PEPE – Why THIS decline is good news for the memecoin

- PEPE’s MVRV ratio has declined from 1.96 to 1.74 despite the price gaining by nearly 10% in 24 hours.

- An ascending triangle pattern suggested that PEPE was poised for more gains.

Pepe [PEPE] staged a bold recovery at press time after a nearly 10% gain to trade at $0.0000249.

These gains mirrored the performance of most memecoins after their total market capitalization rose above $138M after an 8% gain in 24 hours.

PEPE has been among the top performers in the crypto market this month after creating a new all-time high of $0.000028 on the 9th of December.

While it has since dropped by 9%, several signs pointed towards a healthy correction.

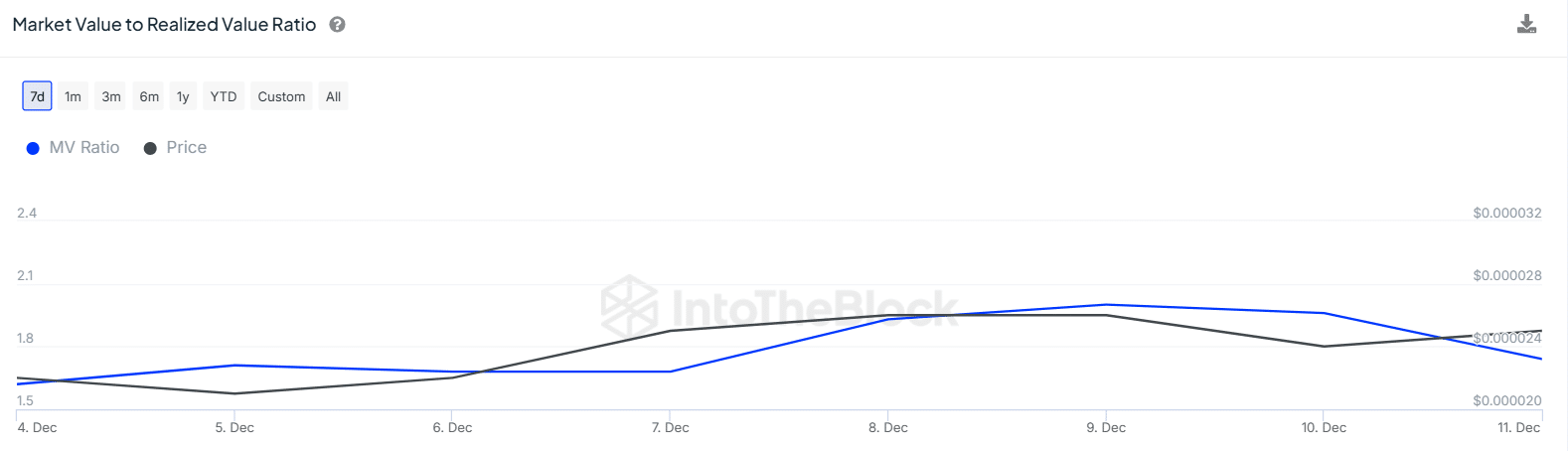

PEPE MVRV hints at further upside

PEPE’s market value to realized value (MVRV) dropped from 1.96 to 1.74 in 24 hours, which shows a drop in unrealized profits.

Despite the price appreciation, a drop in this ratio suggests that traders are willing to hold PEPE, instead of sell.

PEPE’s falling MVRV ratio shows that despite the recent gains, the memecoin is not yet overvalued, indicating there is room for more growth.

The MVRV ratio is also not at extreme levels, despite 94% of PEPE holders being in profit per IntoTheBlock. This suggests that traders are willing to hold instead of taking profits, highlighting bullish sentiment.

Bullish continuation?

