PEPE’s double whammy: Price slips below key level as network activity slumps

- Pepe has a bearish structure and slipped below a key Fib retracement level

- The decline in network activity pointed toward a sustained bearish trend in September

Pepe [PEPE] resumed its downtrend after the bullish 1-day market structure break on the 23rd of August. The structure flipped bearishly on the daily once more after Bitcoin [BTC] fell below the $56k support.

Source: IntoTheBlock

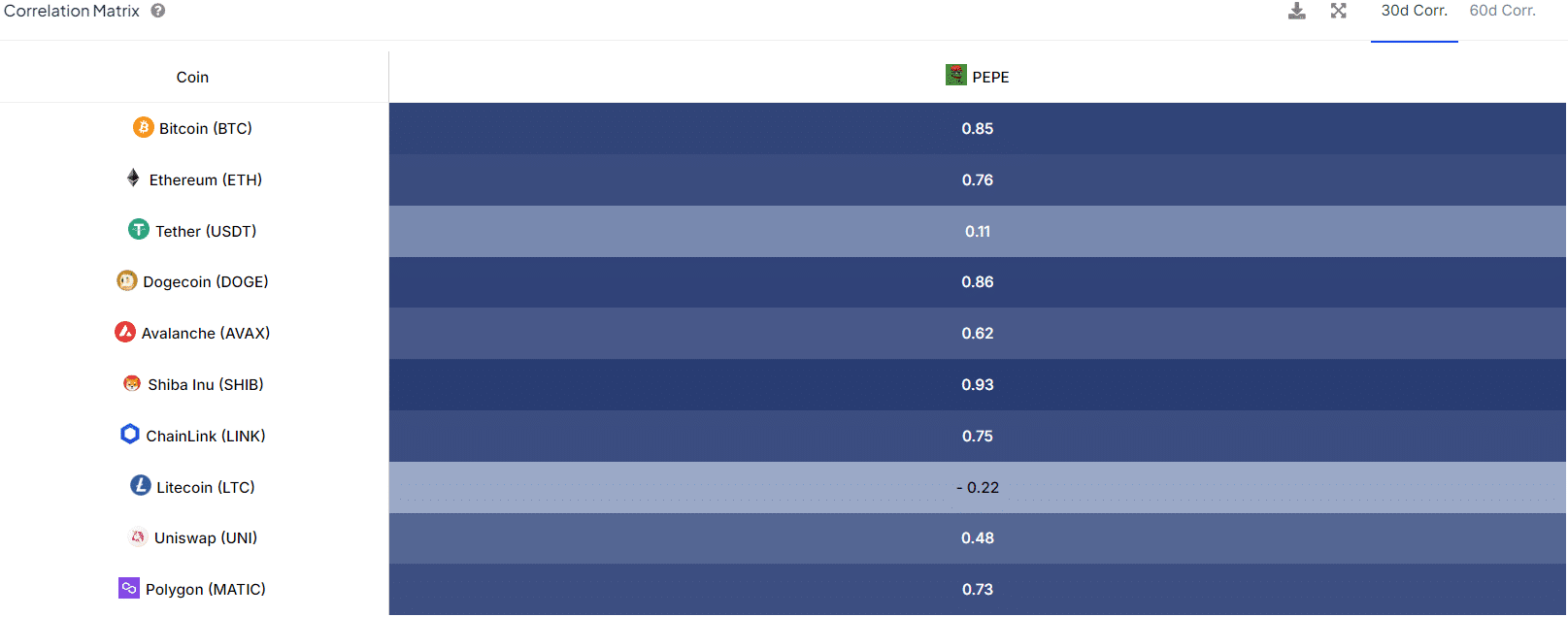

The correlation matrix highlights how closely the price movement of PEPE correlates to Bitcoin but also the other major meme coins, especially Shiba Inu [SHIB].

This also implied that it has been quite difficult for the meme sector to break from the bearish trend of Bitcoin in the past month.

