PEPE’s 2025 outlook – Whale interest is low, but memecoin’s price will…

- PEPE could still be discounted now that this is its first major rally, especially based on Dogecoin’s past performance

- HODLers have been accumulating , but whales still contributed to sell pressure

Should you hold PEPE in your portfolio or did it exhaust its potential upside in 2025? This is a question many crypto investors hoping for some memecoin exposure are likely to find themselves thinking about.

In fact, PEPE has already delivered a 4,300% upside from its lowest historical levels to its December ATH. This performance seemed to suggest that it may have a limited untapped ceiling for the next leg of the bull market.

However, that may not be the case if we look at the gains that Dogecoin, the king of the memecoin segment, achieved in its first major bull run.

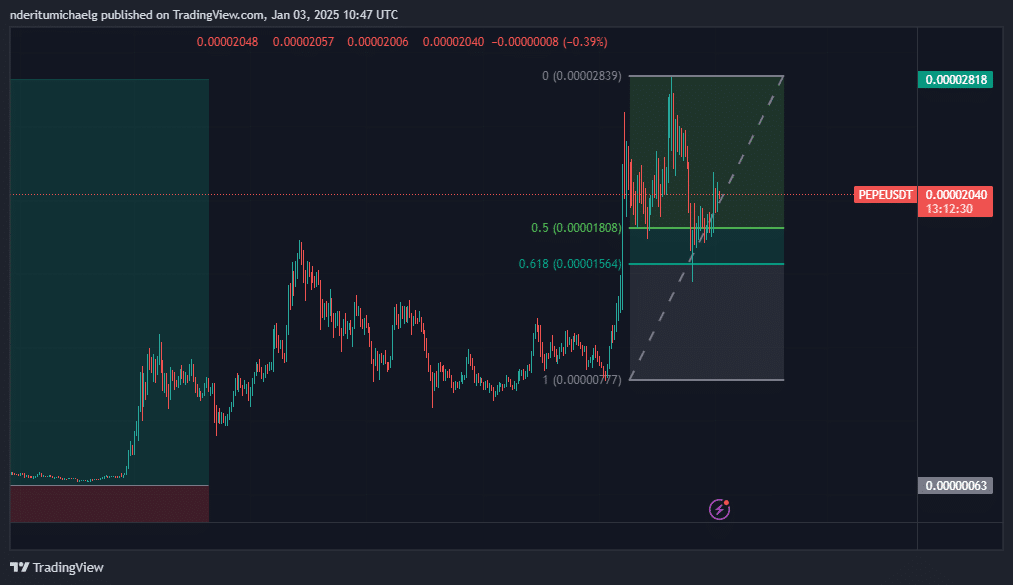

DOGE pulled off over 13,000% gains between 2020 and 2021. By this standard, PEPE could potentially have a bit of a higher ceiling from its latest price level. On the charts, the memecoin recently bounced back at a critical Fibonacci level (0.5 and 0.618 from November low to December peak).

Additionally, at the time of writing, PEPE still seemed to be discounted from its December top by roughly 27%, with a price tag of $0.00002028.

Are investors still interested in PEPE?

Nevertheless, it is worth noting that the memecoin managed to hold on to a significant amount of the gains achieved in November, despite the sell pressure in December – A sign that a significant number of investors are still optimistic about its 2025 performance.

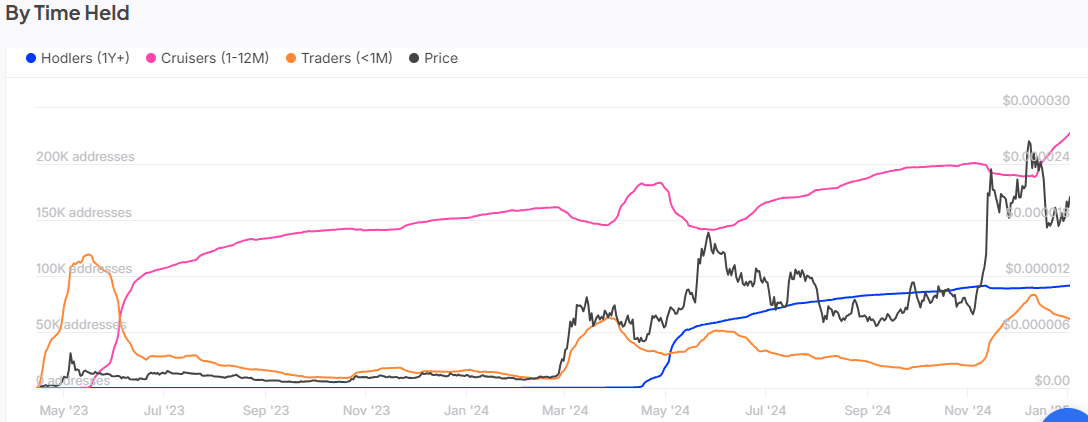

Long-term HODLers peaked at 91,210 addresses before mid November, followed by a significant decline in December. This seemed to be a sign indicating that a significant number of HODLers took profits.

However, they have since re-accumulated, pushing that figure to 91,490 HODLer addresses by 03 January 2025.

The number of cruisers (swing traders) has also seen a significant uptick since 12 December. This suggested that there was a sizeable uptick in accumulation as the price dipped. Cruisers grew from 188,650 addresses on 12 December to 225,950 addresses on 3 January. This may have contributed a considerable deal to the recovering price levels.

Meanwhile, short-term traders dipped from 82,060 addresses on 10 December to 61,450 addresses, at press time – An indication of a shift from long-term trading periods.

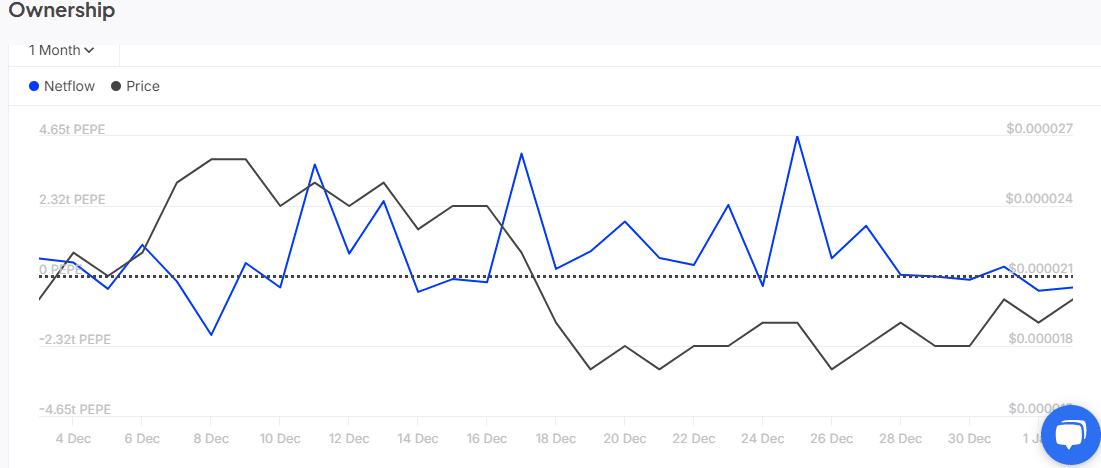

Now, while these observations may be positive, it is worth noting that whales are still focused on short term profit-taking. In fact, large holder netflows amounted to $377.4 billion PEPE ON 2 January – A sign that whales have been selling.

The sell pressure from whales may limit PEPE bulls in the short term.

And yet, the memecoin may still have significant potential upside in the coming months. Only if whales and institutional activity are in its favor though.