Polkadot: Some wins and some losses, assessing Q4 2022 performance

- Polkadot closed Q4 2022 with a growth in its user activity.

- Despite the launch of nomination pools, staking on the network fell.

Polkadot, the Layer 0 blockchain network, ended Q4 2022 with a surge in user activity, according to a recent report by Messari. Despite the unexpected fallout of the cryptocurrency exchange FTX, Polkadot’s user base continued to grow.

Read Price Prediction for Polkadot [DOT] for 2023-24

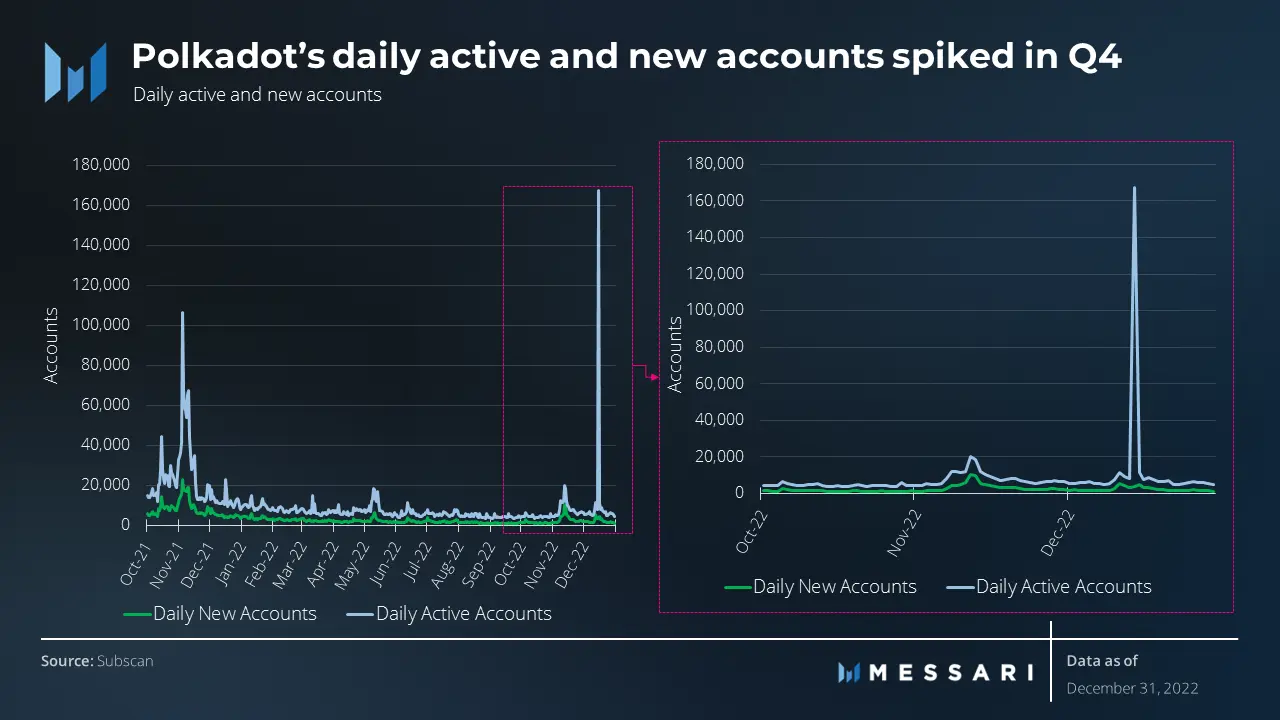

In its report titled “State of Polkadot Q4 2022,” Messari noted that between October and December 2022, the count of daily active accounts on Polkadot spiked by 63%.

In the preceding quarters, daily active accounts on the network fell consistently. However, by the end of 2022, on a year-over-year (Yoy) basis, daily active accounts on Polkadot had grown by 63%, with all of the growth recorded in Q4 2022.

Furthermore, new accounts created on the network also increased by 49.4%. However, on a YoY basis, this fell by 71%. Polkadot closed Q4 2021 with 733,552 new accounts on its network. Between 1 October and 31 December 2022, new accounts created on Polkadot totaled 216,100.

