Polygon

POL’s extended downtrend – Is there ANY upside in the short-term for its price?

POL is continuing its week-long downward spiral, showing no signs of a reversal to the upside.

- At press time, POL seemed to be trading within a broader bullish structure, despite some market pressure

- Hike in selling activity has heightened bearish momentum, with a potential for further declines

Over the past week, POL has dropped by 18.90% on the charts, with bearish sentiment dominating the market. In the last 24 hours alone, the asset recorded a 1.15% decline, further solidifying the bears’ grip on the market.

An analysis by AMBCrypto revealed that POL’s prevailing downtrend may be far from over though. Especially with the asset poised for deeper losses in the near term.

Can a bullish pattern reverse POL’s downtrend?

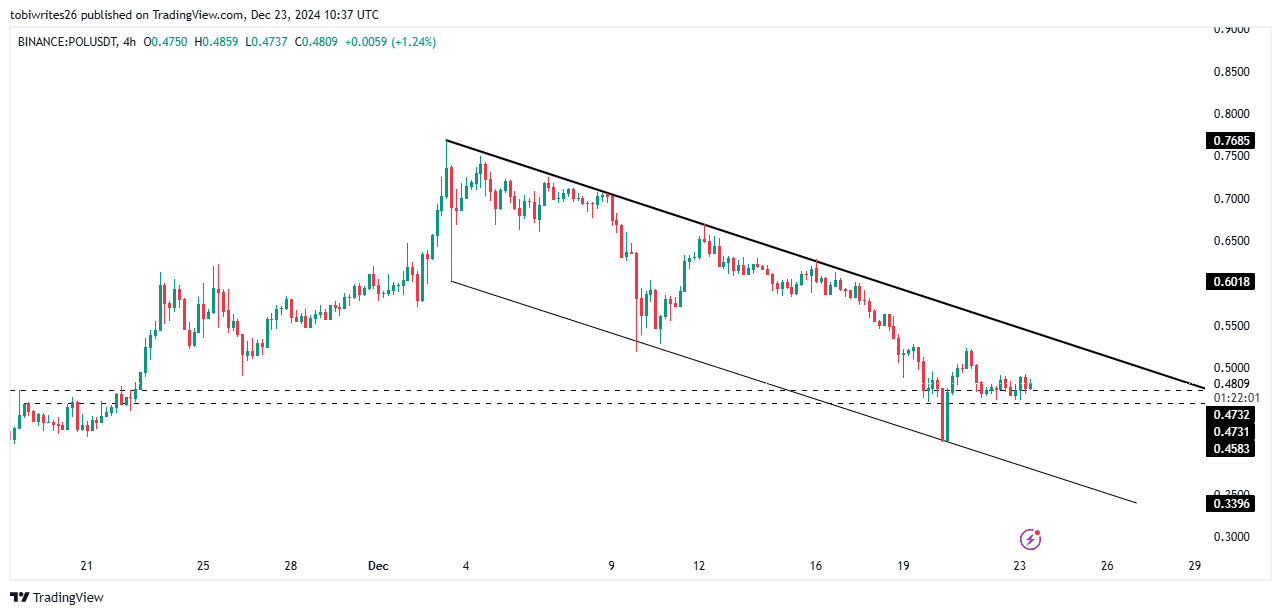

At the time of writing, POL was trading within a descending channel – A pattern characterized by price fluctuations between two key levels: Support and resistance.

The price seemed to be testing a support level at 0.4731, situated in the mid-range of the channel, with a further support at 0.4583 below it.

Typically, this would indicate the possibility of a strong rebound to the upside. However, a closer look revealed that the asset has stalled at this level, showing no significant upward momentum.

Further digging by AMBCrypto found that current on-chain data undermines the likelihood of a rally, as exchange reserves have surged, suggesting that the potential for a reversal is limited at this stage.

POL faces greater risk as availability on exchanges grows

The amount of POL available on exchanges has surged significantly. In fact, according to CryptoQuant, Exchange Reserves rose to over 57 million, marking an hike of approximately 2 million from the previous day.

Such an uptick typically indicates that traders are moving their POL holdings back to exchanges, boosting supply. Such movements often precede sell-offs, which can drive the price of POL south on the charts.

Additionally, the number of active addresses has continued to decline, with the same now sitting at 1,231. This drop suggested diminished activity, with fewer addresses playing a role in price movement. A fall in active addresses typically reflects a lack of interest in the asset, often tied to diminishing investor confidence.

Meanwhile, data from IntoTheBlock revealed a further decline in the average transaction size. While the 7-day average had a reading of $13,796.37, the 24-hour average dropped to $4,908.63—Its lowest point of the week.

This underlined a significant reduction in the value of POL being transacted, further indicating a fall in market activity.

Together, these trends pointed to reduced investor interest, increasing the likelihood of sustained downward pressure on POL’s price.

Trader faces closed positions

Open Interest declined by 2.60%, reaching $88.30 million. Such a fall alluded to a surge in the number of contracts being closed as the market trended downwards.

Similarly, liquidation data highlighted a clear advantage for short traders, as a majority of long contracts have been liquidated. Over the last 24 hours alone, long contracts worth $225,670 have been closed, compared to just $58,380 in short contracts.