Peter Schiff criticizes Bitcoin amidst price blow: ‘The momentum has turned’

- Bitcoin struggled below $60k as critics highlighted its recent underperformance.

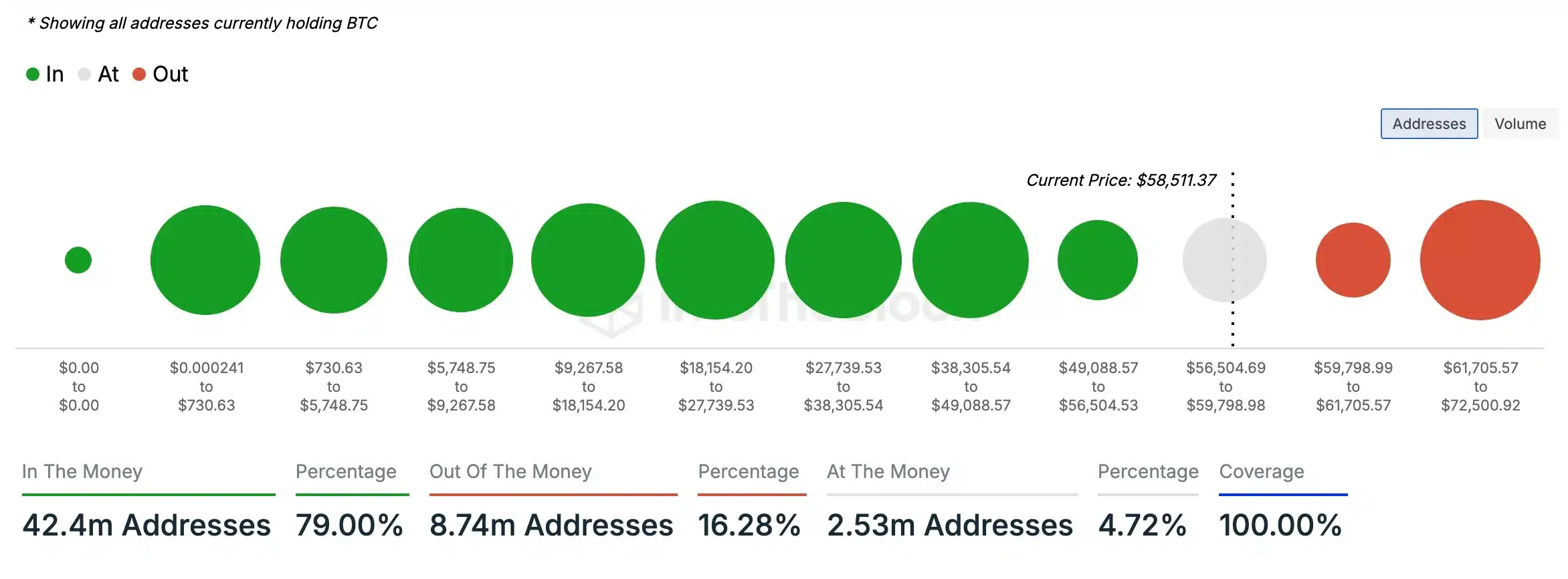

- Despite bearish signals, 79% of Bitcoin holders were “in the money,” suggesting potential bullishness.

The month of September sees Bitcoin [BTC] struggling to surpass the $60,000 mark.

According to CoinMarketCap, while BTC showed a slight daily increase of 0.51%, its weekly performance has been underwhelming, with a significant drop of 8.65%, bringing its trading price down to $58,401.

Peter Schiff has a warning

Amid this struggle, long-time Bitcoin skeptic Peter Schiff took to X (formerly Twitter) to underscore the cryptocurrency’s lackluster performance, highlighting ongoing concerns about its market trajectory.

“We are now eight months into 2024, and all of Bitcoin’s gains for the year occurred during the first two months.”

He also added,

“Since the end of Feb., despite the launch of 11 Bitcoin ETFs, #Bitcoin is down 8%. Over the same six months, the price of #gold is up 23%. The momentum has turned.”

Bitcoin gives mixed signals

In response to this criticism, AMBCrypto analyzed TradingView data and observed that the Relative Strength Index (RSI) has dropped below the neutral level, standing at 44.

This suggested that bullish momentum is faltering. Additionally, the MACD line (blue) was positioned below the Signal line (orange), reinforcing the notion that bearish forces are currently outpacing the bulls.

However, despite recent criticisms and technical indicators suggesting bearish pressure, IntoTheBlock data provided a more optimistic outlook for Bitcoin.

The data revealed that a significant 79.00% of Bitcoin holders were “in the money,” at press time, meaning that their tokens were valued above their purchase price.

In contrast, only 16.28% of holders were “out of the money,” with their BTC valued below their purchase price.

This disparity indicated a strong potential for BTC to experience a bullish shift in the near future.

The crypto community remains positive about Bitcoin

Affirming the sentiment, and drawing a parallel with the BTC’s previous patterns, X user Elja said,

“Similar fractal, different timeframe. Elites are playing the same game again.”

However, it was Sensei who put it best when he said,