PEPE whales accumulate despite losses – Should you follow suit?

- Whales have recently accumulated 828.8 PEPE from Kraken.

- Will the whale actions ignite a price rebound for PEPE?

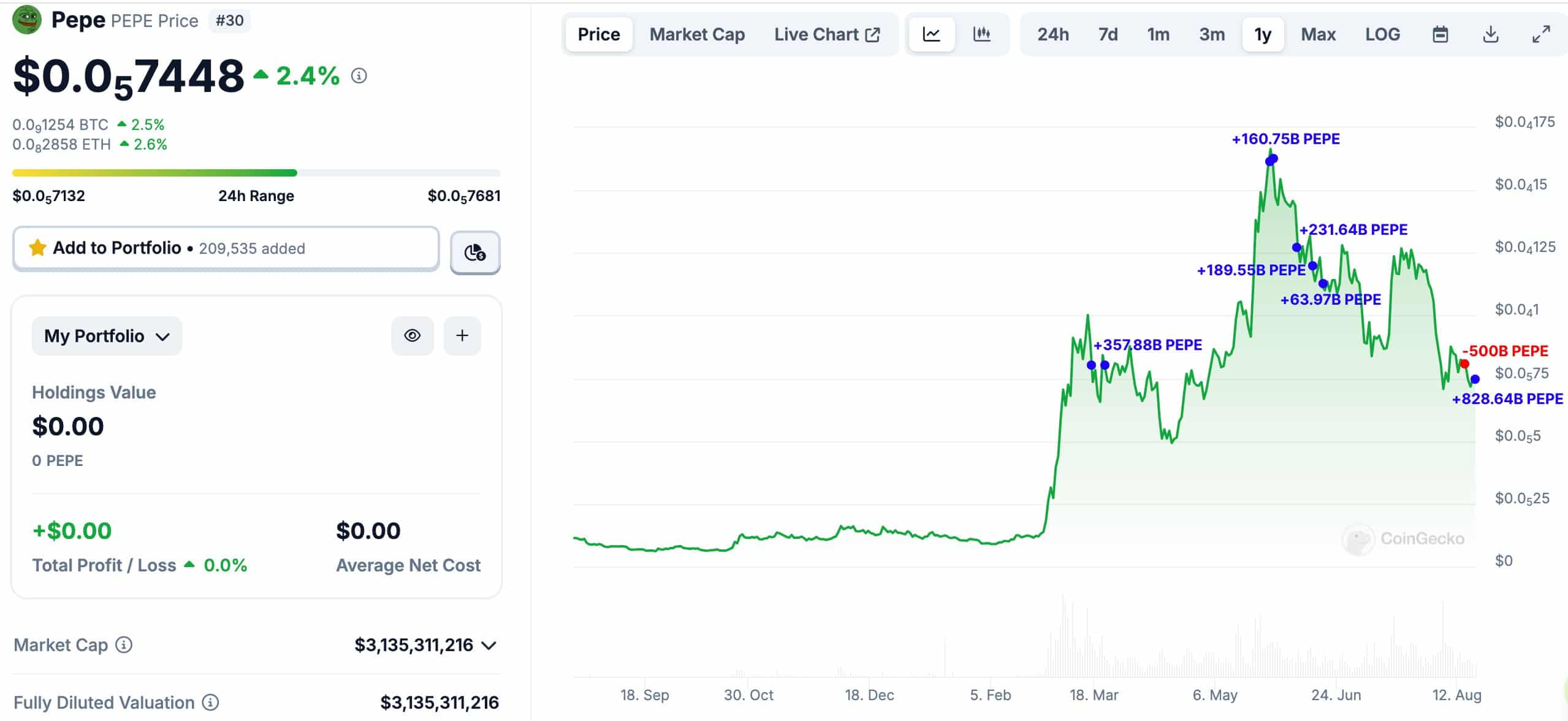

Pepe [PEPE] recorded renewed whale interest despite its current local price lows. According to Spot On Chain, two whale wallets grabbed 828.8B PEPE, worth $6.2 million, from Kraken on 17th August.

The whale wallets, believed to belong to a single person, recently sold 500B PEPE before grabbing more 828.8B PEPE at the recent low of $0.0000074.

“This whale sold 500B $PEPE 3 days ago at $0.000008 and bought 828.64B $PEPE at the lower price of $0.0000074. The whale now holds 1.33T $PEPE($9.93M) but still loses $3.3M on $PEPE.”

Is PEPE’s whale action a buy signal?

