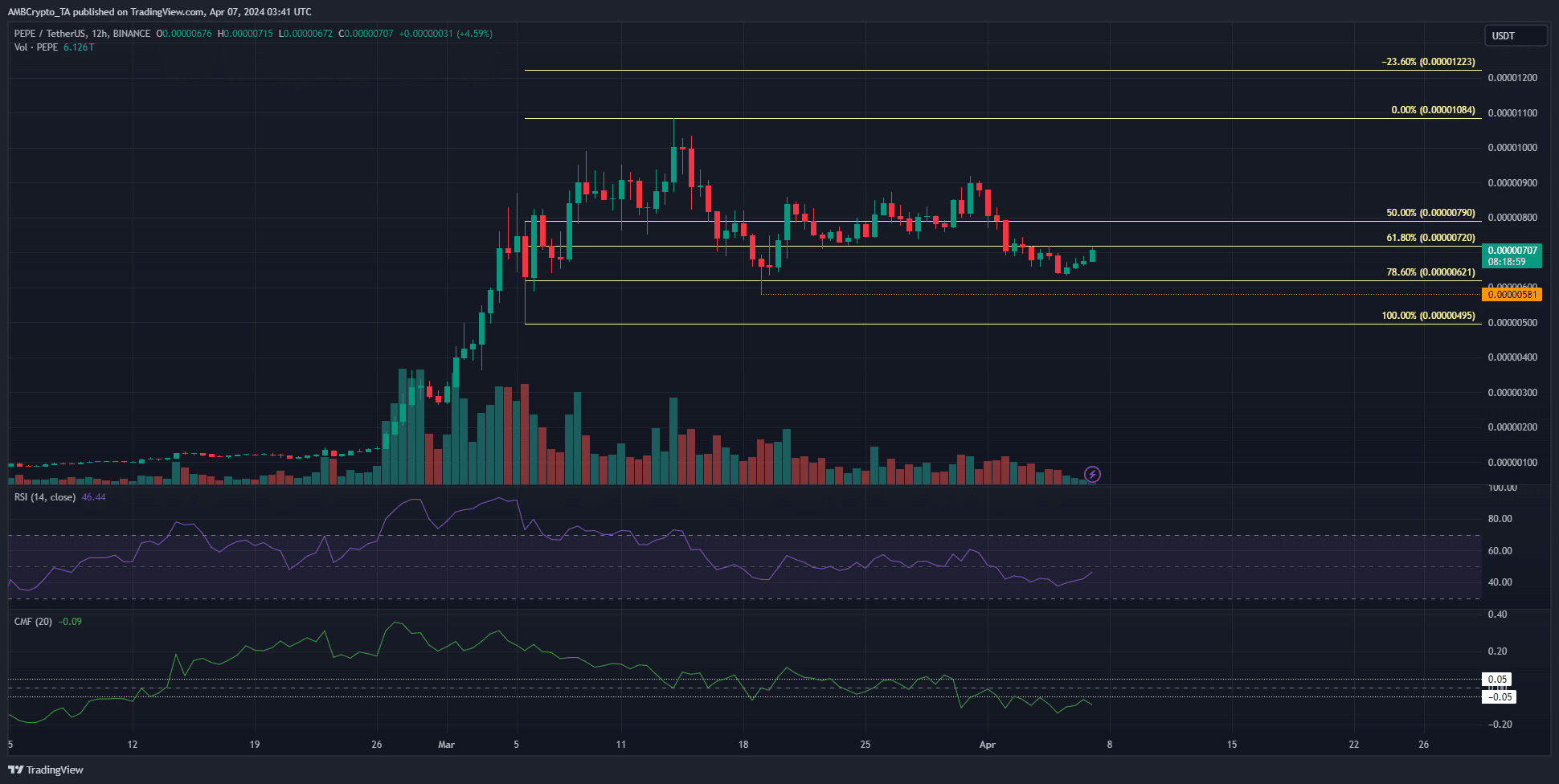

PEPE maintained an uptrend on the longer timeframes. The swing low at $0.00000581 is the one bears have to beat to flip the market structure bearishly.

The price was in the golden pocket based on the Fibonacci retracement levels plotted.

Combined with the fall in the trading volume, it appeared that the meme coin was in a consolidation phase. The RSI was at 46.

While its drop below neutral 50 showed downward momentum was favored, a drop below 40 would be necessary to indicate strong bearish intent.

