Polygon holds key level, but will MATIC fall to $0.61 in May?

- The potential increase may keep more than 17.34% of holders in profits.

- A decline in the MVRV Z Score might invalidate the bias, and probably send the MATIC to $0.61.

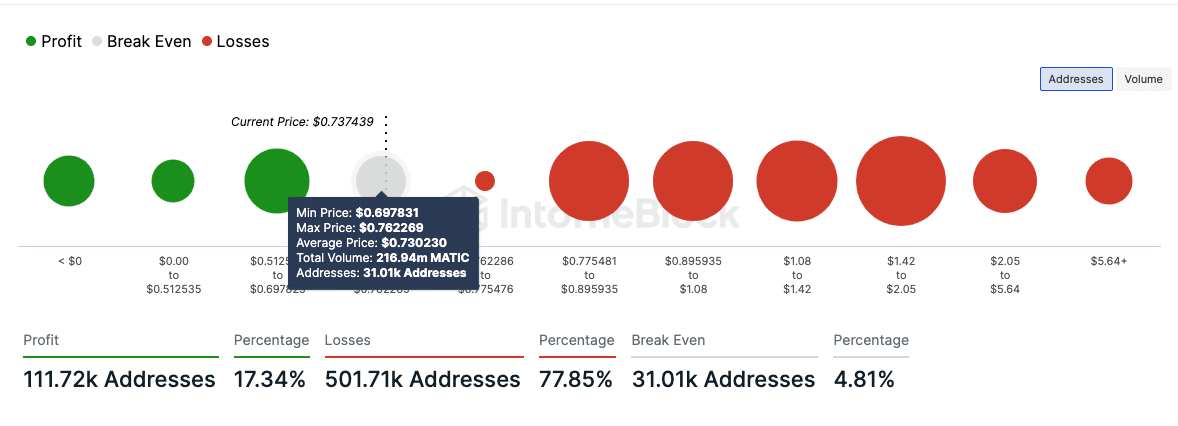

According to IntoTheBlock, Polygon [MATIC] was at a point where 31,000 addresses purchased 216.94 million tokens at an average price of $0.73.

This was a breakeven point for these holders but could also serve as a critical level for MATIC. At press time, 111,724 addresses, representing 17.34 % of the total supply, were in profits.

On the other hand, 501,710 addresses, which was an incredible 77.85% were out of the money. Depending on where the Polygon native token moves, next, the $0.73 region could either be as support or resistance.

This cohort holds the key

A break above $0.73 could take MATIC to $0.76, where 36.69 million tokens were accumulated. If this is the case, the price of the cryptocurrency might begin its breakout to $0.83.

However, a breakdown could trigger a plunge to $0.61 where most holders in profit had their entries. At press time, the price of MATIC had fallen by 4.37% in the last 24 hours.

Should the token maintain this momentum, MATIC’s next move could be a rise between $0.83 and $0.89.

Apart from the participants, Ethereum [ETH] is one altcoin that could influence the next direction of the token.

From our findings, Polygon’s correlation with ETH was 0.93. With Bitcoin [BTC], it was 0.87. Correlation readings range from -1 to +1.

When the reading is close to -1, it implies a divergence in prices. On the other hand, a reading close to 1 suggests that the values of the cryptocurrencies move in almost the same direction.

Therefore, if ETH evades a drop below $3,000. MATIC might rise to $0.83. However, if the price of the second most valuable cryptocurrency declines, MATIC’s price might begin another correction to $0.61.

It’s make or break this time

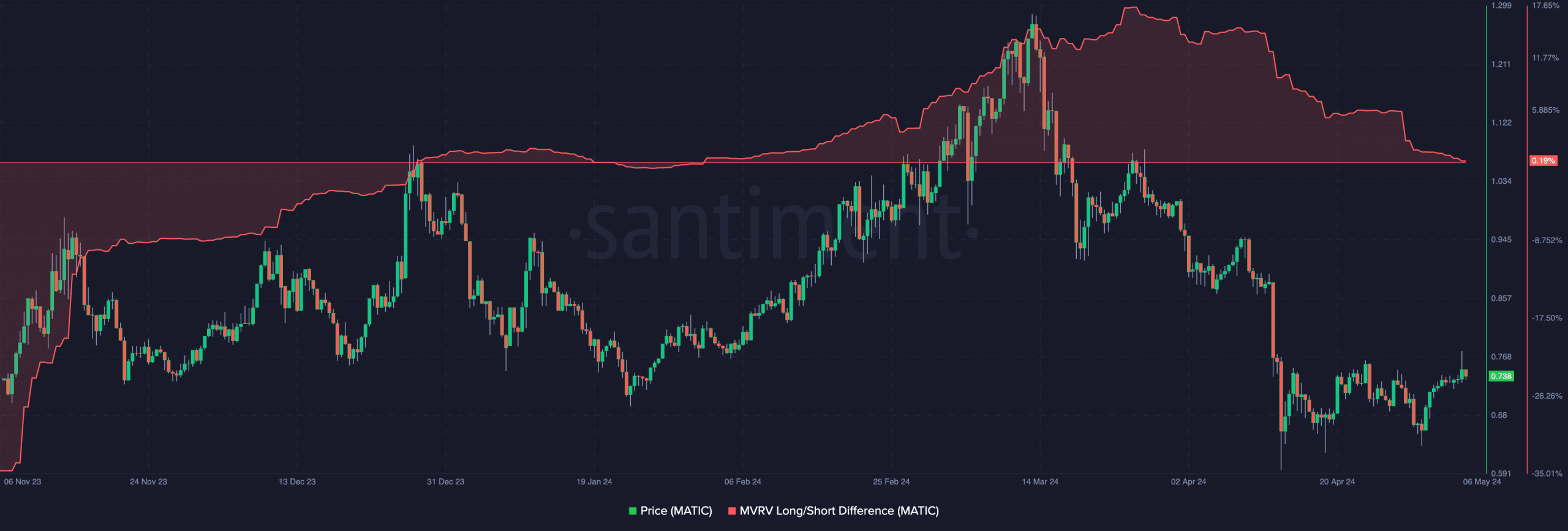

In terms of correction, on-chain data from Santiment showed that another decrease for the token might send it into a bearish phase.

AMBCrypto got this inference after checking the Market Value to Realized Value (MVRV) Z Score.

When the MVRV Z Score is lower than zero, it implies that a token is dealing with bearish dominance, and it could be difficult for the price to increase.

However, when the metric rises in the positive region, it suggests that the price tends to appreciate. At press time, Polygon’s MVRV Z Score was 0.19.

If the reading drops further, the bullish prediction mentioned above could be invalidated. Conversely, a quick uptick in the metric might stop MATIC from plunging to another difficult stage.

Realistic or not, here’s MATIC’s market cap in ETH terms

Hence, traders might need to watch out for the outcome before taking a stand. At the same time, the reading of the metric could indicate that the token is undervalued.

If millions of addresses begin to accumulate MATIC at $0.73, then falling into a bear cycle could be off the table.