Pepe

PEPE surges by 11%, but there’s more work to be done

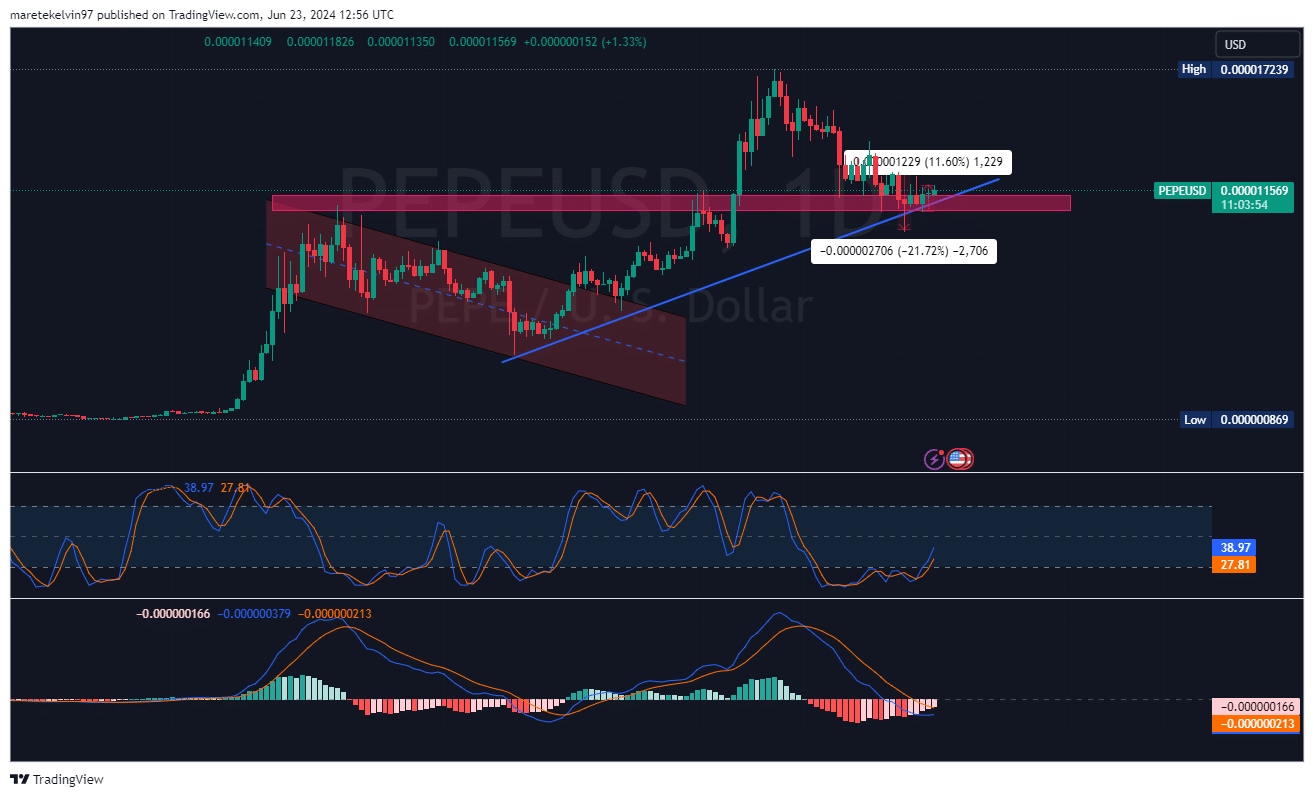

As PEPE surges 11.60% in 72 hours, what’s driving this bullish momentum?

- PEPE surged by 11.60% in 72 hours.

- Bullish momentum accumulated despite short-term bearish bias.

Pepe [PEPE] has caught the crypto market by storm after an impressive surge of 11.60% in less than 72 hours. This rapid increase indicated strong bullish momentum, despite some short-term bearish indicators.

Let’s dig deep into the key market trends and on-chain data driving this performance.

According to CoinMarketCap’s data, PEPE’s price stood at $0.0000116, a 2.56% increase in the last 24 hours. PEPE’s price has climbed steadily, breaking past resistance levels and forming a bullish trend line.

However, the market has a short-term bearish bias, indicated by the RSI and MACD, which suggested a potential pullback before a continuation of the upward trend.

What the liquidity has in store

The price action correlated with liquidation levels on Bitmex, as indicated by the Coinglass liquidation heatmap.

High liquidation levels often lead to increased volatility, hence creating opportunities for sharp price movements. The heatmap indicated substantial liquidation activity around the $0.000012 level.

This suggested that traders should keep an eye on these levels for potential support or resistance.

AMBCrypto further analyzed Santiment’s whale activity and social volume data for more insights.

From historical data, when the percentage of stablecoin total supply held by whales (more than $5 million USD) approaches 50% along with social volume exceeding 49.25, PEPE’s prices surge.

As from the Santiment’s data, PEPE met these conditions, showing a potential strong bullish signal.

What is on the horizon for PEPE?

The increase in social volume, coupled with the accumulation of stablecoins by whales, pointed to spiked market interest and potential upward price pressure.

Read Pepe’s [PEPE] Price Prediction 2024-25

This trend suggested that PEPE could continue its bullish rally in the long term, provided these on-chain conditions persist.

However, since the Stochastic RSI and MACD indicators suggested short-term bearish pressure, price pullbacks cannot be written off.