Polygon’s continual disruption could influence MATIC’s Q1: Here’s how

- Polygon collaborated with a finance giant in tokenizing assets.

- While NFT interest surged, MATIC could also remain bullish in Q1.

As part of its plans to expand its impact in the crypto sector, Polygon [MATIC] secured a partnership with Hamilton Lane per its $2.1 billion tokenization flagship fund. In October 2022, the investment firm announced that it planned on tokenizing three of its funds, along with its digital asset partner Securitize.

Read Polygon’s [MATIC] Price Prediction 2023-2024

Now, individual investors can access the fund via the Polygon network. According to Polygon’s co-founder, Sandeep Nailwal, the development has the potential to drive the project’s DeFi growth while admitting that institutional liquidity was a welcome development.

Hamilton Lane @hamiltonlane, $890bn Financial Giant is tokenizing their $2.1B flagship fund on @0xPolygon!

Innovation on institutional liquidity is the next frontier for growth in Defi.

Liquidity @0xPolygonDeFi about to ?.

Come and build #OnPolygon https://t.co/eSRjjVRRtv

— Sandeep | Polygon ? Top 3 by impact (@sandeepnailwal) January 31, 2023

Offering opportunity in abundance

Colin Butler, Polygon’s global head of institutional capital, commented on the matter. Details from the official blog post revealed how Butler’s comment revolved around democratizing blockchain practical applications and financial opportunity. He said,

“The tokenization of private funds is a massive leap forward for investors and fund managers–a broader pool of investors enticed by greater opportunity and disintermediation.”

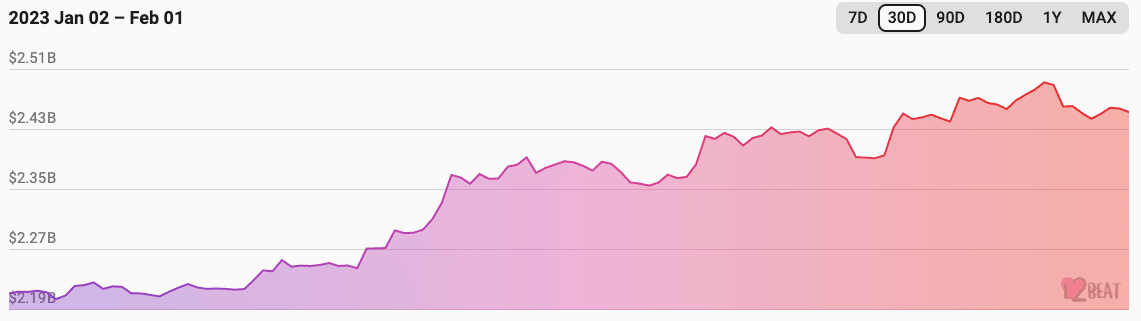

This headway comes after the web3 projects recorded giant strides regarding its network. Interestingly, the Polygon Total Value Locked (TVL) has been on a consistent increase since January. The TVL takes into consideration a project’s market capitalization and deposits it into the protocol.

According to L2Beat, the Polygon TVL was worth $2.9 billion at press time. Thus, a lot of users were able to bridge assets between Polygon and Ethereum [ETH]. This has been with the help of Polygon’s Proof-of-Stake (PoS) validators.

Besides the tokenization fund and TVL hike, Polygon has been performing exceptionally in the NFT market. A few days back, it hit an impressive landmark on the NFT marketplace OpenSea.

In addition, another marketplace, Rarible, tweeted that the Polygon Ape Yacht Club was its community marketplace of the previous week.

.@PolygonApeYC is our Community Marketplace of the Week!

Explore this collection of 10,000 unique apes with 185 attributes on the @0xPolygon blockchain. Unlock access to a fun community and cool aidrops!

