Pepe

PEPE’s correlation with Ethereum might play out THIS way for the memecoin

Declining large-holder addresses may impact PEPE’s value in the short term.

- Data revealed that the memecoin’s strong ties to ETH could stall further growth

- High exchange outflows might help PEPE

Frog-themed memecoin Pepe [PEPE] was one of the few top-50 cryptocurrencies to register gains in the last 24 hours. At press time, PEPE was trading at a value of $0.000011, following a 3.35% hike its its value on 21 June.

However, AMBCrypto found that the uptrend might not last. One reason for the same may be the memecoin’s correlation with Ethereum [ETH]

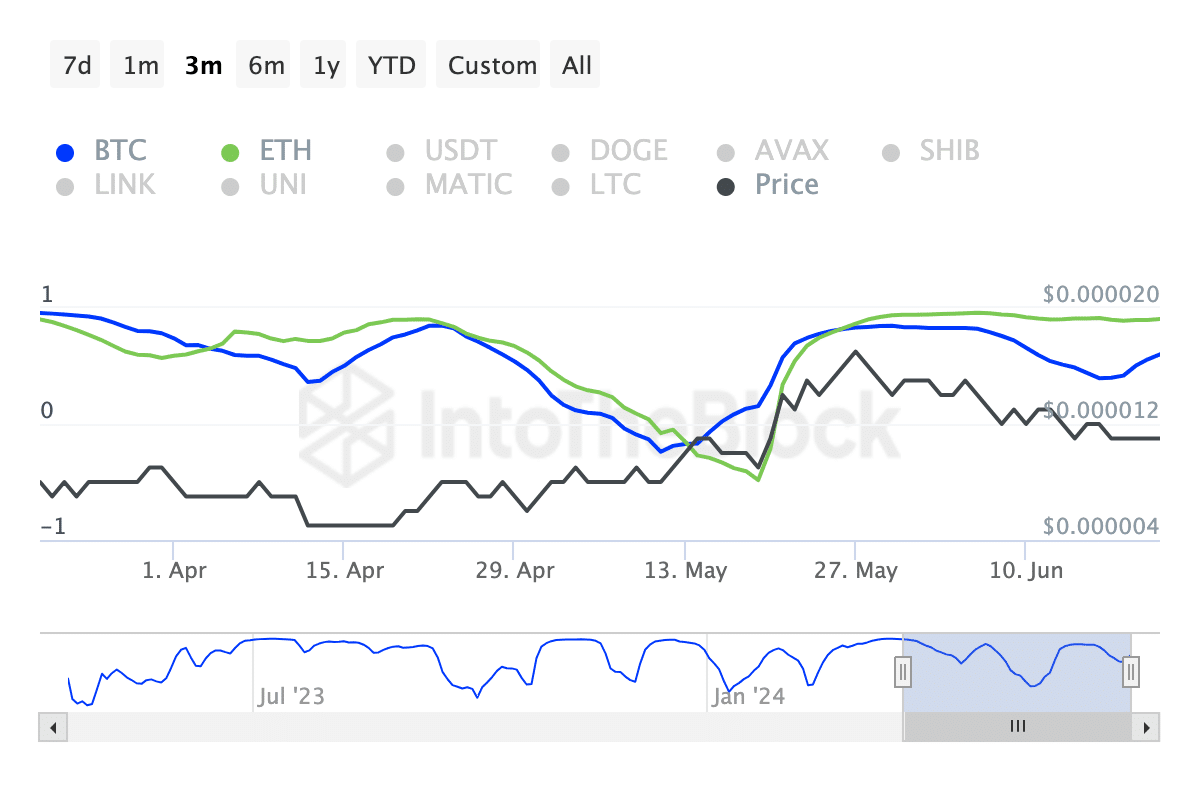

. According to IntoTheBlock, PEPE’s correlation with ETH was. 0.91 at press time.ETH has strong links with PEPE

The aforementioned figure was far above the correlation it shares with Bitcoin [BTC], which stood at 0.60. Values of the correlation ranges from -1. to +1. When the reading is close to -1, it means that prices hardly move in the same direction.

However, if the reading is close to +1, it means that prices head in the same direction most times. And that was the case with ETH and PEPE.

But unlike PEPE, ETH did not appreciate on the charts. Instead, it moved sideways, trading at $3,502 at press time.

Should the price of the altcoin continue to consolidate or encounter a decline, PEPE’s price could retrace

too. Beyond that, only a few memecoins also jumped, meaning a lot of capital was not flowing into the category to kickstart a rally.On the contrary, exchange flows seemed to suggest that ETH might not be able to halt the uptrend. At press time, PEPE’s exchange inflows were 845,000.

Memecoin is in a tight spot

Inflows measure the number of tokens being sent into exchanges. When this number is high, it means that selling pressure could be intense, and could probably lead to a price decline.

On the other hand, Santiment data revealed that the exchange outflows were much higher at 131.07 million. The rise in the outflows

means that those accumulating the token are refraining from keeping them on exchanges.Instead, participants are keeping them in non-custodial wallets. Should this activity continue, PEPE might overlook its strong ties with ETH, and the price could appreciate on the charts.

If this is the case, the value of the token could hit $0.000013 in the short term. However, traders might not need to be cautious.

This, because of the holdings distribution data. Consider this – Addresses by holdings revealed the 30-day change of the number of participants buying more of a token at a certain threshold.

In most cases, the retail cohort rarely impact prices like large investors. At press time, the number of addresses holding $1,000 to $10 million worth of the token had fallen.

Considering the most recent sell-offs across the market, PEPE might now struggle to keep up with its former bullish momentum.

Realistic or not, here’s PEPE’s market cap in ETH terms

If this happens, the prediction to $0.000013 mentioned above could be invalidated. Therefore, PEPE’s price could move at the same pace as ETH, and its price might remain around the $0.000011 zone.