PEPE rejected at $0.00000920, falls nearly 10% in 48 hours: What now?

- PEPE was rejected at $0.00000920 resistance, sparking a 9.17% drop in 48 hours.

- Metrics and liquidation data pointed to continued bearish pressure.

Recent price action for popular memecoin PEPE suggested further downside ahead.

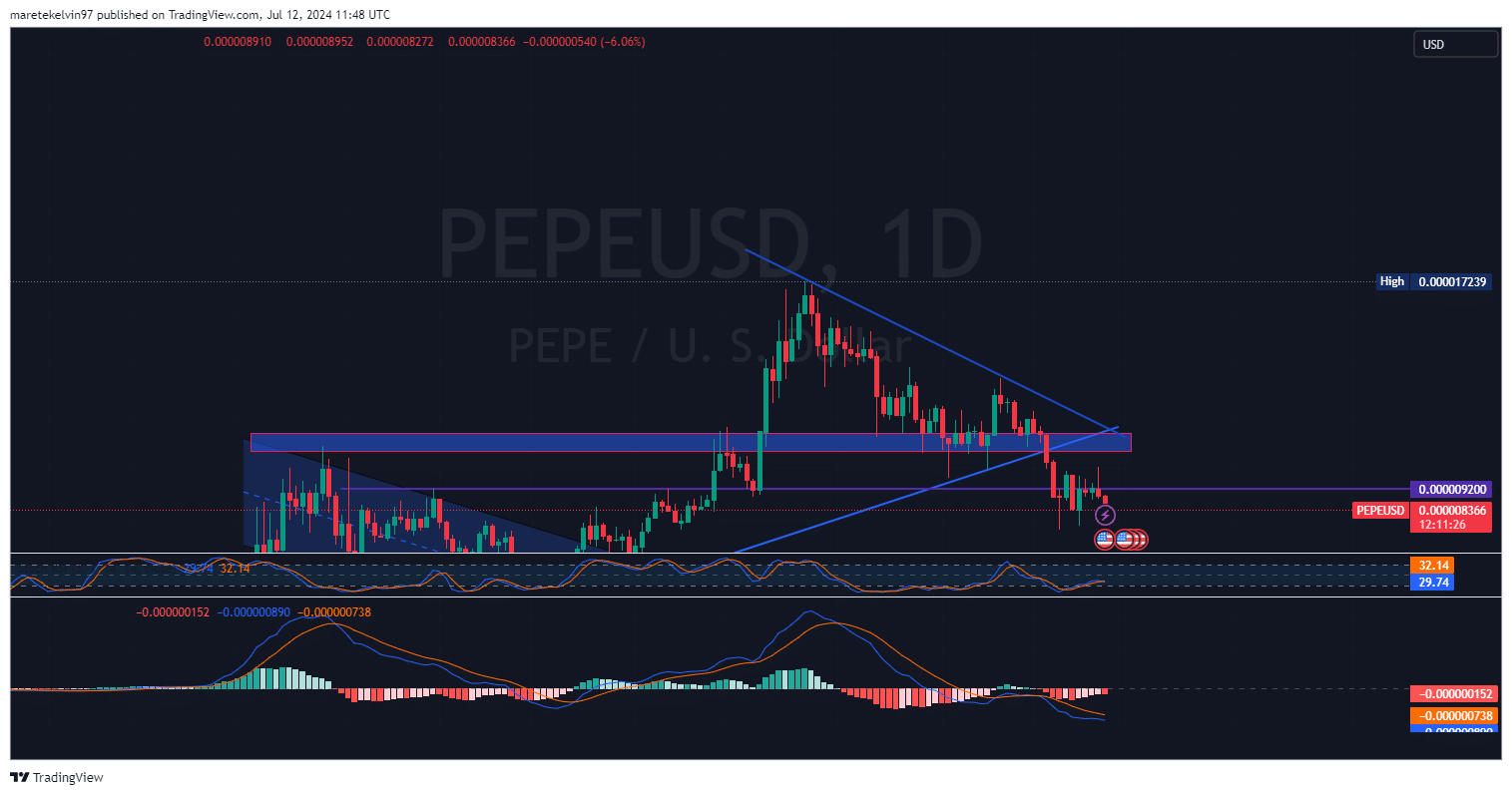

After building bullish momentum and surging 17.80% in the last three days, PEPE faced rejection at a critical resistance level of $0.0000092.

As of this writing, PEPE had witnessed a sharp decline of around 9.17% in the last 48 hours. AMBCrypto dove deeper into the latest developments and analyzed what they meant for PEPE’s short-term outlook.

Resistance proves too strong

PEPE had been gaining ground in recent days, with buyers pushing the price upwards. However, the token hit a wall at the $0.00000920 resistance level.

This key price point proved too difficult to breach, resulting in a rejection.

