PEPE surges 13% in 24 hours: Is the memecoin turning bullish again?

- PEPE’s price and volume surge indicate renewed market interest.

- Profitable addresses and bullish sentiment rose as well.

Pepe [PEPE] has started making waves in the crypto market once again, as the memecoin saw a remarkable 13.32% price increase in just 24 hours. This boost has pushed its market cap up by 13.02% to $3.4 billion.

And that was not all; trading volume grew by 64% to hit $711.05 million. This explosive growth in both price and volume suggested renewed interest in the meme coin.

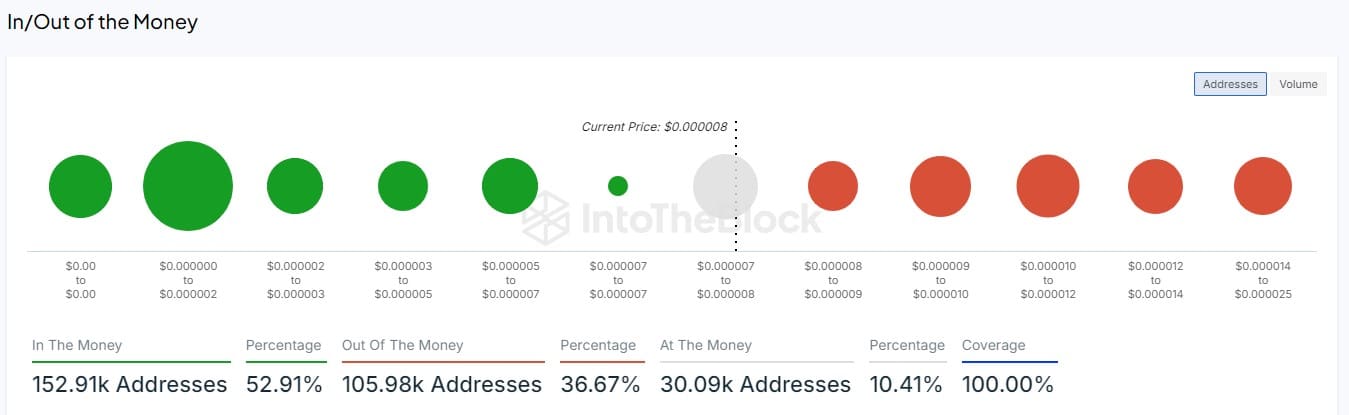

Diving deeper, AMBCrypto found interesting on-chain data. At press time, 52.91% of addresses holding PEPE were profitable.

A slight majority like this could mean an even distribution of holdings across various individuals.

Also, the long/short ratio lent towards bulls as more investors decided to go long. This optimism may cause additional increases if the trend is sustained.

Breaking the downtrend

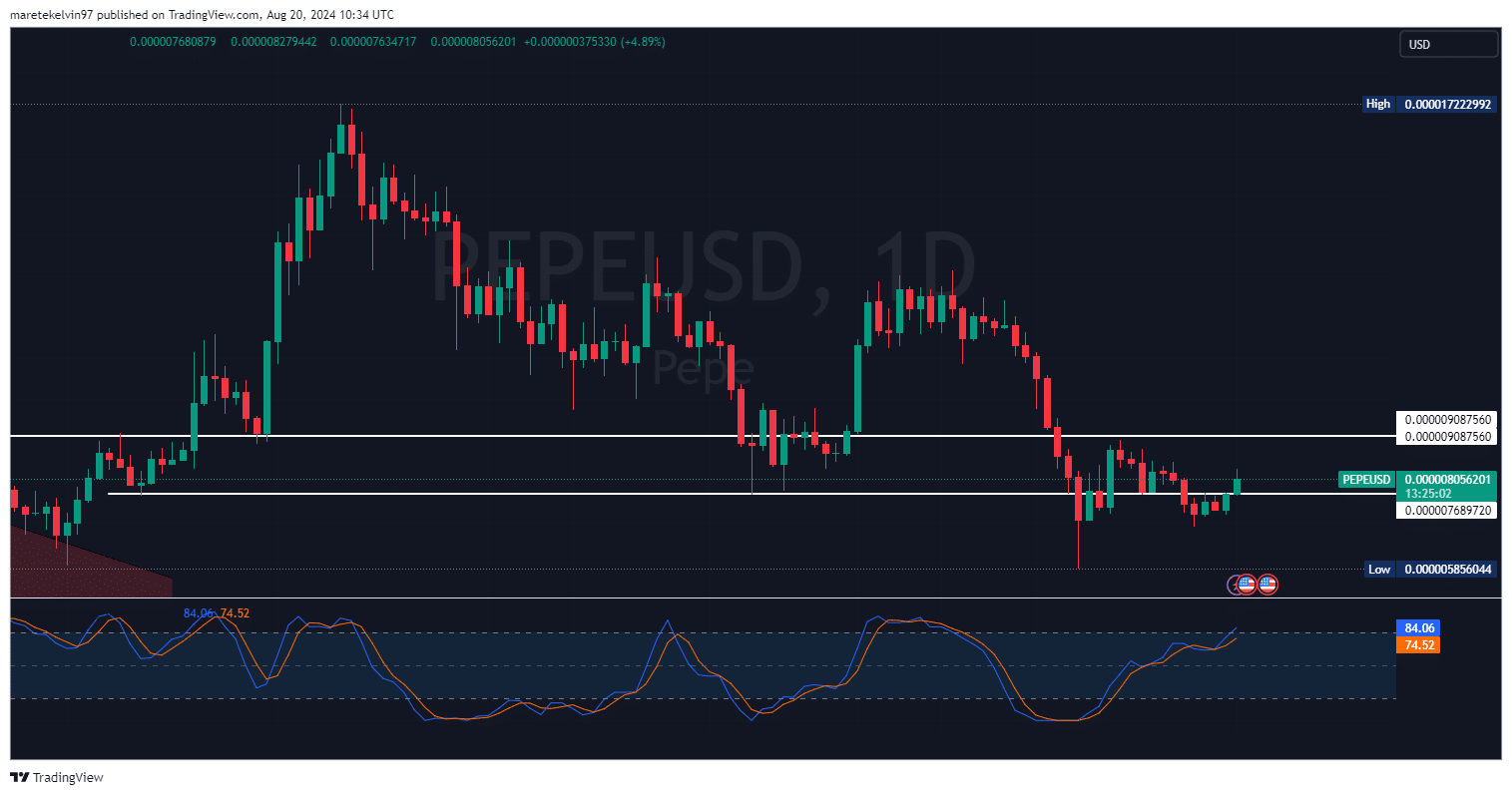

PEPE’s price chart is intriguing, indeed. Since late July, the token has been on a downtrend, with lower lows being formed over time coupled with lower highs.

Nevertheless, recent price surges broke this descending pattern. This breakout, coupled with a bullish stochastic RSI crossover, hinted at a potential trend reversal.

What does this mean for PEPE?

The combination of price surges, increased volume, and technical breakouts paints an exciting picture for PEPE.

However, caution should be taken since meme coins are well-known for their wild swings in prices that can reverse suddenly.

Read PEPE’s Price Prediction 2024-2025

If the holders decide to cash out their profit, the resulting selling pressure could pull the price down in the short term.

However, breaking the downtrend and bullish indicators might show a chance for future growth.