PEPE’s future looks uncertain as bulls, bears surrender – What now?

- On-chain data showed that PEPE’s next direction remained unclear.

- Waning active and new addresses puts the memecoin in line for sideways trading.

Hopes of another increase in Pepe’s [PEPE] price have been dealt a huge blow, AMBCrypto can confirm. The memecoin, which was one of the strongest movers after the market recovered on the 6th of July, was down 3.21% in the last 24 hours.

But it does not end there. At press time, PEPE’s price was $0.0000088. According to the IntoTheBlock, the value could continue to trade within this range for some time.

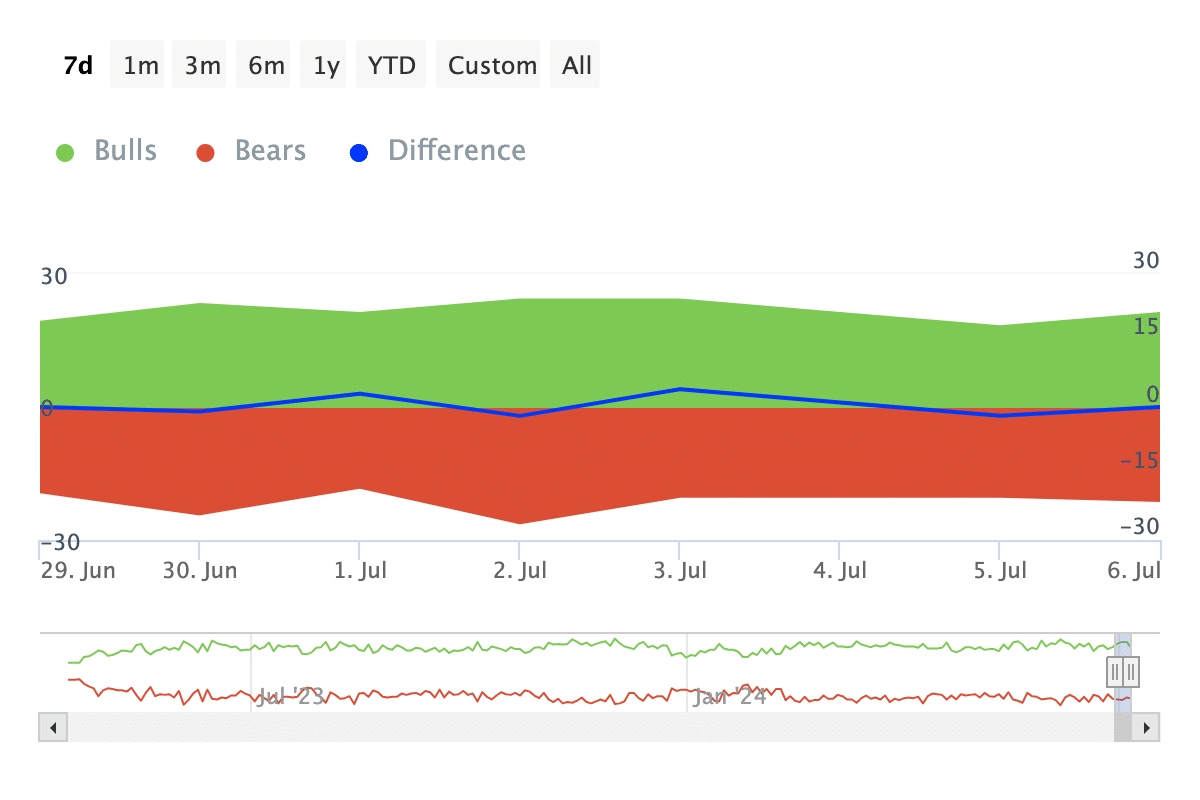

We made this inference after looking at the Bulls and Bears indicator. This indicator tracks the activity of buyers who bought or sold 1% of the total volume within a period.

Bulls and bears tied at the same score

Those who bought 1% of the total volume are called bulls. On the other hand, those that sold are termed as bears. If there is a higher number of bulls than bears, it increases the chances of a price rise.

However, if bears are more than bulls, the price might tilt toward a decrease. As of this writing, there was an equal number of bulls and bears. Going by this condition, PEPE might not experience a notable surge in value nor will a significant correction occur.

