PEPE’s surge: Can holders expect large profits amid rising social buzz?

- PEPE surged significantly in terms of price over the last few days.

- Social volume and sentiment around the token grew.

Pepe [PEPE] witnessed some challenges over the past month as the memecoin sector started to get extremely crowded. However, over the last few days, the tides have turned in PEPE’s favor.

PEPE rises

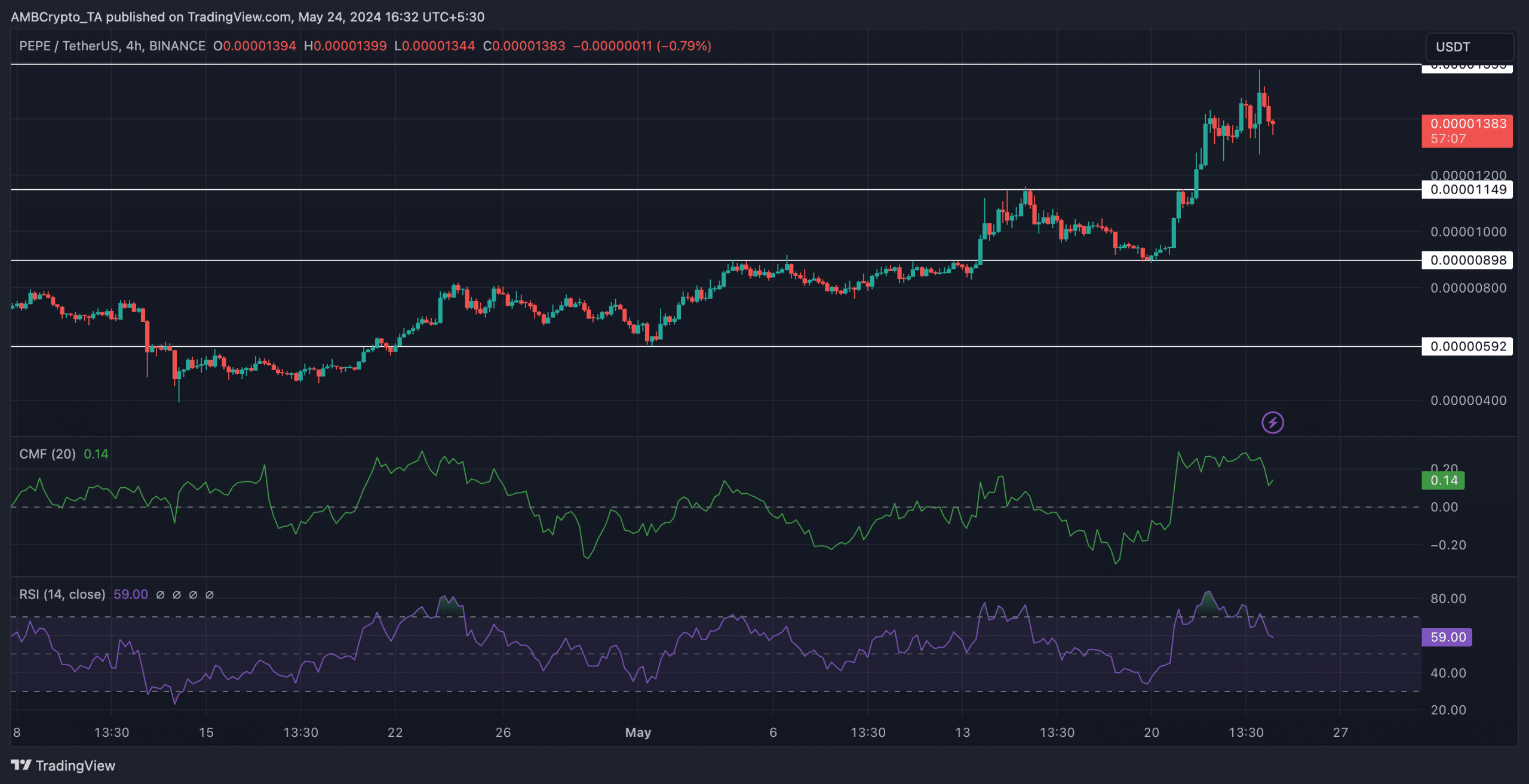

In the past week itself, the price of PEPE surged by 40%. At press time, PEPE was trading at $0.00001385.

Over the past month, the price of PEPE has shown multiple higher highs and higher lows, indicative of a bullish trend. The price of PEPE broke past all the resistance levels during this period and was aiming at its previously attained all-time high of $0.00001535.

If it manages to surge by 9.77% in the next few days, it will be able to surpass its previous all-time high.

The CMF (Chaikin Money Flow) of PEPE, however, had plummeted. This indicated that the money flowing into PEPE declined significantly.

Moreover, the RSI(Relative Strength Index) for PEPE had also started to go south, implying that the bullish momentum around PEPE has started to wane.

If bearish pressure on PEPE starts to rise, the price could move back to trading between $0.00001149 and $0.00000898 levels in the future.