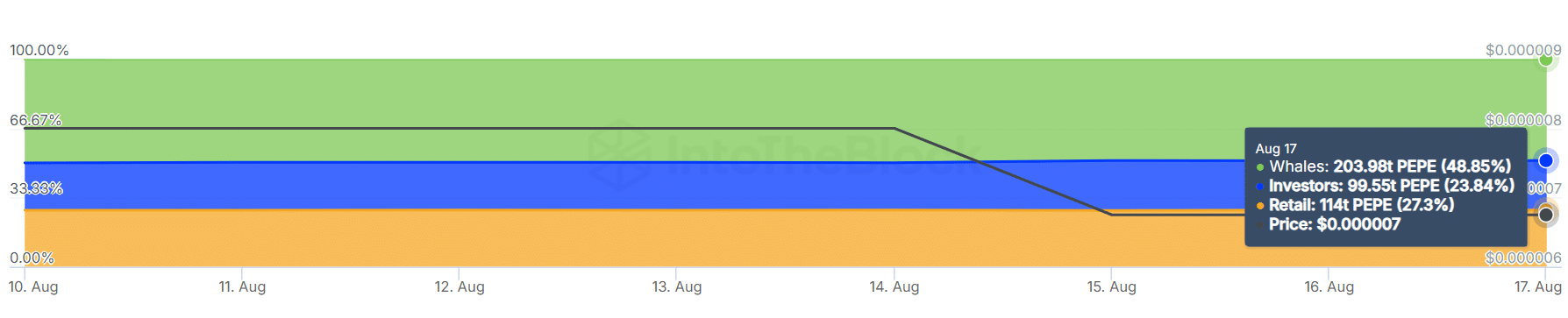

PEPE memecoin concentration is mainly dominated by whales, per IntoTheBlock data. As such, whale moves like the aforementioned one could impact PEPE prices.

In the past 7-day trading period, whales held nearly 49% of PEPE circulation, followed by retail class at 27% and investors at 23%. In short, PEPE whale moves can’t be overlooked.

So, was the whale bid price of $0.0000074 ‘cheap’ and a buy signal for other sidelined speculators?

Yes, the whales snagged PEPE at a ‘cheaper’ value.

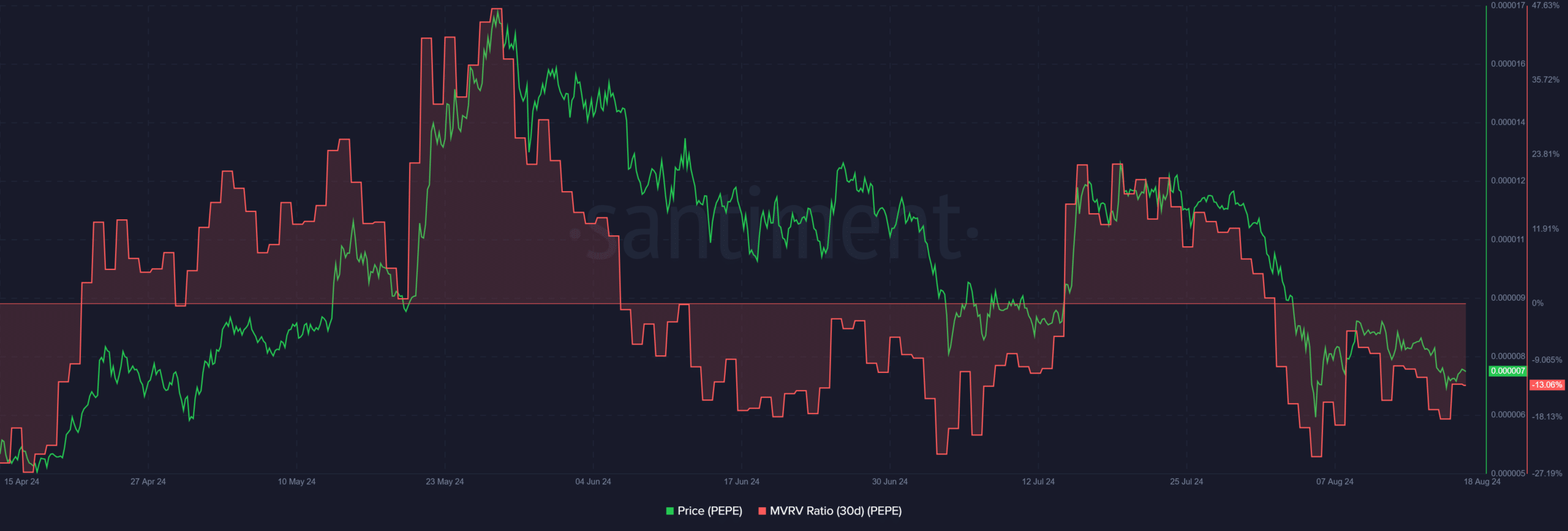

The negative reading (-13%) of the MVRV (Market Value to Realized Value) ratio showed that the PEPE was undervalued and suggested that it was relatively cheap at current values.

It meant that short-term PEPE holders (held for the past 30 days) held the meme coin at a loss.