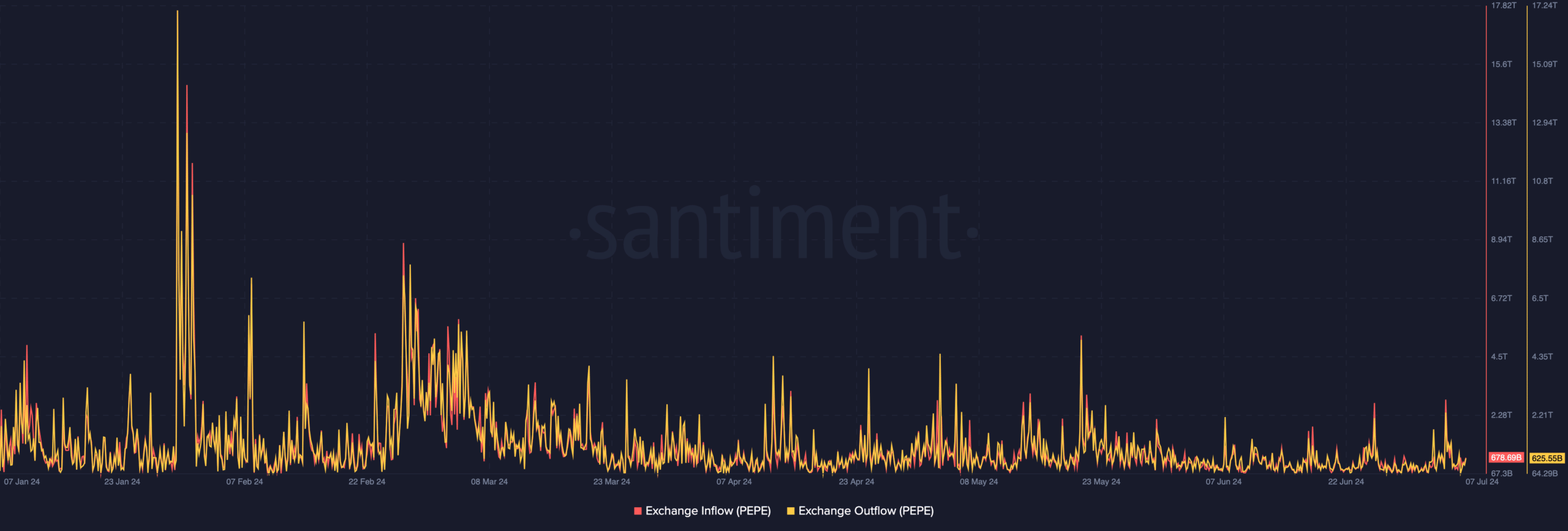

To validate this potential, AMBCrypto also evaluated the exchange flow. According to Santiment, the Exchange Inflow was 678.69 billion. This inflow is the number of tokens sent into exchanges from external wallets.

In most cases, participants who keep tokens on these platform plan to sell them in the short term. Conversely, PEPE’s Exchange Outflow was 625.55 billion. The outflow is the number of tokens withdrawn from exchanges.

When this number rises, it means holders prefer to keep their assets rather than sell them. Due to the close number of inflow and outflow, PEPE might not get a clear upside or downturn.

As such, it is possible for the token to keep trade between $0.0000088 and $0.0000095.

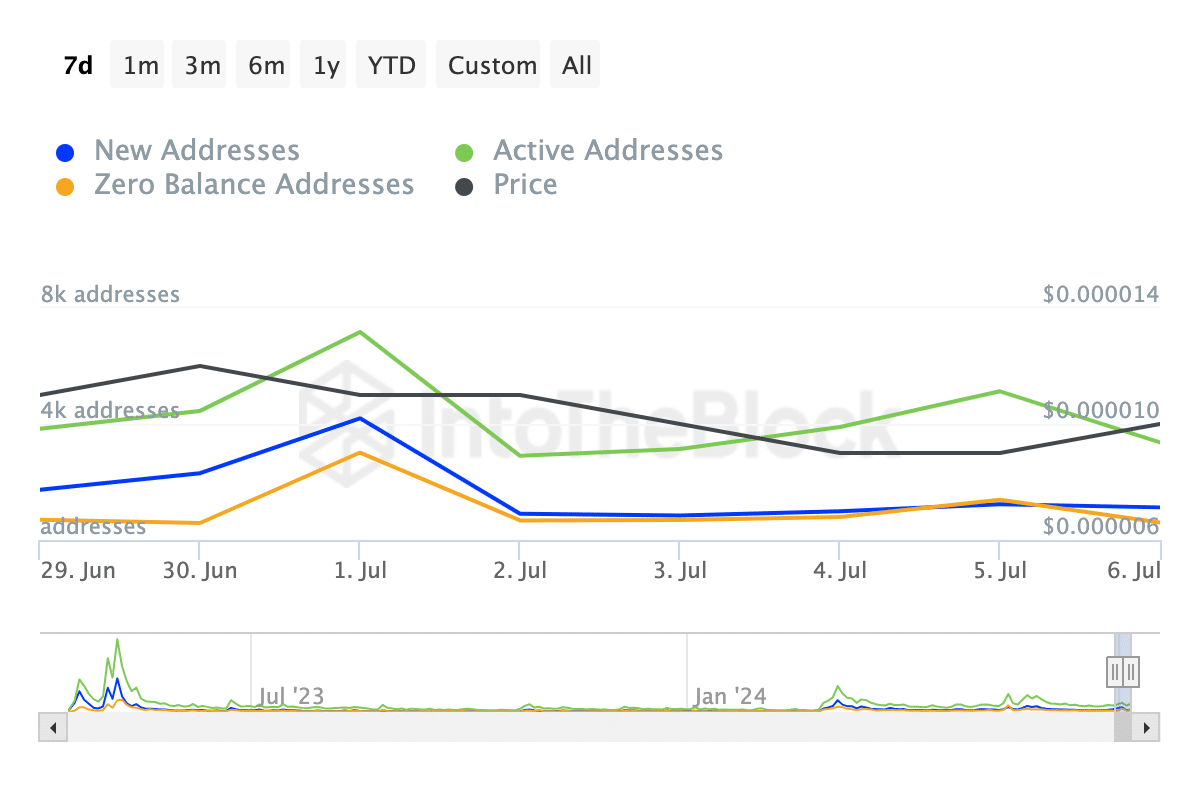

Network activity continues to drop

Evidence of this also reflected on the network. At press time, the number of new, active, and zero-balance addresses on PEPE had decreased.

Active addresses shows the number of user participation a network. New addresses, on the other hand, acts as a proof of adoption of a token. When these metrics increase, it implies that traction on the network is at a good level.

If that is the case, it means that demand for the token is rising. Therefore, the recent decrease implies that demand for PEPE was low.

If that remains the case, the value of the token might face consolidation. And the likely targets might be in the $0.0000088 and $0.0000095 region as mentioned above.

Realistic or not, here’s PEPE’s market cap in DOGE terms

However, this prediction could be invalidated if buying pressure intensifies and leads to a rally.

It could also be the case if PEPE holders liquidate some of their holding, potentially leading to a notable correction.