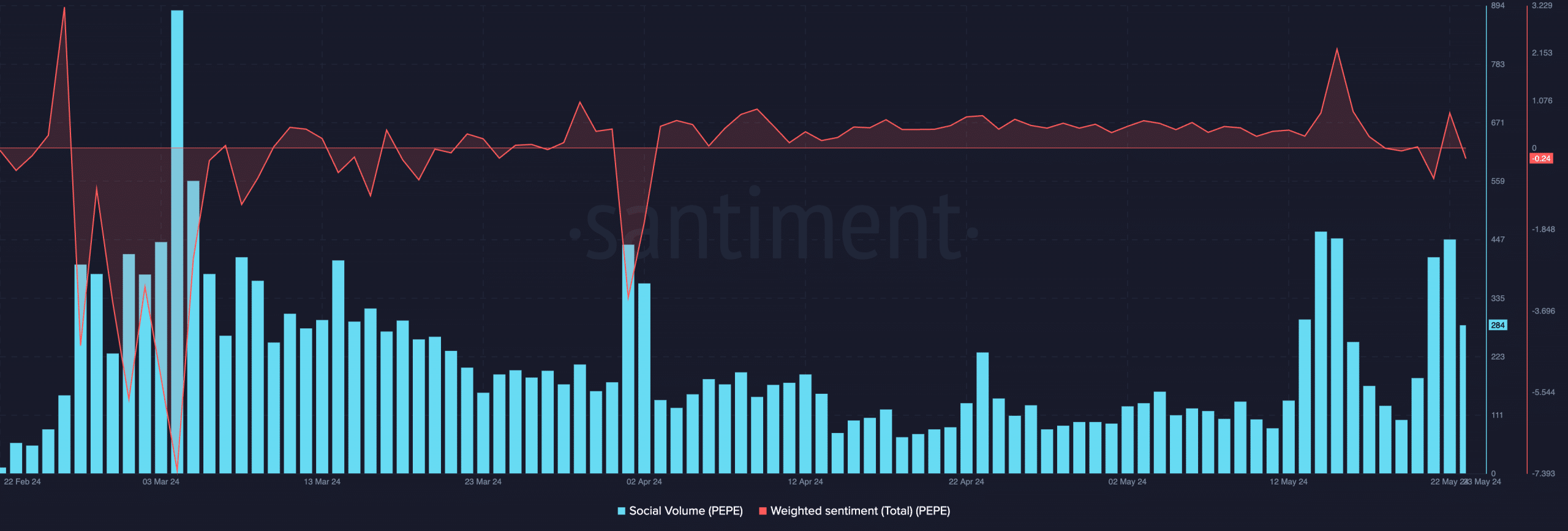

A large part of any memecoins price trajectory is determined by its popularity on social media platforms.

AMBCrypto’s analysis of Santiment’s data revealed that the social volume around PEPE had surged, indicating that the popularity of PEPE had materially grown over the last few days.

Additionally, the weighted sentiment for PEPE also spiked significantly, implying that the number of positive comments around PEPE had outnumbered the negative ones.

If the popularity of PEPE continues to rise, the memecoin may be able to sustain its current momentum in terms of price going forward.

New addresses move in

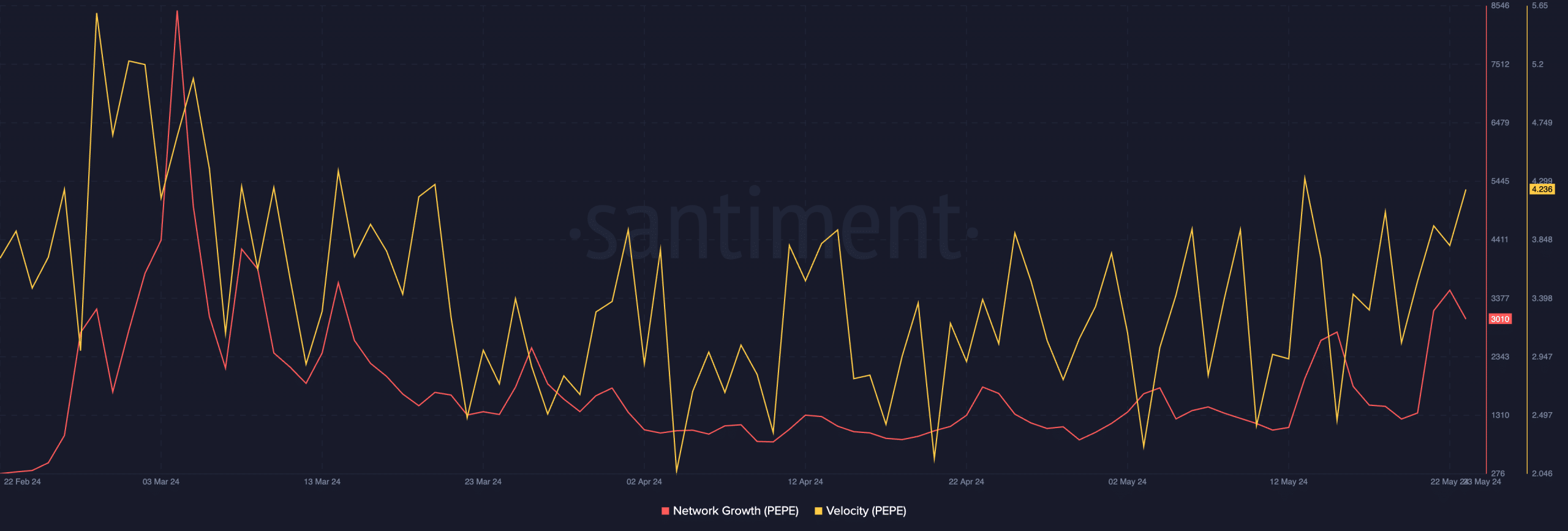

Along with this, PEPE also saw a massive surge in velocity, which implied that the frequency at which PEPE was trading at had grown materially.

However, with that, the network growth of PEPE had fallen.

Is your portfolio green? Check out the PEPE Profit Calculator

A declining network growth indicated that the number of new addresses interested in PEPE had fallen significantly.

If new addresses continue to lose interest in PEPE, its recent rally could get impacted negatively.