Polygon makes a slew of announcements but can it bring investors some relief

Polygon is pushing its dedication toward making the crypto space more accessible to newer highs with the launch of Polygon Supernet and the $100 million fund. This fund will be used for development and research contracts and grants, integrations and partnerships, as well as acquisitions.

Polygon brings Supernets

Polygon Supernets are basically blockchain networks that will enable mainstream adoption of Polygon. These Supernets are designed and created with specific use cases pertaining to an application or project.

But Polygon has still maintained its network’s security even on Supernet chains by deploying a shared security layer in the form of a MATIC-staked validator marketplace. And individual projects will not be liable for this security either since Polygon validators will stake MATIC and receive rewards in MATIC as always.

Additionally, to further adoption, Polygon is also working with Stripe to enable instant payment for sellers and content creators by paying out crypto earnings in USDC on Polygon.

However, these developmental efforts did not seem to strike a chord with the investors in the way one would expect them to.

On the charts, MATIC did register a 6.2% rise early in the day yesterday but failed to sustain it and ended up losing it all. Currently, it is struggling to keep above its 6-month-long support level of $1.360, making it difficult for investors to enjoy some profits.

MATIC price action | Source: TradingView – AMBCrypto

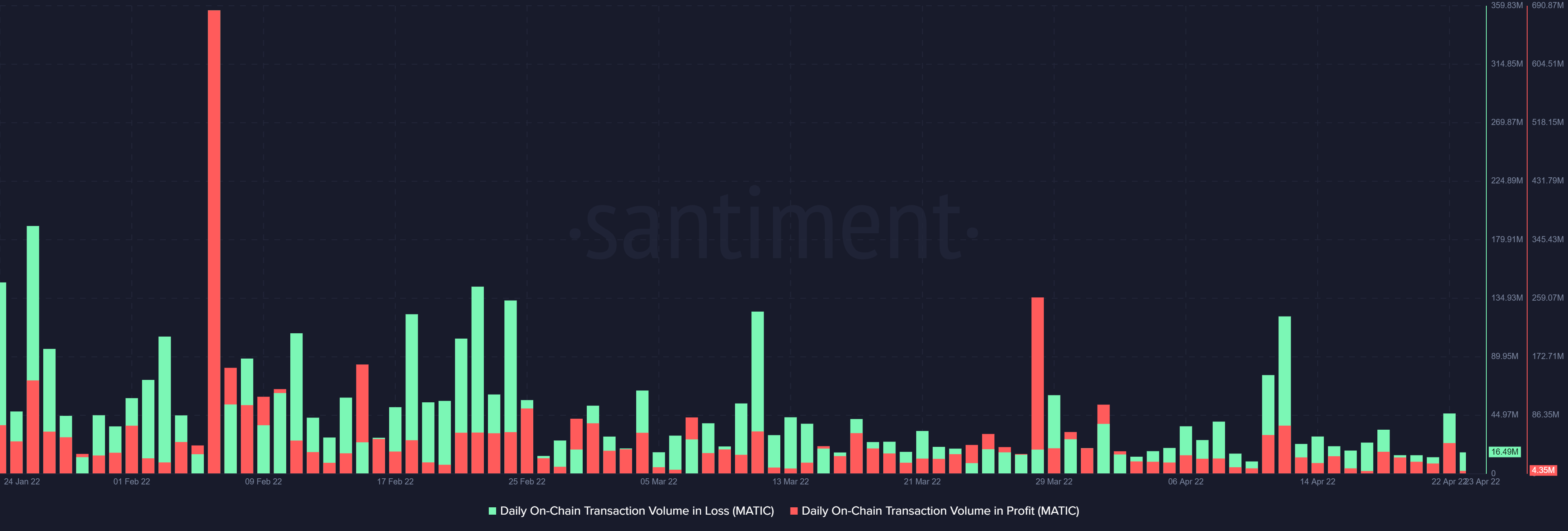

This is also backed by the fact that the volume of on-chain transactions in losses has been dominating the transactions in profits, and this is evidence enough that investors are starting to get agitated. The same led to some minor long term holder selling, as noted yesterday, in which 6.5 billion days were destroyed.