Go explore! ?https://t.co/tlN4ofJ67F

— Rarible (@rarible) January 31, 2023

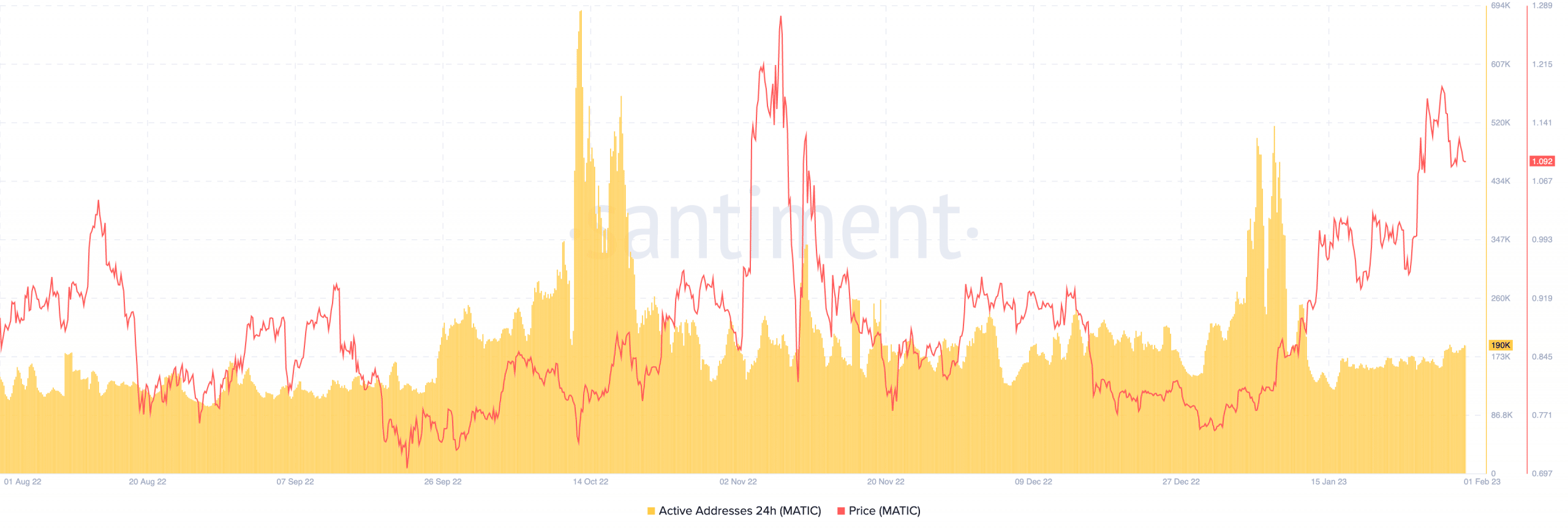

This was another confirmation that the OpenSea milestone was no fluke. Santiment data showed that crypto users have sustained the momentum of transacting on the Polygon network. At the time of writing, active addresses on Polygon had increased to 189,000 as MATIC exchanged hands at $1.09.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

MATIC to hold the bull in Q1?

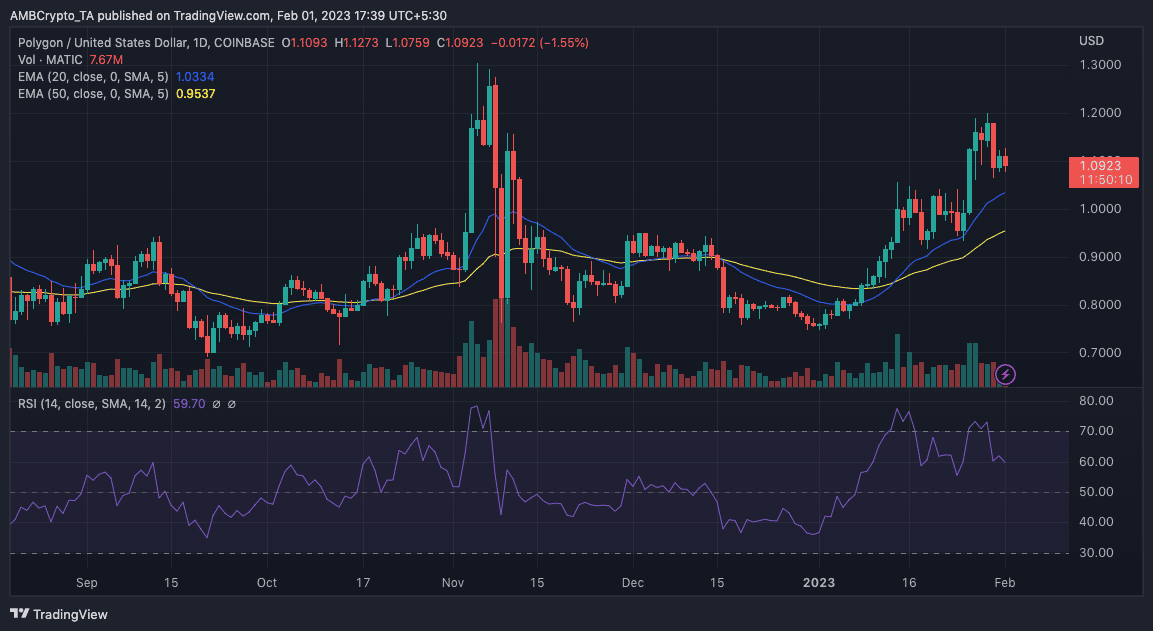

Per price action, the Relative Strength Index (RSI) showed that MATIC’s momentum had reversed to the overbought region. At 59.70. However, it was far above the oversold region, indicating that MATIC bulls were still sustaining the buying momentum.

In a case where the buying power supersedes sell pressure, the MATIC could remain in the rally region in the first quarter. Indications from the Exponential Moving Average (EMA) also aligned with a short-term green level since the 20 EMA (blue) was above the 50.