Polkadot’s [DOT] recovery is likely: Can bulls target pre-FTX levels?

![Polkadot’s [DOT] recovery is likely: Can bulls target pre-FTX levels?](https://ambcrypto.com/wp-content/uploads/2023/01/ankush-minda-7KKQG0eB_TI-unsplash-1-e1674709526486.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- DOT found a steady ground, and price recovery could be likely.

- DOT’s Funding Rate declined, but there was a slight improvement at press time.

Polkadot [DOT] bulls secured a steady hold at $6.178. At press time, DOT’s value was $6.277 with a flash of green, indicating a recovery could be likely.

Despite January’s rally, DOT is one of the few assets that hasn’t hit its pre-FTX levels. However, DOT could hit its pre-FTX value in the next few days/weeks, especially if next week’s FOMC announcement is dovish.

Read Polkadot [DOT] Price Prediction 2023-24

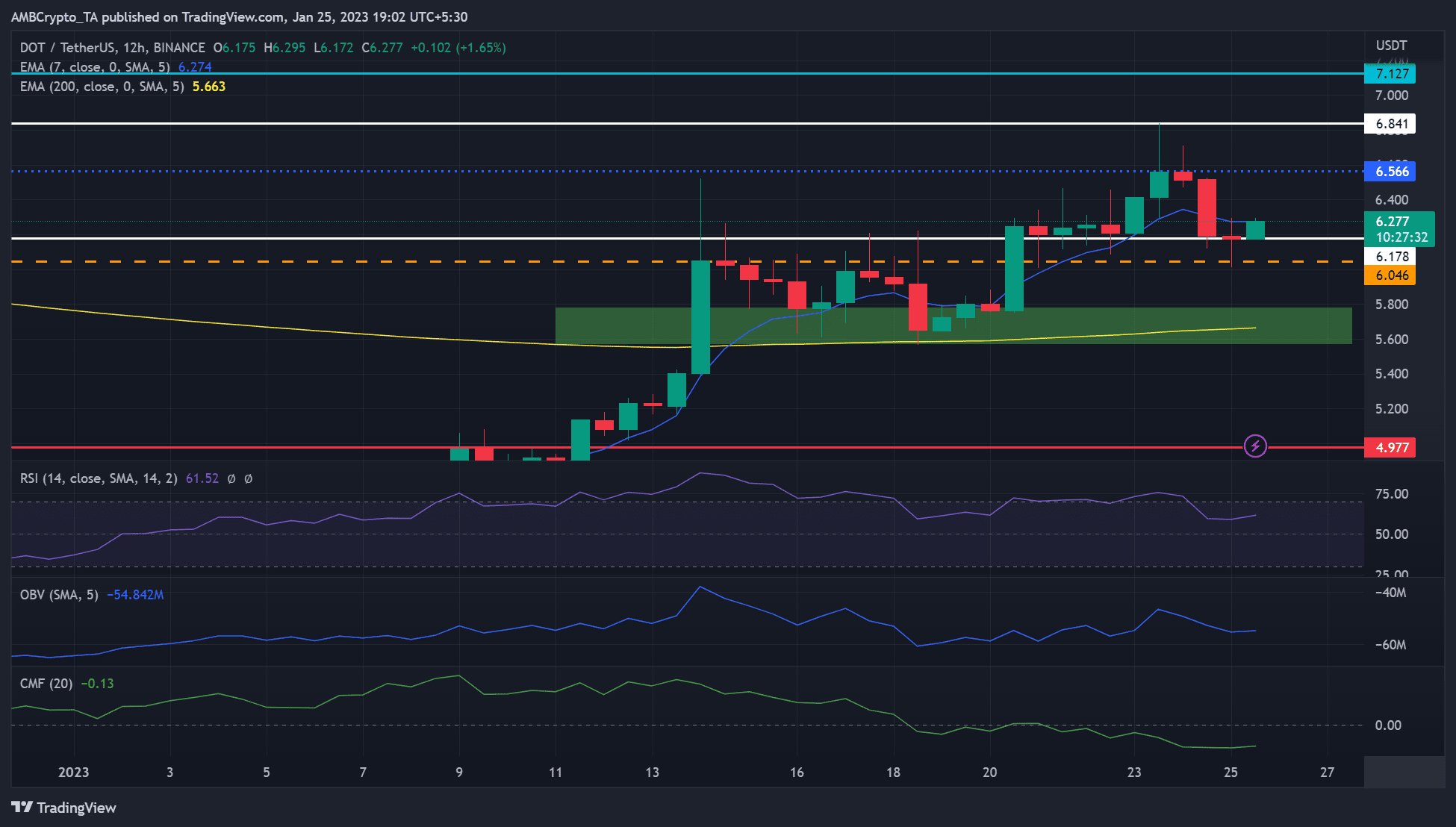

The pre-FTX level at $7.127: Is a retest likely?