Network activity statistics will dull bullish hopes

Source: IntoTheBlock

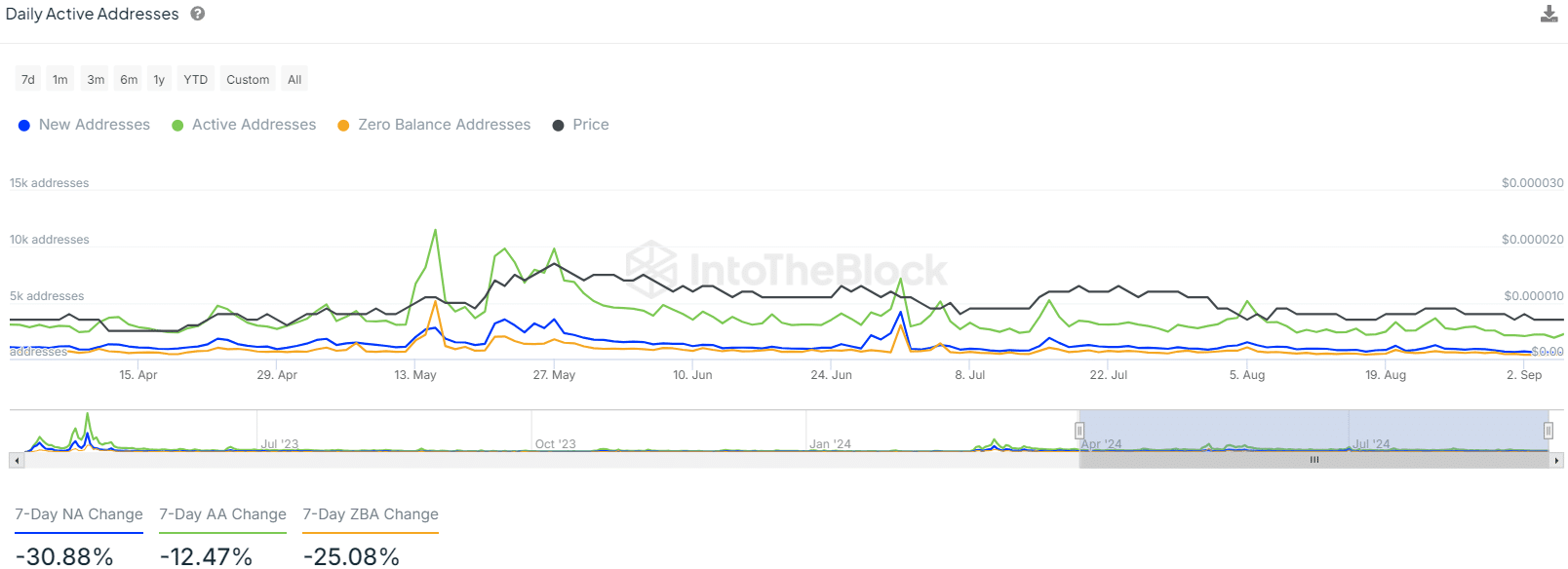

AMBCrypto examined the daily active addresses chart, which showed that the new addresses and active addresses were down by 30.88% and 12.47% respectively in the past week. This meant that activity and adoption were declining.

This was not just a short-term trend. In May, these Pepe metrics formed a respectable high, with active addresses reaching 9.85k. However, since then it has been a steady decline, with the current value at 2.22k.

At the same time, the zero balance addresses have also declined, which usually is a signal of network health and increased participation but in this instance is overshadowed by the other network metrics.

Source: IntoTheBlock

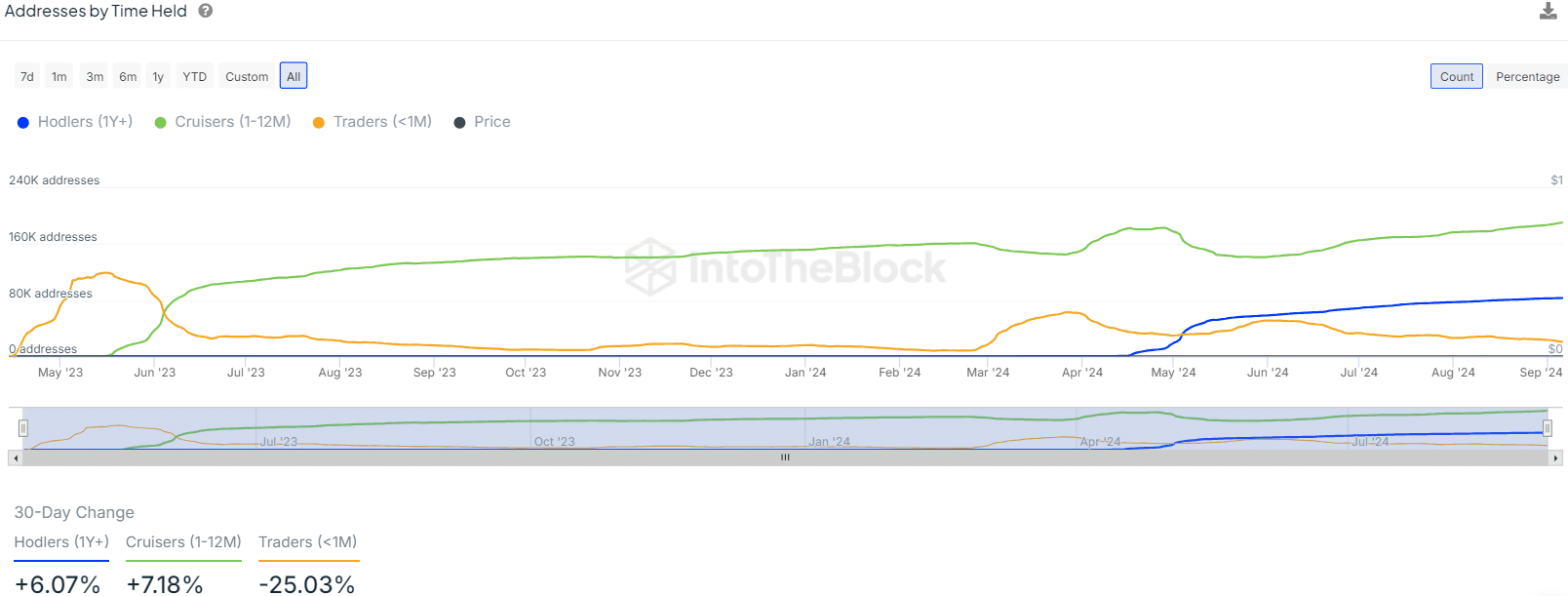

Similarly, over the past month the number of addresses holding PEPE in the short-term, designated as traders, has decreased by 25.03%. The increase in the holder’s numbers was a slight encouragement.

