PNUT crypto surges 60% in 24 hours, but analysts warn of a possible dip

- PNUT now seeks demand zone to push forward.

- Technical indicators point toward a slight pullback, allowing the asset to stabilize before any further gains.

The meme token PNUT has been one of the top-performing assets in recent weeks, recording a remarkable 1,610.05% increase over the past month, a 561.21% gain in the last seven days, and a 60% surge in just the past 24 hours.

However, new analysis by AMBCrypto suggests that PNUT may enter a period of consolidation, potentially pausing its upward trend as it gathers momentum for the next phase of its rally.

Bearish shift in PNUT with doji formation

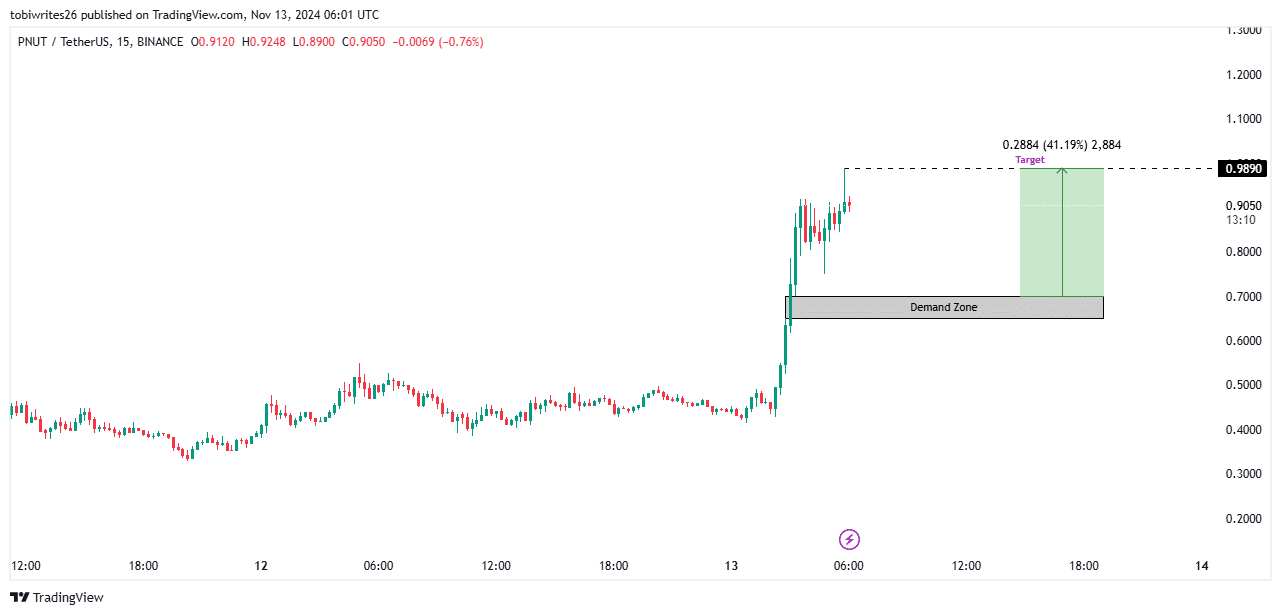

As of this writing, PNUT was showing signs of a potential decline on the 15-minute chart, with the formation of a bearish Doji candlestick indicating possible downward movement.

A bearish Doji candlestick typically forms at a local price peak and suggests mounting selling pressure, as market participants prepare for potential re-entry at lower levels. This pattern signals that traders may be seeking an opportunity to drive prices down to a key demand zone.

The expected drop could bring PNUT to a demand zone between 0.7010 and 0.6499, where sufficient liquidity may support a rebound. Should PNUT reach this level, it could then rally back, potentially gaining up to 41.19%.

Technical indicators shows temporary decline in PNUT

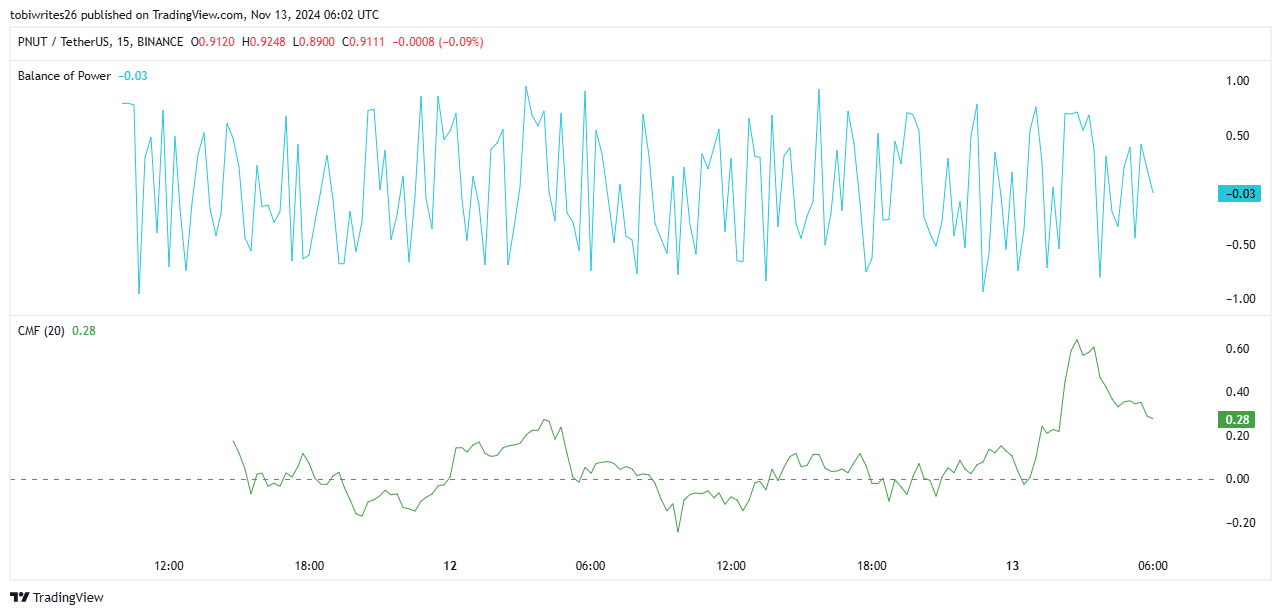

Current technical indicators suggest a short-term downward trend for PNUT. As of this writing, both the Balance of Power (BoP) and Chaikin Money Flow (CMF) indicators reflect bearish signals.

The Balance of Power (BoP) indicator, which helps traders gauge market control between buyers and sellers, is currently positive but showing a downtick.

This slight decrease suggests that while bullish sentiment remains, the price may dip if the downward trend persists, likely moving toward the previously identified demand level.

Similarly, the Chaikin Money Flow (CMF), which measures liquidity inflow and outflow, indicates declining fund inflows into PNUT. This reduced liquidity could lead to further price pressure before any potential recovery.

Bearish sentiment rises among PNUT market participants

Data from Coinglass indicates a growing bearish sentiment toward PNUT, with more short positions than long positions currently open.

As of this writing, the long-to-short ratio stands at 0.987, slightly favoring bears, though the difference in contract numbers remains narrow.

With most technical indicators going against an upward move for PNUT, it’s increasingly clear that buying pressure has weakened. This decline in demand is likely to contribute to further price drops in the short term.