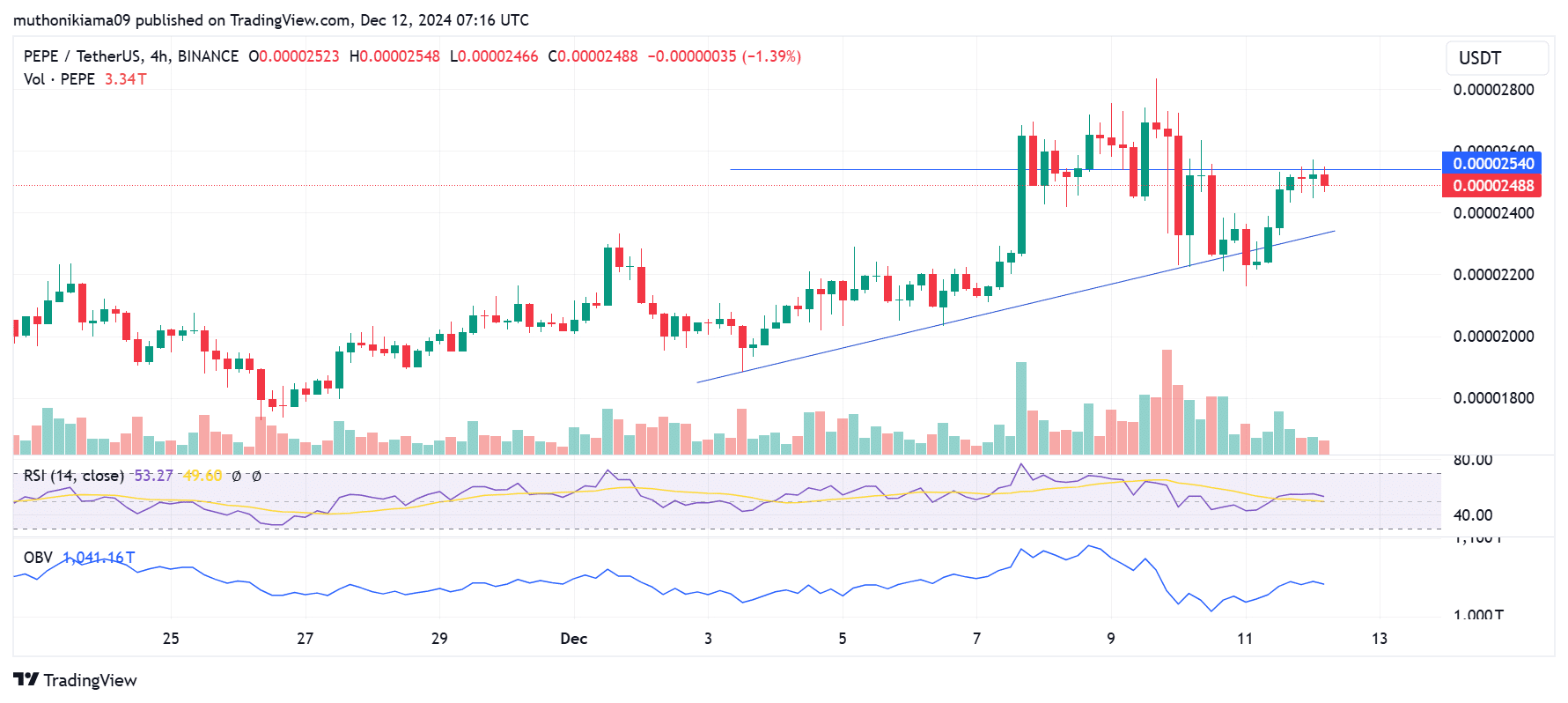

PEPE had formed an ascending triangle pattern on its four-hour chart, which often shows a bullish continuation.

However, a bullish breakout above the upper trendline of $0.0000254, which is also a strong resistance level, will depend on the buying activity.

The Relative Strength Index (RSI) stood at 53 showing weak bullish momentum. Additionally, the RSI line has flattened, showing that buyers are indecisive.

The on-balance volume (OBV) indicator also shows a similar outlook after flattening following a sharp uptrend earlier this week.

PEPE’s bullish breakout from this ascending triangle and a continuation of the uptrend will depend on new buyers entering the market.

If it flips resistance at $0.0000254 with high buying volumes, it could lead to more gains.

However, if the uptrend shows signs of weakening and traders who are taking profits push the price below the support level at $0.0000223, it could cause a bearish reversal.

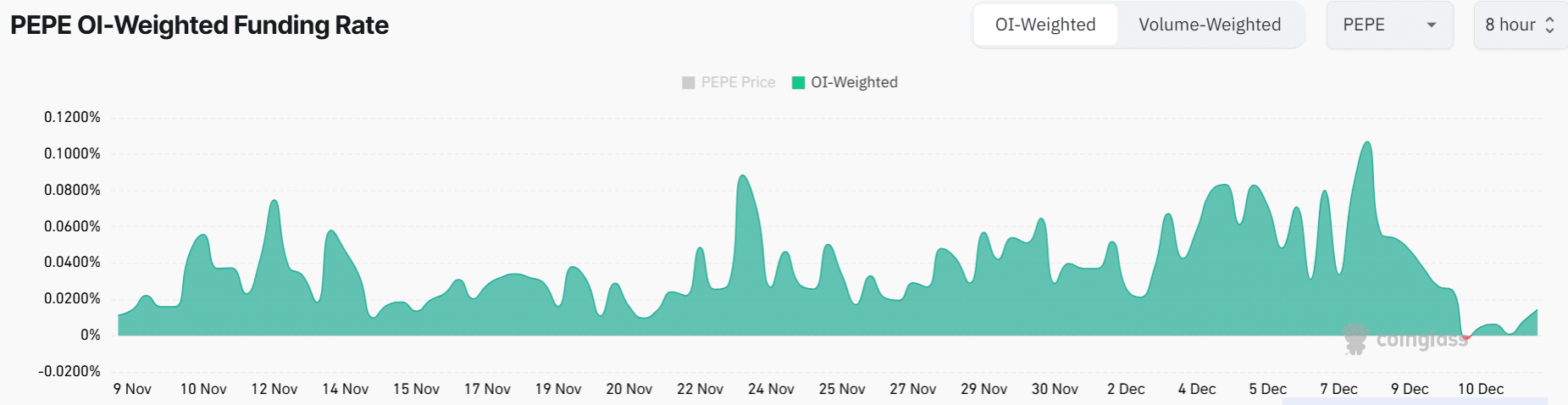

PEPE’s Funding Rate drops

Data from Coinglass showed a notable drop in PEPE’s Funding Rate. The Funding Rate reached a record high earlier this week, but it has since dropped to 0.0144%.

This shows while bulls are still willing to pay a fee to maintain their positions, the number of long positions has dropped.

When there is reduced activity in the derivatives market, it can result in lower volatility, which can give PEPE room for growth. However, if the Funding Rates continue to drop and turn negative, it could cause a bearish sentiment.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Will PEPE form a new ATH in 2024?

PEPE is less than 10% shy of its all-time high. With less than three weeks left before the end of the year, the memecoin is already showing bullish signs, with the reduced leverage giving room for a healthy recovery.

If PEPE overcomes resistance at $0.0000254, which is the upper trendline of the ascending triangle, it could extend its gains and possibly make a new ATH before year-end. However, an increase in profit-taking could cause a downtrend.