On the 12-hour chart, the Relative Strength Index (RSI) was 61, showing a bullish DOT. The On Balance Volume (OBV) and the Chaikin Money Flow (CMF) had upticks, indicating that trading volumes increased slightly, thus helping strengthen the DOT current market.

If the trend continues, the recovery’s momentum will increase, allowing bulls to target the overhead resistance at $6.841 and the pre-FTX level of $7.127. However, bulls must clear the bearish order block at $6.566 to continue the upward momentum.

Alternatively, bears could overwhelm bulls, given the low trading volumes. Such a move could plunge DOT below the $6.178 support, invalidating the bullish bias described above. But the drop could settle at the 100-period EMA (exponential moving average) or the support range of $5.600 – $5.800 (green zone).

Is your portfolio green? Check out the DOT Profit Calculator

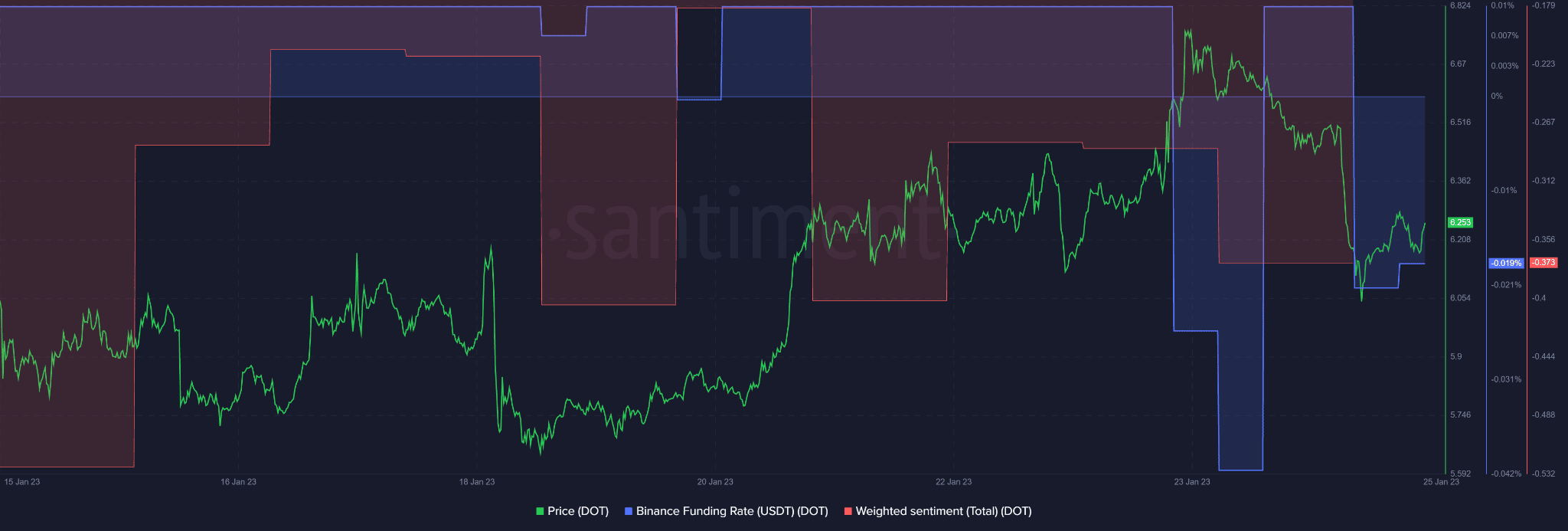

DOT’s sentiment and Funding Rate was negative, but …

A sharp drop in Funding Rate around January 23 coincided with DOT’s recent top. Further price drop on January 24 saw another decline in Funding Rate, indicating falling demand in the derivatives market.

However, at the time of writing, the Funding Rate recorded a slight improvement as it moved upwards. The improvement reflects the price recovery spotted at press time, and more demand in the derivatives market could prop up DOT’s value.

Nevertheless, DOT’s sentiment remained negative, showing investors were still uneasy with the asset. But the increasing open interest (OI), as evidenced by Coinglass, could further boost the price recovery.