Liquidity targets for PEPE

Source: Hyblock

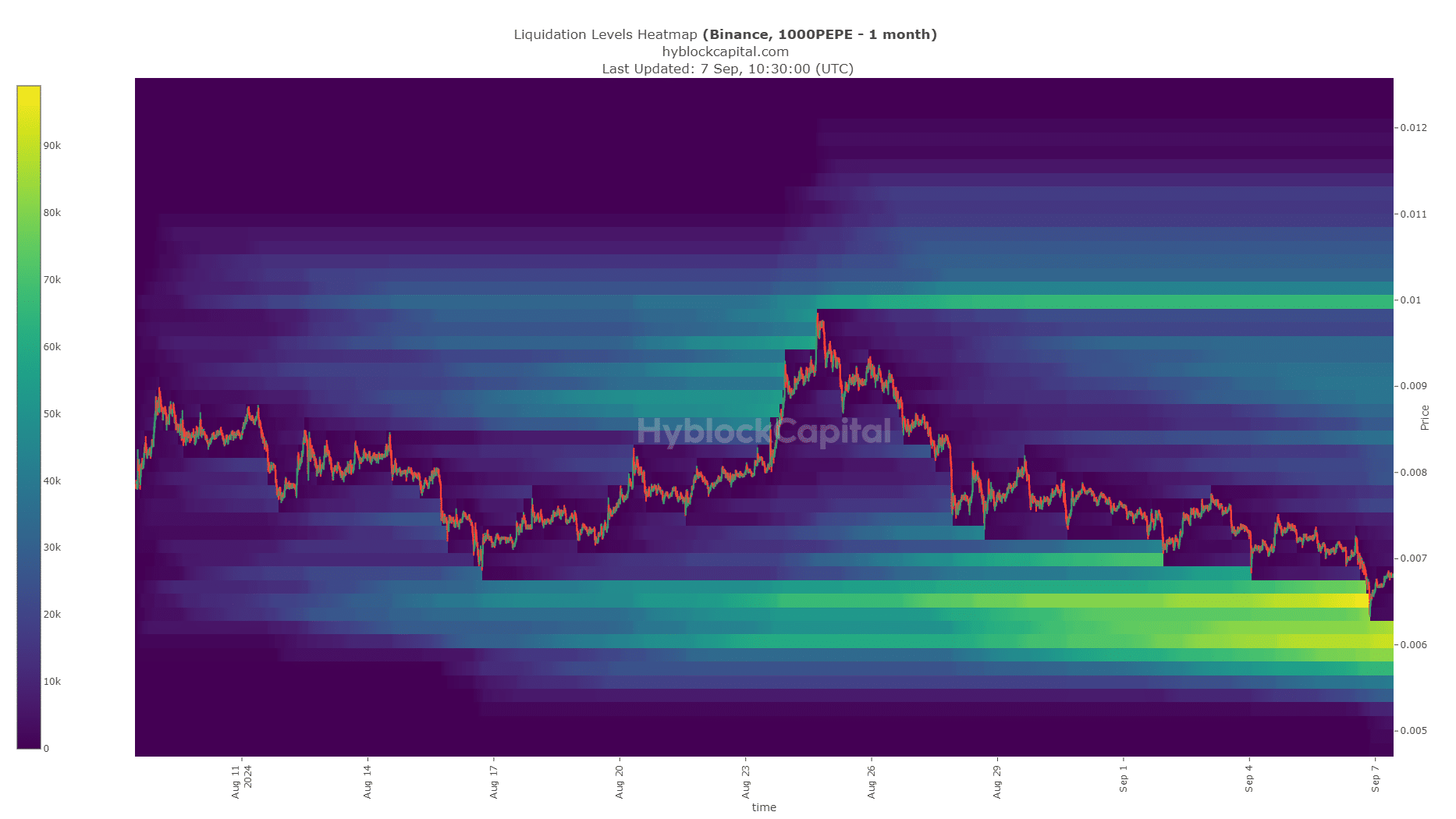

The liquidation heatmap showed that the $0.00000588-$0.00000619 zone is a target for September.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

A revisit to this liquidity pool would likely see a trend reversal and can be a good buying opportunity for investors.

However, if Bitcoin continues to face losses and sentiment does not begin to shift in the coming weeks, these liquidity clusters might not be enough to halt the bearish price advance.