Pepe

PEPE’s price action depends on these whales – All the details

A major transfer could be the first step to a price hike on PEPE’s charts.

- Whale activity can significantly influence PEPE’s price

- Large transfers often coincide with notable price changes

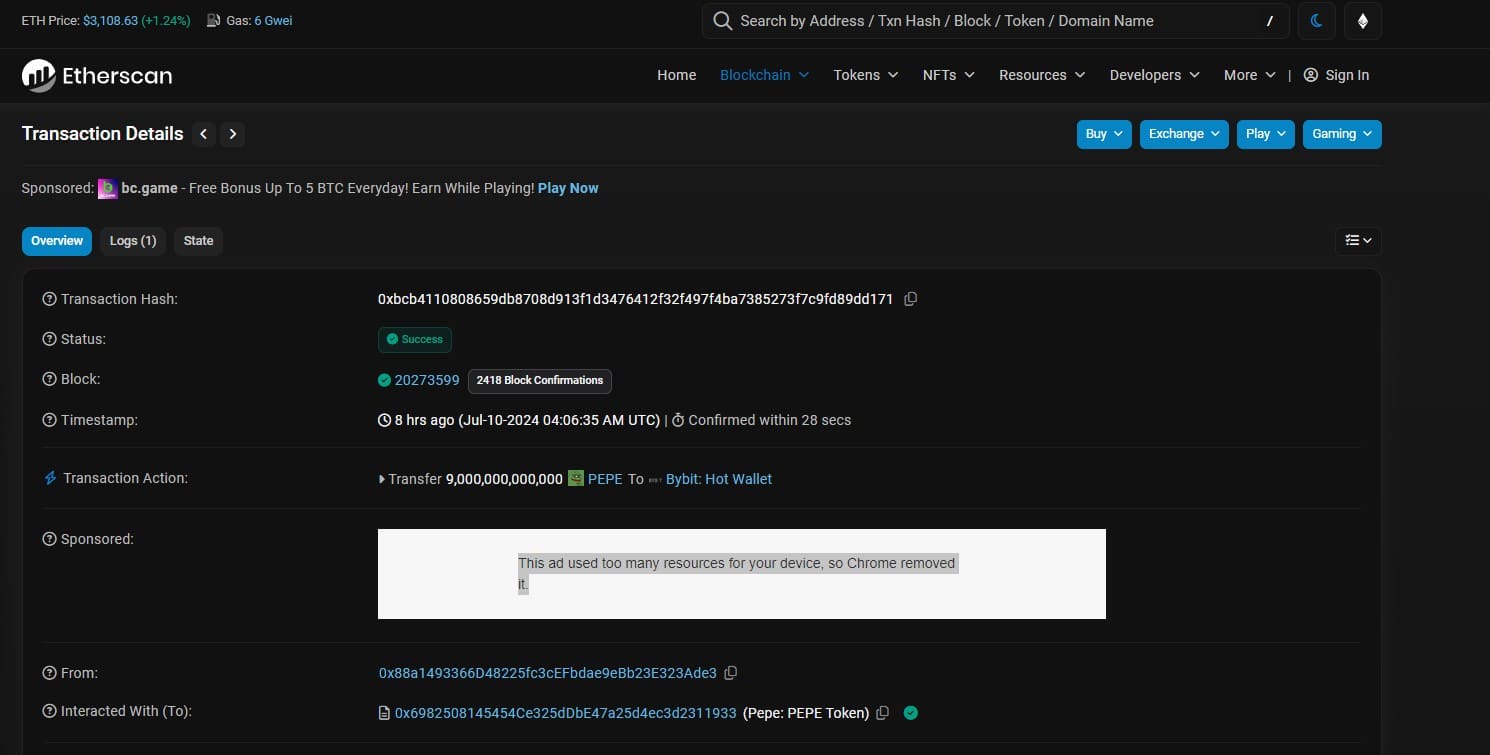

On 10 July, Etherscan data reported a huge PEPE transfer. An unknown wallet transferred 9 trillion PEPE tokens valued at $82 million to Bybit. This transfer happened as PEPE’s price rose by around 9.7%. As expected, this fueled curiosity about potential future price hikes.

The sender’s address, identified as 0x88a14933…23e323ade3, is not a stranger to high activity or frequent transactions. Currently, the address has an ETH balance of 100.22 ETH, valued at $311,399. The address also holds tokens worth $275,325,480 across 29 different tokens.

This address recently made several high-value Ethereum transfers to Bybit’s hot wallet too, including transfers of 2,900 ETH, 8,000 ETH, 10,000 ETH, and multiple 9,000 ETH transactions.

The sender actively transferred various tokens, indicating diversified trading activities. Its frequent transaction history is a sign of potential liquidity management strategies.

PEPE whale activity and distribution

According to IntoTheBlock, whales hold significant chunks of this altcoin, with the largest holder having at 12.17% of the total supply.

On the flip side, AMBCrypto’s analysis of PEPE’s whale distribution indicated that investors hold less than 1%. This spike in large transaction volumes is often positively correlated with price hikes, according to historical data.

For instance, significant price rises followed transaction volume spikes in May 2023 and March 2024.

AMBCrypto further analysed Coinglass’s data to access the liquidity that may have been created by a hike in whale activity. According to the same, there have been several spikes in liquidations.

This spike coincided with significant price movements too. This means that high trading volumes, driven by whale activity, can lead to greater liquidations. By extension, this means that the market is vulnerable to major price movements.

Here’s what’s next

PEPE’s price has been steady lately with no significant price movements, but this whale activity could change that. PEPE could break past key price levels if enough bullish momentum is accumulated. Otherwise, the price consolidation may continue on the charts.