Polygon [MATIC]: Bulls fixated on a key swing high, is it even reachable

![Polygon [MATIC]: Bulls fixated on a key swing high, is it even reachable](https://ambcrypto.com/wp-content/uploads/2023/03/image-1200x800-1.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Lower timeframe charts were bullish, while the daily chart was neutral at press time.

- Funding rates were positive alongside surging open interest rates.

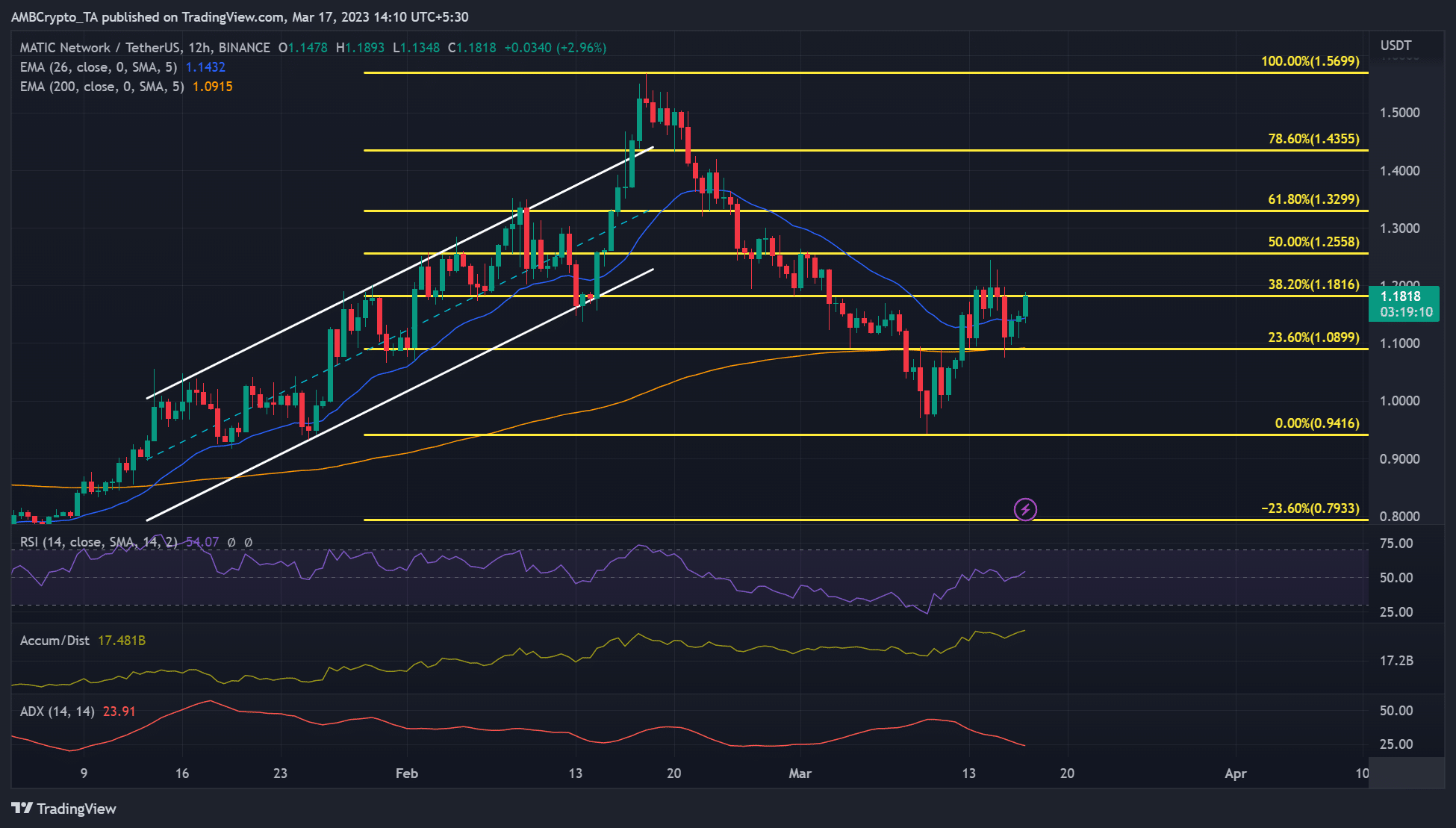

Before getting a steady ground, Polygon [MATIC] depreciated 40%, from $1.57 to $0.94. Bulls got refuge at $0.94, fronting a recovery that hit a price ceiling at 50% Fib level ($1.2558).

The second leg of recovery was on at the time of writing, but bulls must overcome a key obstacle to hit a recent swing high.

Is your portfolio green? Check out the MATIC Profit Calculator

The king coin, Bitcoin [BTC], retested its recent high of $26K, which could push most altcoins, including MATIC, to aim at their local highs too.

However, if BTC faces price rejection at the $26K level, the rest of the altcoin market could enter into a retracement.

Can bulls push above the 38.2% Fib level?

MATIC’s uptrend rally in the second half of January chalked an ascending channel. But a breach above the channel faced rejection at $1.57, setting MATIC to plunge 40%. So far, it has two legs of recovery.

The first leg faced rejection at 50% Fib level ($1.2558), and the second leg, seen at press time, could attempt to restest the same level if bulls overcome the hurdle at 38.2% Fib level ($1.1816).