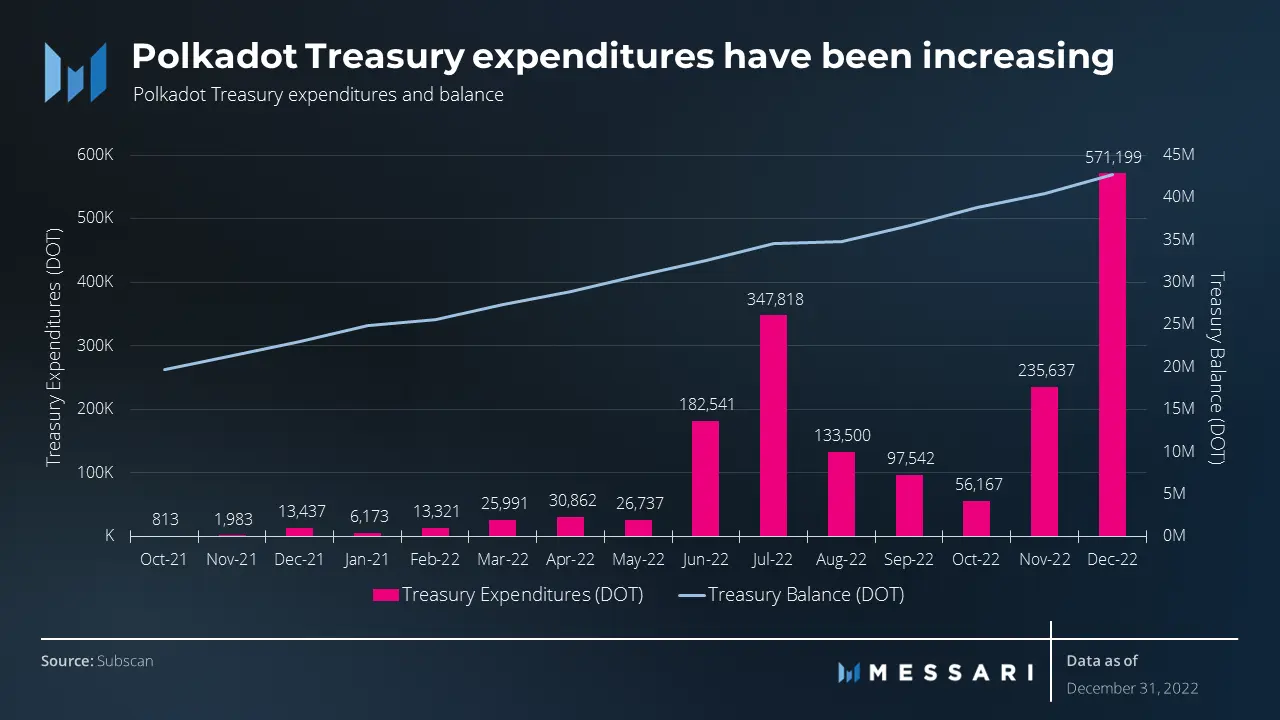

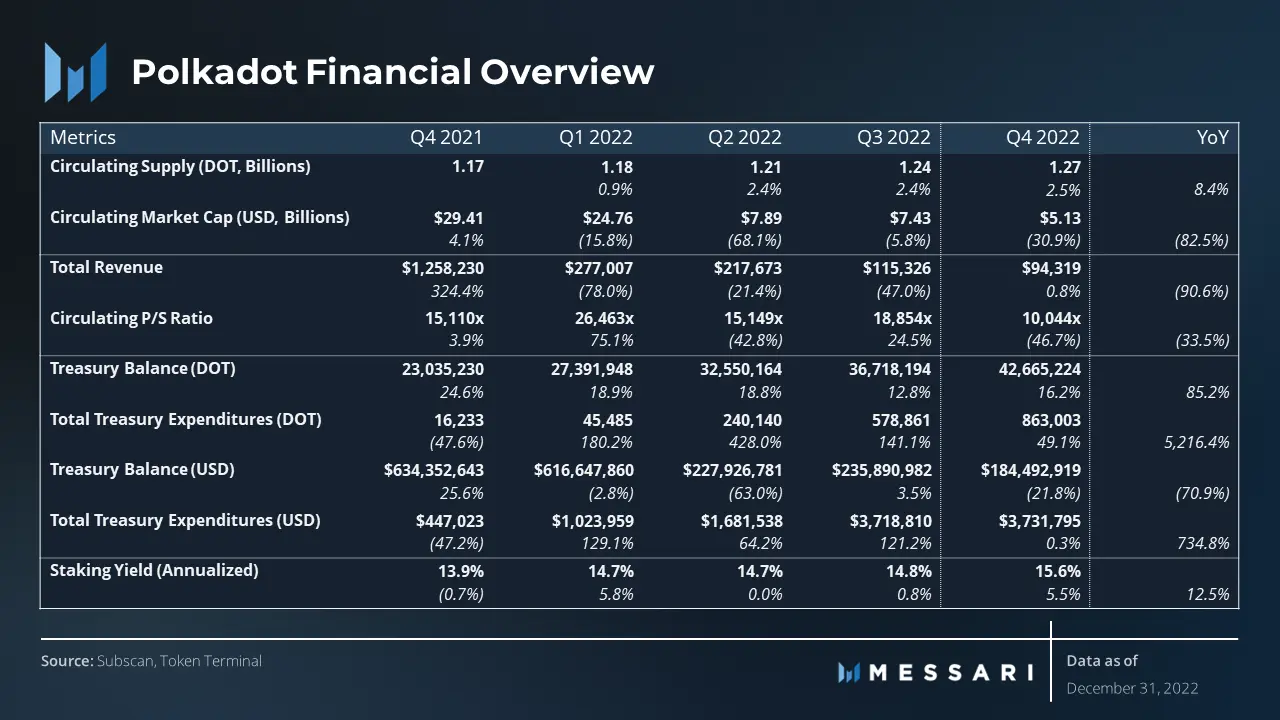

While Polkadot’s Treasury expenses shot up in Q4 2022, its revenue fell. According to Messari, Treasury expenses for the network increased significantly in the last quarter of 2022, with 863,000 DOT ($3.7 million) spent.