Conversely, a positive MVRV reading would mean that PEPE was overvalued. Additionally, positive MVRV values also mean holders have unrealized profit and could be tempted to sell for profit.

Meanwhile, PEPE topped Open Interest (OI) rates amongst memecoins over the weekend, likely due to recent whale moves. This suggested that more liquidity flowed into the memecoin, a positive catalyst for price.

What’s next for price action?

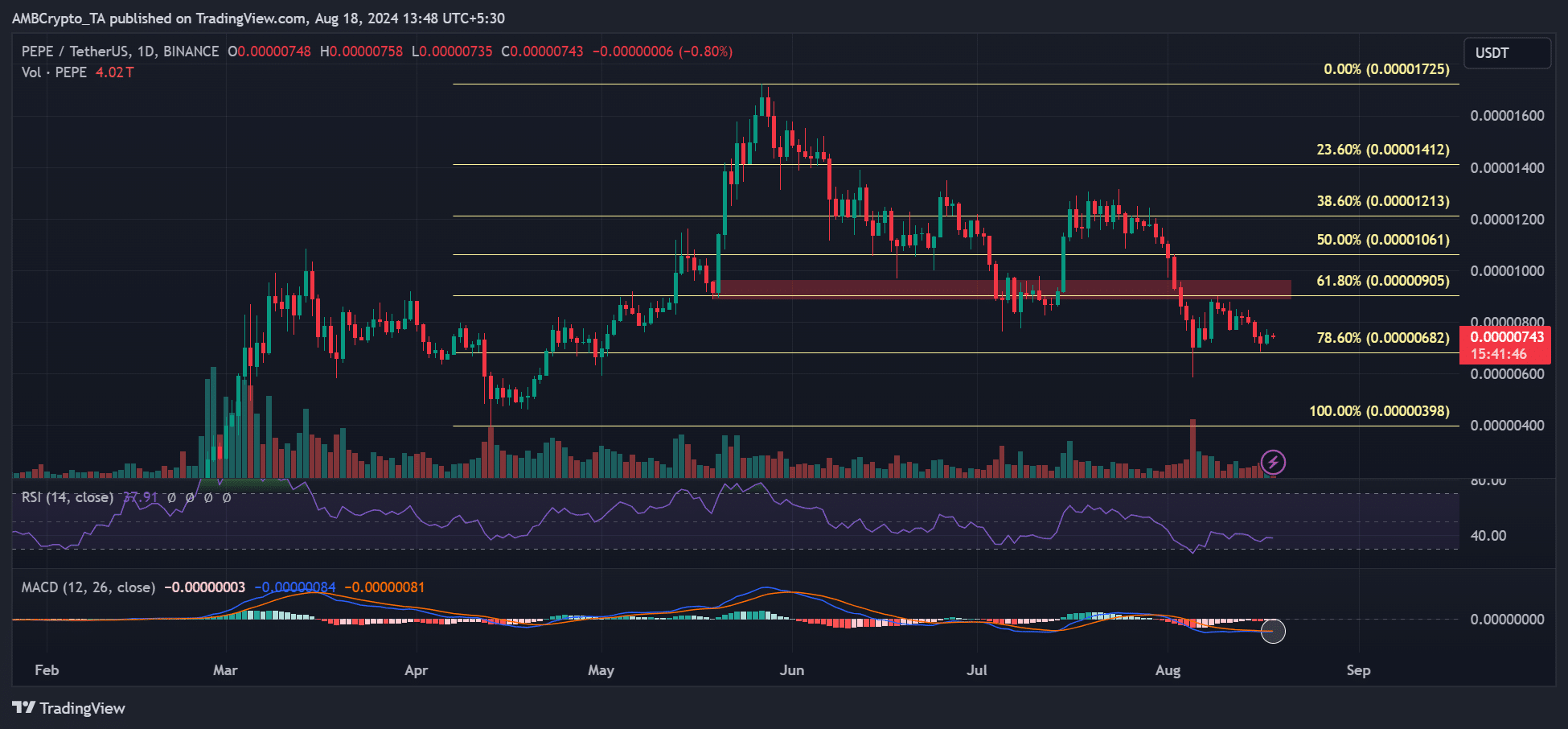

On the daily charts, MACD (Moving Average Convergence/Divergence) was on the verge of a bullish crossover, which could signal the start of an uptrend or recovery.

If so, the immediate and short-term bullish target for PEPE bulls will be 61.8% Fib level ($0.000009). The 78.6% Fib level (0.0000068) was a key short-term support on the lower side.

Read PEPE Price Prediction 2024-2025

However, the market structure was still bearish as of press time. Besides, the demand for PEPE was flat, as shown by the sideway RSI (Relative Strength Index), which was below the neutral level.

PEPE bulls could watch for a convincing break above the supply level of $0.000009. Such a move would flip the market structure bullish and signal an extended recovery potential.