But price rejection at the 50% Fib level could offer another correction with the 38.2% Fib level ($1.1816) and 23.6% Fib level ($1.0899) as key support levels if the trend goes south.

However, failure to close above the 38.2% Fib level could attract bears to sink MATIC to the 23.6% Fib level ($1.0899) or the swing low of $0.94, especially if BTC faces sharp retracement from $26K.

The Relative Strength Index (RSI) and Accumulation/Distribution indicators showed sharp rises, indicating increasing buying pressure and accumulation in the past few days.

However, Average Directional Index (ADX) declined, suggesting a likely consolidation or correction for MATIC. Moreover, the 200 EMA moved sideways, reinforcing a likely price consolidation scenario for the asset in the next few days/weeks.

Funding rates and OI increased

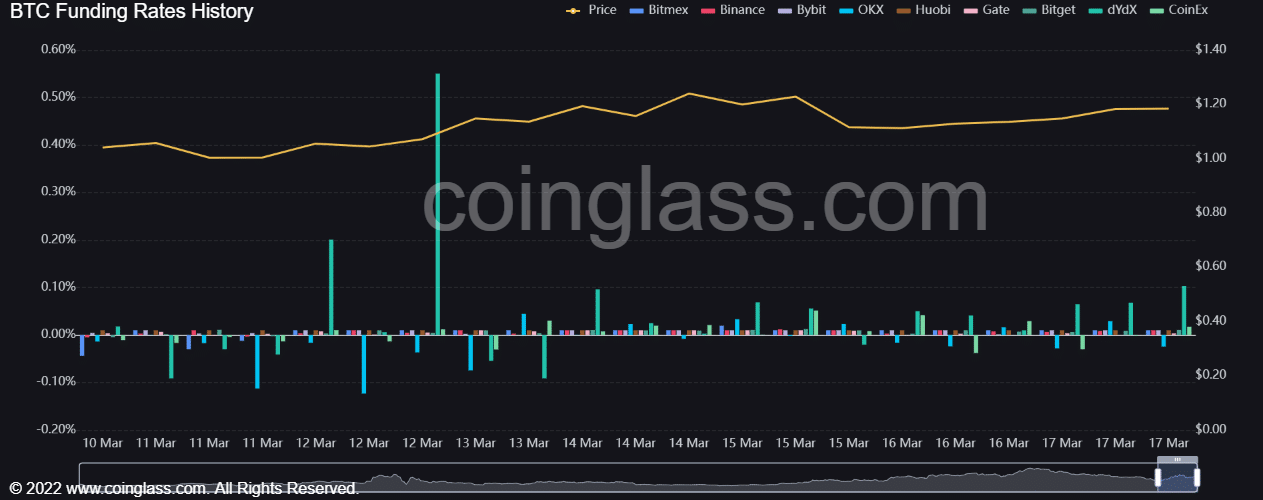

As per Coinglass, MATIC’s funding rates remained fairly positive since 10 March – a bullish signal witnessed since the first leg of recovery.

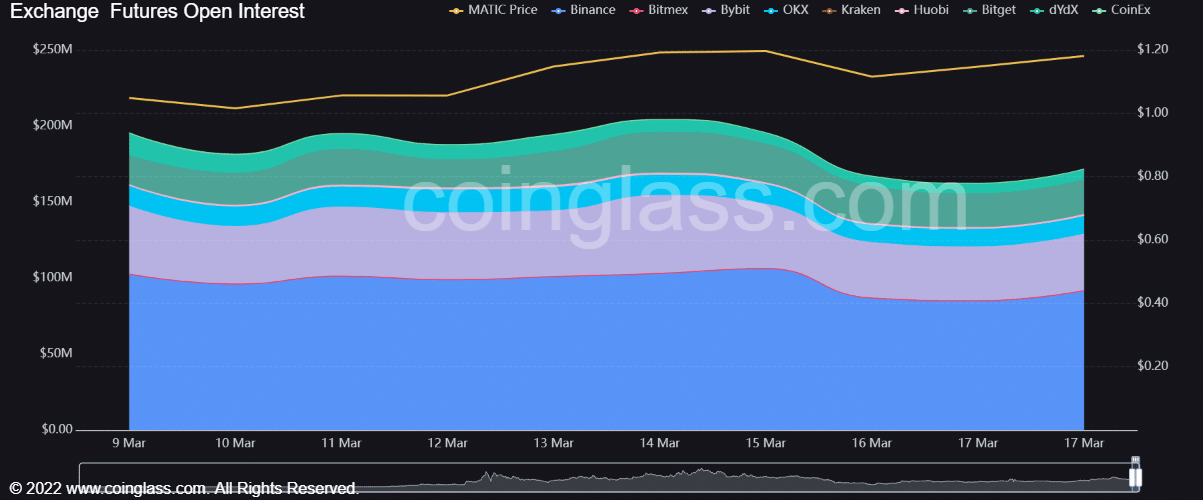

Moreover, the open interest (OI) rate increased further from 16 March, marking the start of the second leg of recovery after BTC hit $26K.

Read Polygon [MATIC] Price Prediction 2023-24

A surge in OI beyond $1.20 could mean a bullish sentiment capable of overcoming the hurdle at the 38.2% Fib level. But a drop in OI below $1.2 could complicate the recovery.