The majority of these expenditures, 571,000 DOT, were made through the Ethereum-to-Polkadot Snowbridge in December, making it the largest Treasury expense of the year, Messari found. Projecting a further increase in Treasury usage this year, Messari said,

“The implementation of the new OpenGov model in 2023 will likely result in an increase in Treasury usage.”

Revenue, on the other hand, fell by 1%. Per the report, Polkadot logged a total revenue of $94,319 in the three-month period under review.

Despite the surge in user activity on the network in the last quarter of 2022, revenue dropped. In fact, throughout the last year, Polkadot’s revenue fell. On a YoY, Polkadot closed 2022 with a 91% drop in revenue, Messari reported.

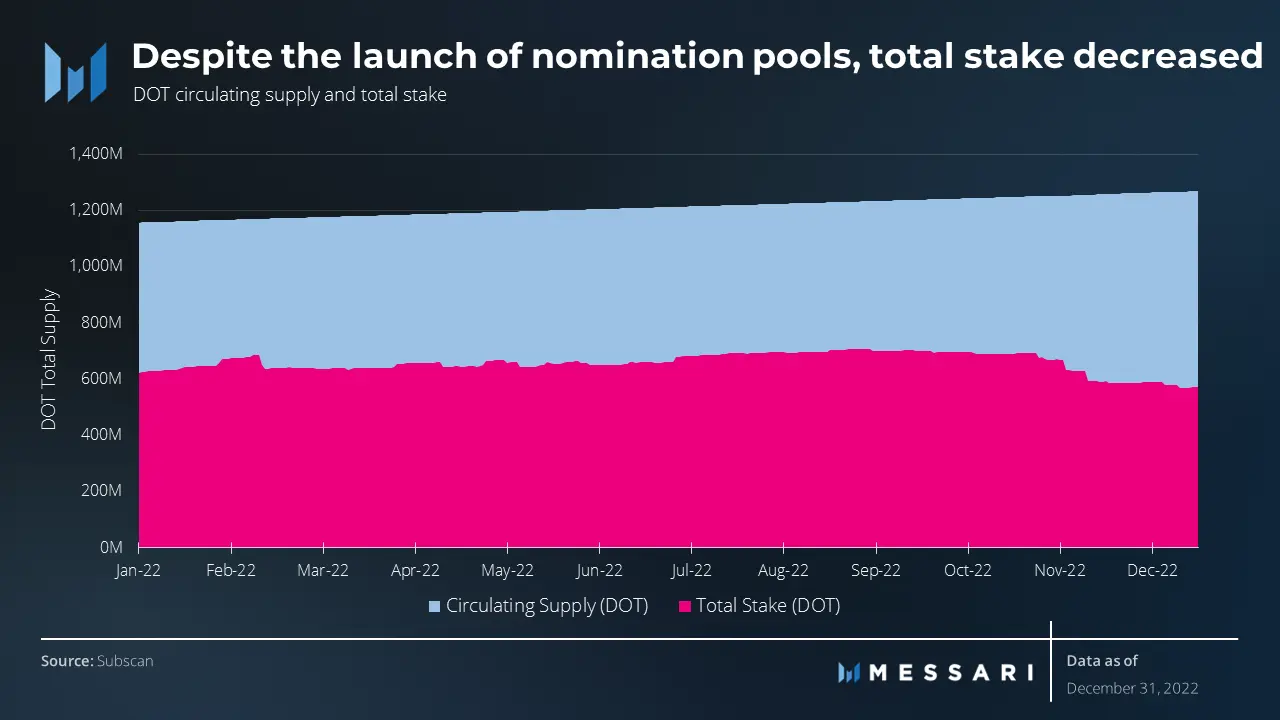

As for staking on the network, Messari found that Polkadot’s staking metrics showed a decline in the last quarter of 2022, despite the launch of nomination pools.

Nomination pools are a new feature for the Polkadot staking system that allows multiple DOT holders to pool their tokens and act as a single nominator. The pools make staking accessible to everyone with as little as one DOT and are supported by popular wallets.

Realistic or not, here’s DOTs market cap in BTC’s terms

Total stake dropped 18% from 698 million to 572 million, leading to a decrease in the percentage of circulating supply staked from 56% to 45%.

On the other hand, the number of nomination pool members increased steadily, reaching 3,500 members with a combined stake of 850,000 DOT by the end of the quarter.