Polygon

Polygon – Assessing impact of $41.2M whale dump on POL

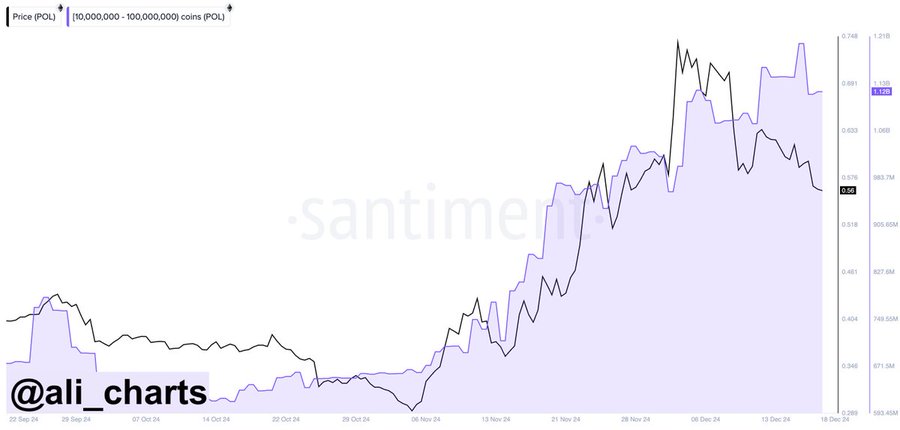

Polygon whales have sold 80 million POL tokens worth $41.2 million over the past 48 hours.

- POL declined by 6.11% over the past 24 hours.

- Polygon whales sold 80 million tokens worth $41.2 million.

Since hitting a recent high of $0.7675 two weeks ago, Polygon [POL] has struggled to maintain an upward momentum.

As a result, the altcoin has declined, hitting a local low of $0.48. With POL’s continued decline, most investors are closing their positions. These traders are selling to avoid further losses. This trend has persisted, especially among whales.

Polygon whales sell 80 million tokens

In his analysis, Ali Martinez

observed that Polygon whales have turned to selling. According to him, whales have sold over 80 million POL tokens worth $41.2 million over the past 48 hours.Increased whale dumping usually causes higher selling pressure, pushing prices down. This is evidenced by a dropping Relative Strength Index (RSI). The RSI dropped from 71 to 40, nearing oversold territory. This dip implies most holders are currently selling, as seen with whales.

When whales start selling, it shows their lack of confidence in the market’s direction. They sell to capitalize on recent gains while avoiding more losses. With whales turning bearish, it’s a warning signal for retail traders about a potential dip.

This bearishness has spread among retail traders, signaled by a higher number of short positions. According to Coinglass, most investors are taking short positions. With 55% of total positions, it implies that most investors anticipate prices to decline soon.

Impact on POL’s charts?

As observed, whale market sentiment has turned negative following POL’s sustained decline over the past week.

The continued selling by whales is reflected in the POL price charts. As of this writing, Polygon is trading at $0.5176. This marks a 6.22% decline on daily charts. The altcoin has also declined on weekly charts, dropping by 21.31%.

This decline over the past week amidst increased selling implies that the downtrend is continually strengthening. The Directional Movement Index reinforced this as ADX sat above +DI at 28.

This downtrend is further confirmed by a negative Price DAA divergence. When this sees a sustained drop, it validates the continuation of the current.

Is your portfolio green? Check out the POL Profit Calculator

Therefore, with a strong downward momentum, POL could see more losses on its price charts. In a drop, Polygon will find support around $0.48. However, if the trend reverses, POL will reclaim $0.53.