Following the failed breakout attempt, PEPE’s price took a nosedive. Over the past 48 hours, the token shed 9.17% of its value. This rapid decline erased recent gains and put it back on a bearish trajectory.

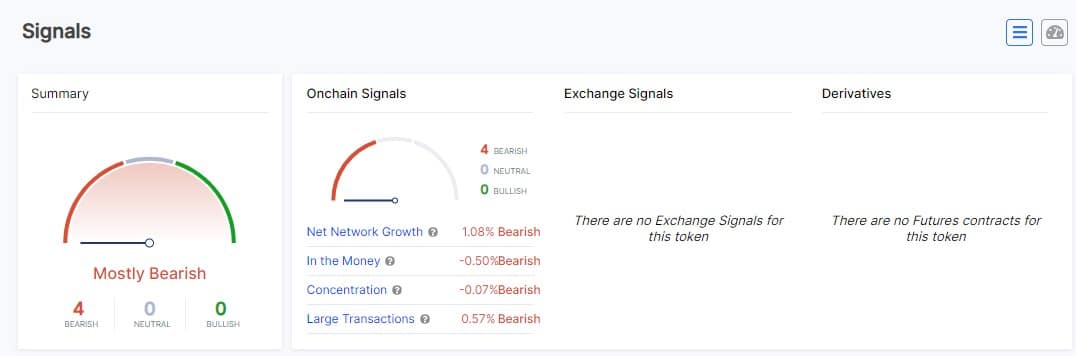

The rejection at the key resistance level and subsequent price decline for PEPE correlated closely with bearish on-chain signals observed by AMBCrypto via IntoTheBlock. Most signals painted a bearish picture.

Notably, the Net Network Growth indicated a bearish trend of 1.08%, while the number of investors “in the money” sat at -0.50%, a bearish sign.

Concentration levels were also slightly bearish at -0.07%, and large transactions displayed a bearish signal of 0.57%.

This correlation of negative signals across multiple metrics suggested that it may face continued downward pressure in the immediate future.