The Chaikin Money Flow was below -0.05 to indicate heavy capital flow out of the market. This suggested that further losses were imminent.

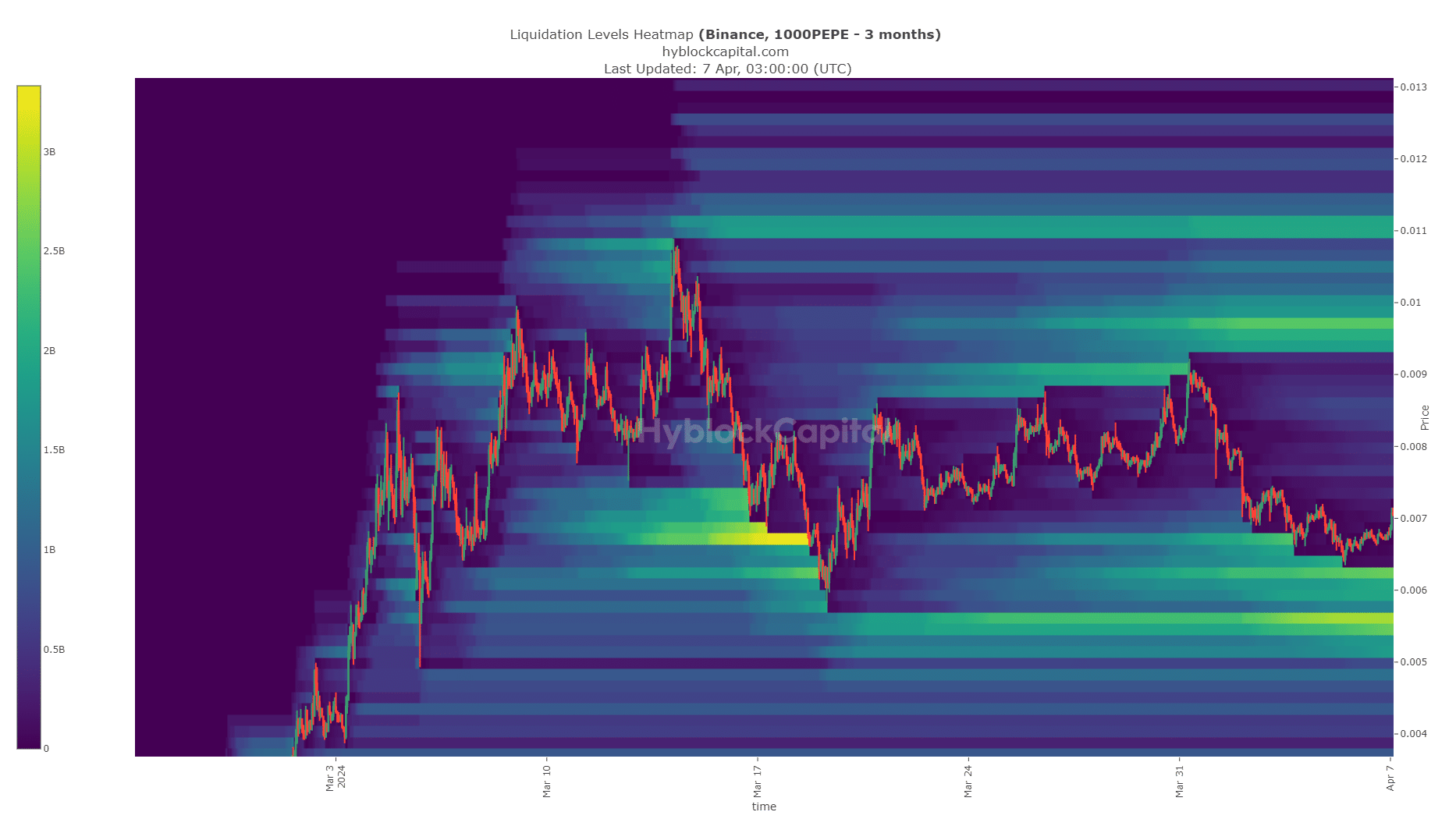

A reaction from the liquidity pocket was underway

Source: Hyblock

The liquidation heatmap showed that $0.000006-$0.0000062 had a high concentration of liquidation levels.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The token has already seen a short-term positive reaction but could decide to dip further to hit the liquidation levels bunched up nearby.

The $0.0000056 is also an area of interest that could attract PEPE prices. If we see such a drop, it would indicate bears were dominant and that the trend had potentially shifted.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)