Polkadot – DOT’s downtrend to continue? Here’s why $3.6 may be at risk!

- The $4.22 support is critical, but is likely to be lost soon

- Negative funding and dwindling Open Interest pointed to short-term bearishness

Polkadot [DOT] was trading at $4.3, at press time. It visited the $3.6 support level on 5 August. DOT previously tested this support level back in October 2020 and October 2023.

In fact, the steady downtrend in recent months has not been encouraging. Even during periods of a Bitcoin [BTC] uptrend, Polkadot bulls were unable to capitalize on the market-wide sentiment shift.

Another Polkadot drop below $4 is likely

The falling wedge pattern highlighted in an earlier report has not yet been invalidated. The first sign of the bullish breakout that this pattern promises would be a breakout past $5.6.

At press time, such a move appeared far, far away though. The daily RSI and the DOT market structure showed strong, persistent bearish pressure. The OBV continued to slump lower in the absence of buying pressure.

Hence, a move to the $3.6 level appeared more likely than a reversal to $5.6. Even when the $5.6-level is besieged in the future, it would likely pose significant resistance to the altcoin.

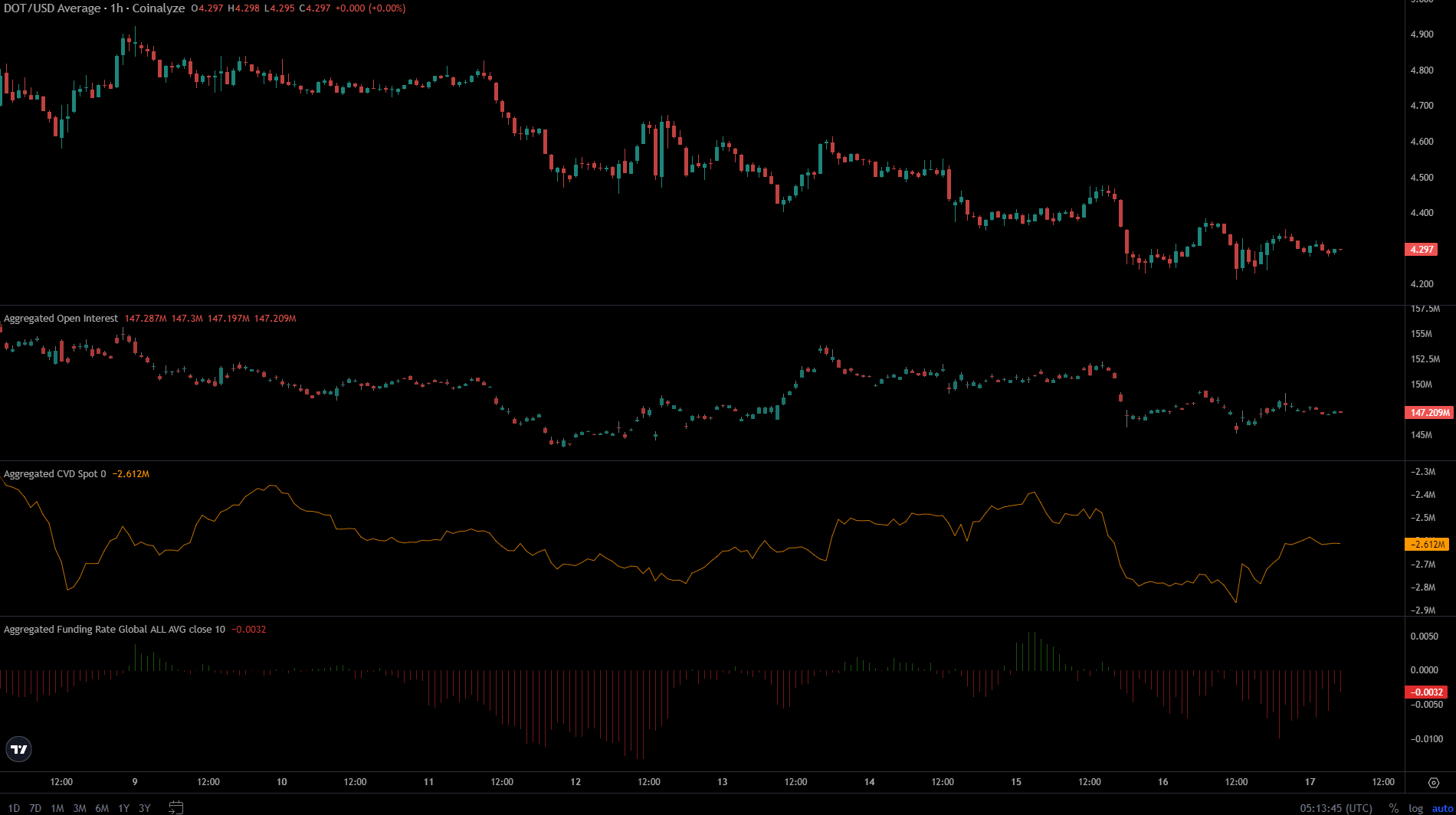

Futures market showed speculators did not believe in recovery

Source: Coinalyze

Over the past three days, the price of Polkadot has retreated slowly from the $4.6-mark. The Open Interest was also in decline, falling from $152 million to $147 million. The funding rate was negative, showing that short positions were dominant.

Read Polkadot’s [DOT] Price Prediction 2024-25

The spot CVD saw a decent bounce over the past 24 hours, but that does not mean the bulls can follow up on it. Overall, the technical and Futures market indicators reinforced the bearish bias from the price action.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion