Pepe’s rally not over: Targets 2024 highs after triangle breakout

- Should it break out from the current ascending triangle formation, PEPE is expected to reach its annual high of 0.00001725.

- Both whales and retail investors are tactically accumulating PEPE, positioning themselves ahead of the anticipated surge.

Despite a challenging month with a 5.77% drawdown, Pepe [PEPE] recent performance shows promising signs of recovery, with a 16.11% increase on its weekly chart. Further bullish indicators suggest continued upward momentum.

AMBCrypto has detailed the key factors that could drive PEPE’s expected rally.

Buying pressure eases amidst symmetrical triangle formation

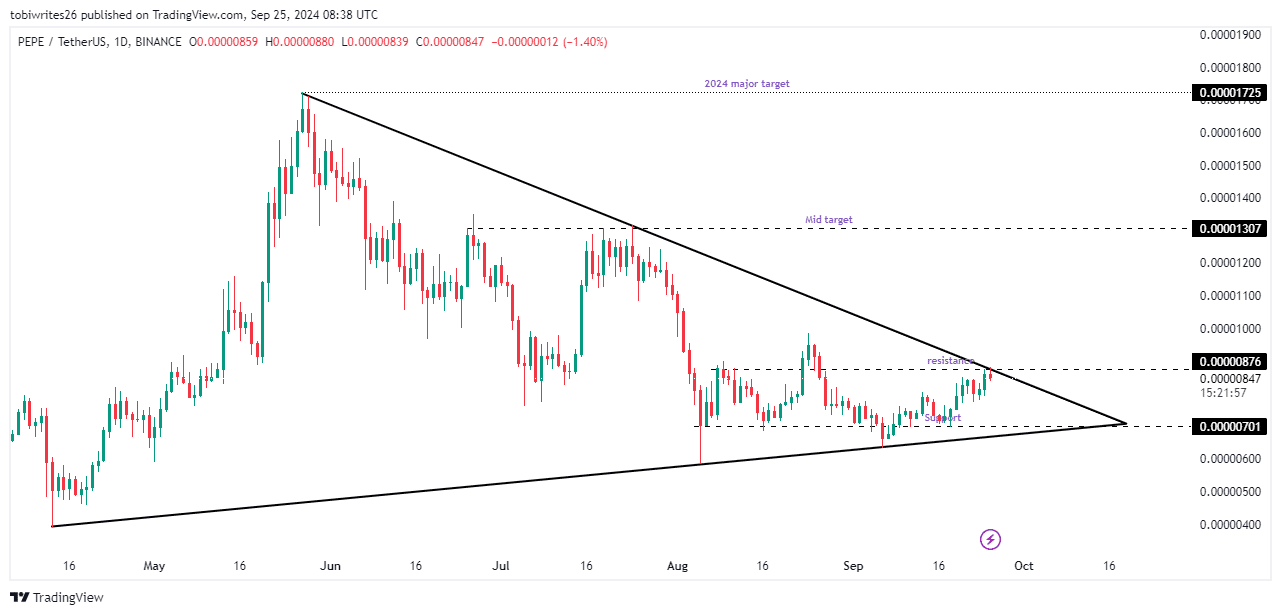

At press time, the coin was trading within a symmetrical triangle, characterized by converging upper and lower lines that serve as resistance and support zones, respectively.

PEPE recently rallied from a significant horizontal support level at 0.00000701, ascending to the upper resistance of the triangle pattern at 0.00000876. This resistance line also aligns with another key resistance level, emphasizing the strength of the barrier.

While symmetrical triangles typically indicate potential bullish outcomes, a breakthrough above the upper resistance line is essential. Successfully breaching this level could propel the memecoin to its 2024 high of 0.00001725 or to a mid-level target of 0.00001307.

Should PEPE fail to overcome this resistance, it is likely to retreat to the horizontal support line at 0.00000701 or the lower boundary of the triangle, as it seeks to build momentum for another rally attempt.

AMBCrypto has analyzed whether PEPE will manage to break through the upper resistance line of the symmetrical triangle. Here are the insights gathered.

On-chain metrics suggest an impending PEPE rally

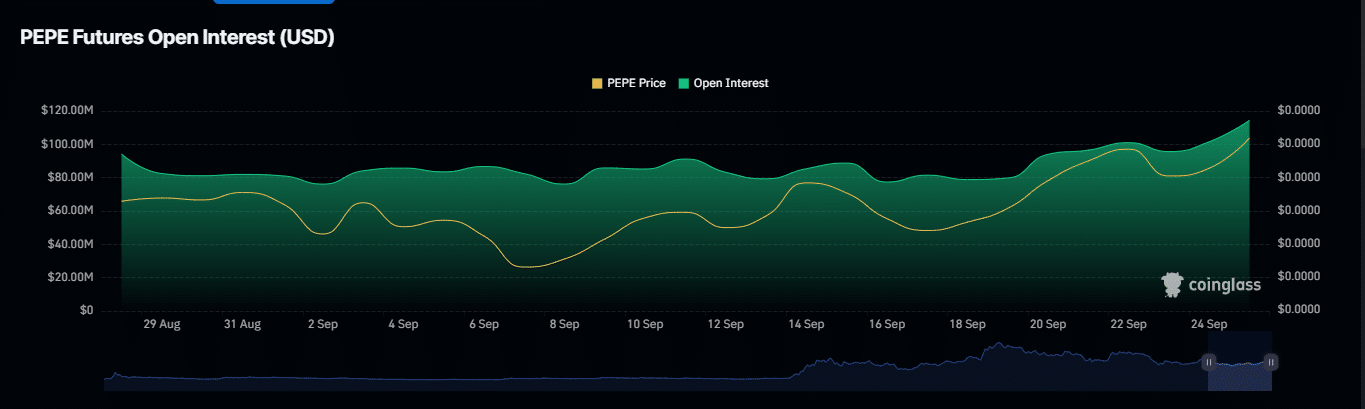

AMBCrypto’s analysis, using on-chain metrics from Coinglass, reveals a noteworthy accumulation of PEPE by both whales and retail traders, who are increasingly opening long positions.

Open Interest, a key indicator that measures trader enthusiasm in the market, has seen a notable increase. It surged from $95.68 million on 23rd September to $114.39 million by 25th September, reflecting heightened trader interest in the memecoin.

Furthermore, exchanges’ considerable outflow of PEPE has led to a negative NetFlow. This typically indicates that market participants are transferring PEPE to self-custodial wallets for long-term holding, a sign of their confidence in the asset’s potential appreciation.

Such movements often result in a supply squeeze, which could drive price upward, potentially breaking through established upper resistance levels.

Read Pepe’s [PEPE] Price Prediction 2024-25

Further bullish indicators emerge

Utilizing the Relative Strength Index (RSI)—a technical indicator designed to measure the velocity and magnitude of price movements—AMBCrypto has identified a potential rally for PEPE.

Currently, the RSI is exhibiting an upward trend with a reading of 56.75, suggesting that price is likely to follow suit. As these values — typically move in tandem, an upward trend in the RSI often precedes a corresponding rise in the asset’s price.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)