MATIC transactions in losses are higher than transactions in profit | Source: Santiment – AMBCrypto

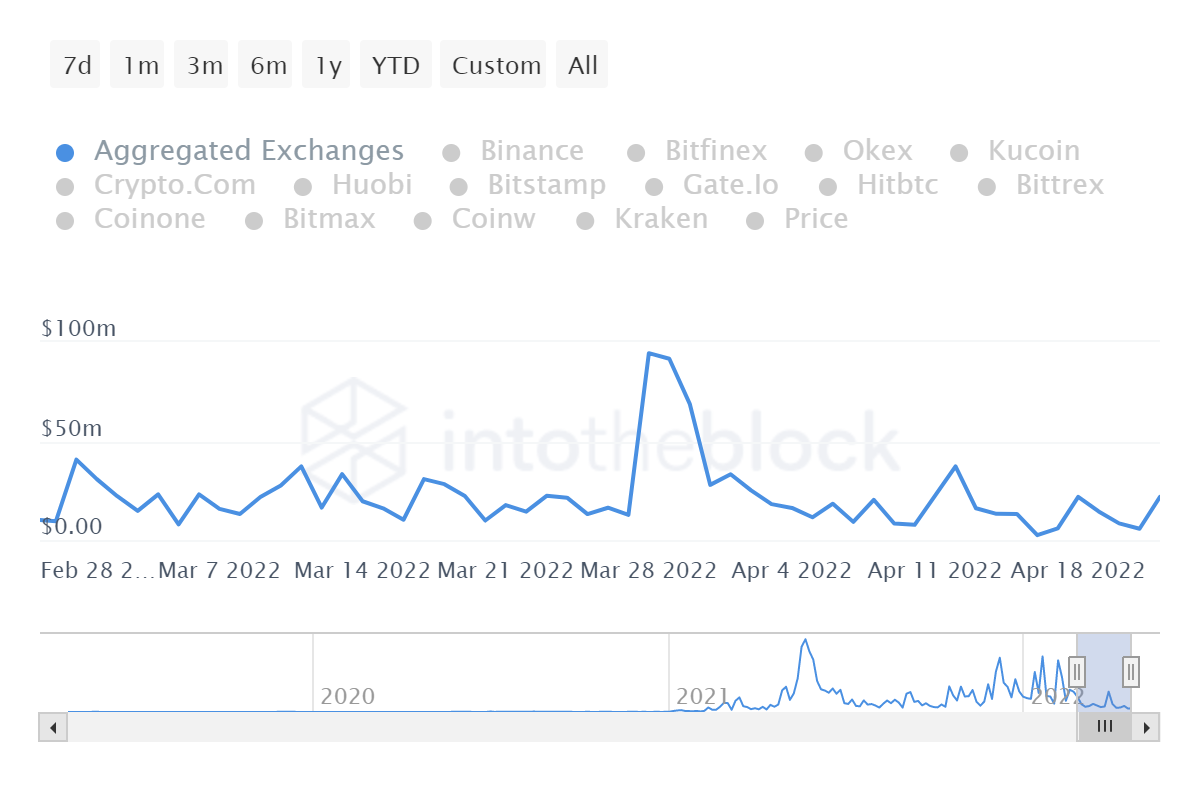

But this spike was only in response to the news and not an indication of a shift in trends in any way since the total flow of MATIC on the chain has been restricted within $20 million for the entirety of March as well as April.

MATIC total flows on chain | Source: Intotheblock – AMBCrypto

Since Supernets are interconnected to each other and Ethereum, it is certain that they will be seeing actual use cases soon. Being a novel feature, if they trigger some bullishness in investors just as Polkadot’s para-chains did, MATIC could then benefit from it.