Polygon

Polygon logs 200% hike in THIS key metric: Can it help MATIC?

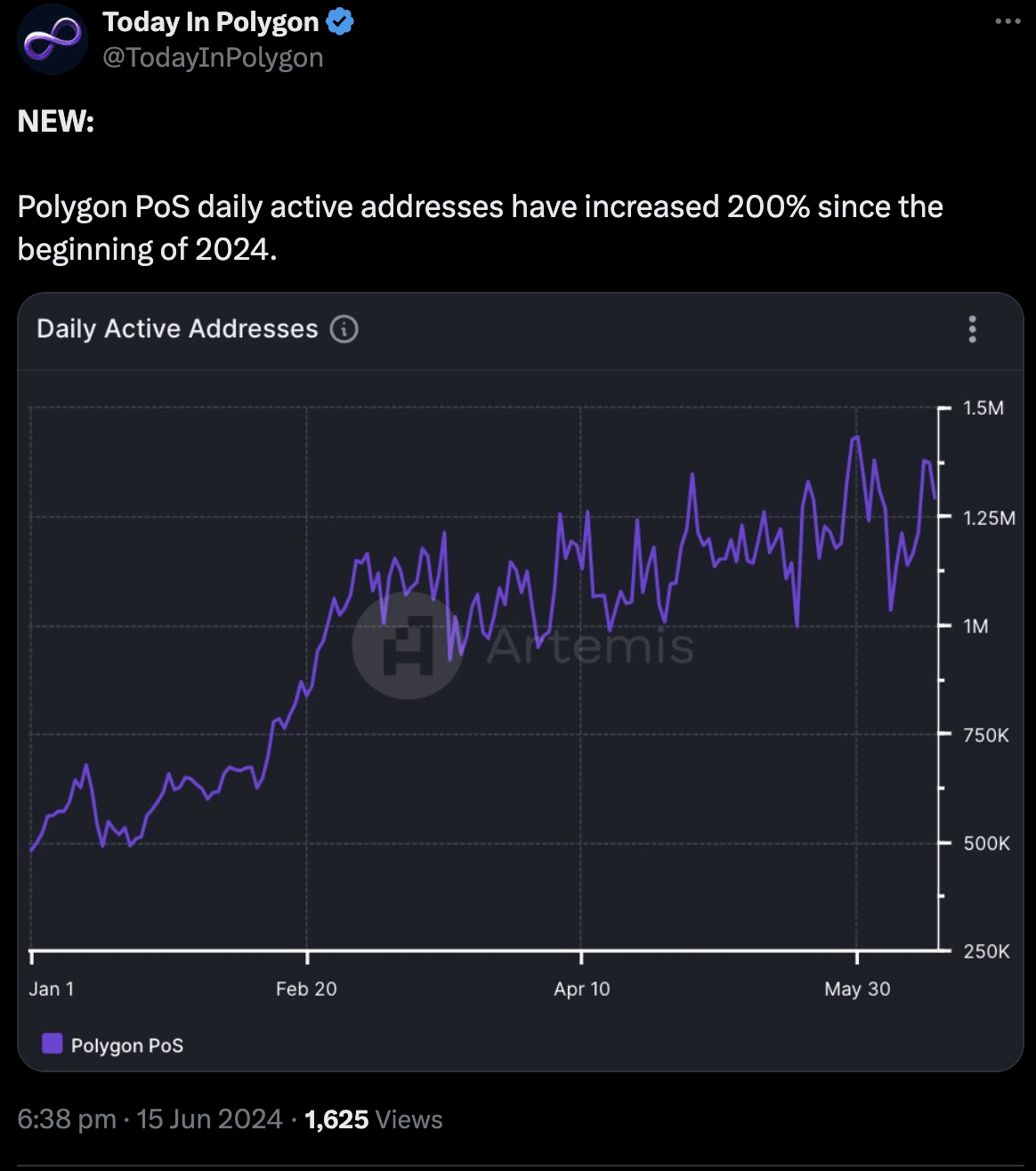

Since the beginning of the year, active addresses on Polygon have surged by 200%.

- Polygon witnessed a 200% rise in active addresses since the beginning of the year.

- Trader interest in MATIC fell, indicated by falling open interest.

While Bitcoin[BTC]

, Ethereum[ETH] and Solana[SOL] have been garnering attention due to ETFs and memecoins, Polygon[MATIC] has been seeing a significant amount of growth since the beginning of the year as well.Activity on the rise

Data showed a staggering 200% increase in daily active addresses since the year began.

Despite the surge in activity, the price movement of MATIC wasn’t correlated with the growth in activity on the Polygon network. The price of MATIC fell by 19%.

Before the price of MATIC crashed, it exhibited sideways movement with no clear indication of a trend being formed. However, after the correction, MATIC exhibited a bearish trend indicated by the lower lows and lower highs it formed.

To break this trend and for MATIC to have a chance at a reversal, MATIC would need to re-test and break past the $0.6346 level and aim for the $0.6886 mark.

The RSI (Relative Strength Index) was on MATIC’s side at 52.65, implying that there was some bullish momentum supporting MATIC.

The Awesome Oscillator (AO), however, was negative indicating that the short-term price movement was weaker than the long-term trend, potentially signaling a decline in buying pressure and a stronger likelihood of prices continuing to fall.

MATIC’s on-chain signs

However, on-chain metrics revealed some positives for MATIC. Over the past few days, the network growth for MATIC grew significantly, implying that the number of new addresses accumulating interest in MATIC had grown.

A rising network growth also suggested that new users were willing to buy MATIC at the current reduced prices.

The velocity at which MATIC was trading at had also grown, implying that the number of times, MATIC was being traded at witnessed an uptick as well.

The new addresses that were accumulating MATIC weren’t large addresses. AMBCrypto’s examination of Santiment’s data revealed that the cohorts that had more than 10,000 MATIC tokens were actually selling their holdings.

It was retail interest that had driven the recent uptick in growth in MATIC’s price.

Is your portfolio green? Check out the MATIC Profit Calculator

How are traders feeling?

Even though retail spot traders were interested in accumulating MATIC, the same enthusiasm wasn’t seen amongst futures and option traders.

An analysis of coinglass’ data revealed that the Open Interest in MATIC had plummeted significantly after the 1st of April.