PEPE liquidations heating up

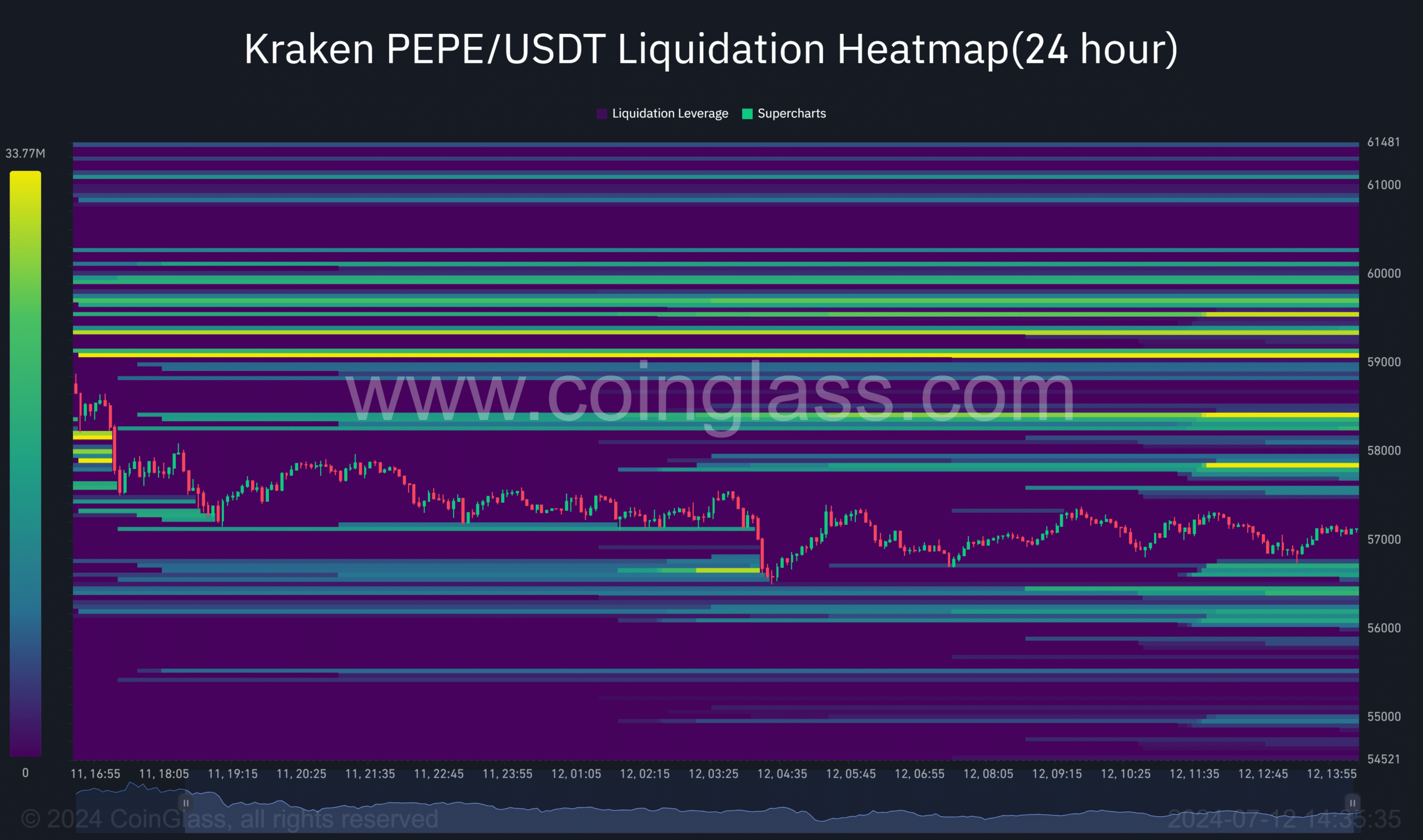

As PEPE’s price dropped, there was a surge in liquidations on derivatives exchanges.

AMBCrypto’s analysis of the liquidation heatmap data from Coinglass showed many forced closures of leveraged long positions in the past 24 hours.

This wave of liquidations may have played a part in the PEPE’s further dips. It also indicated that many investors were too optimistic and took on too much risk.

If the price keeps falling, this could lead to more selling signals.

Sentiment cooling off

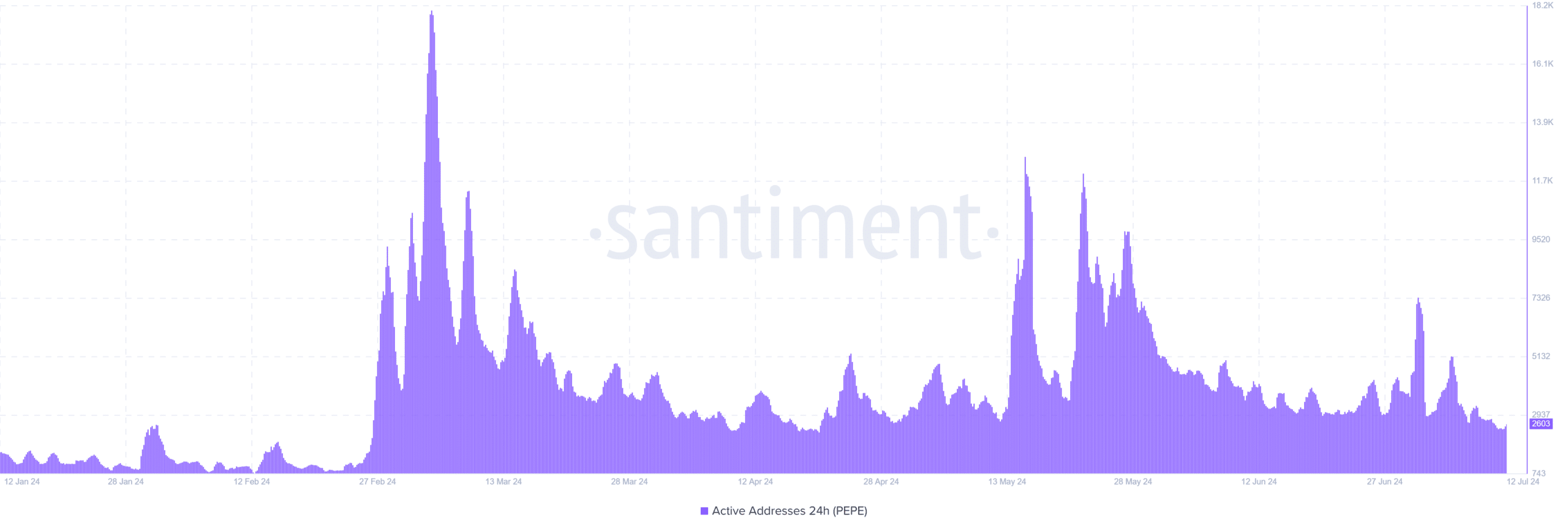

PEPE’s price decline coincided with cooling sentiment among holders. Notably, Santiment’s Active Addresses data indicated a sharp drop-off in network activity over recent weeks.

This fading interest and engagement could make it difficult for PEPE to stage a recovery in the short term. Without renewed buying pressure, the path of least resistance appears to be downward.

Source: Santiment

What’s next for PEPE?

Given the convergence of bearish signals, PEPE looks primed for further dips in the days ahead. The next key support level to watch is $0.00000720.

Read Pepe’s [PEPE] Price Prediction 2024-25

If this support fails to hold, PEPE could revisit its recent lows around $0.00000650.

For any chance at a bullish reversal, PEPE needs to reclaim the $0.00000920 resistance level that it recently rejected.