Polygon [MATIC] correction slows down – Can bulls get new opportunities?

![Polygon’s [MATIC] correction slows down - Can bulls get new opportunities?](https://ambcrypto.com/wp-content/uploads/2023/02/frances-gunn-c9z9RlCh0Zo-unsplash-e1677237237983.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC has depreciated by 15%.

- A consolidation was underway, and bulls could win if $1.3405 support remained steady.

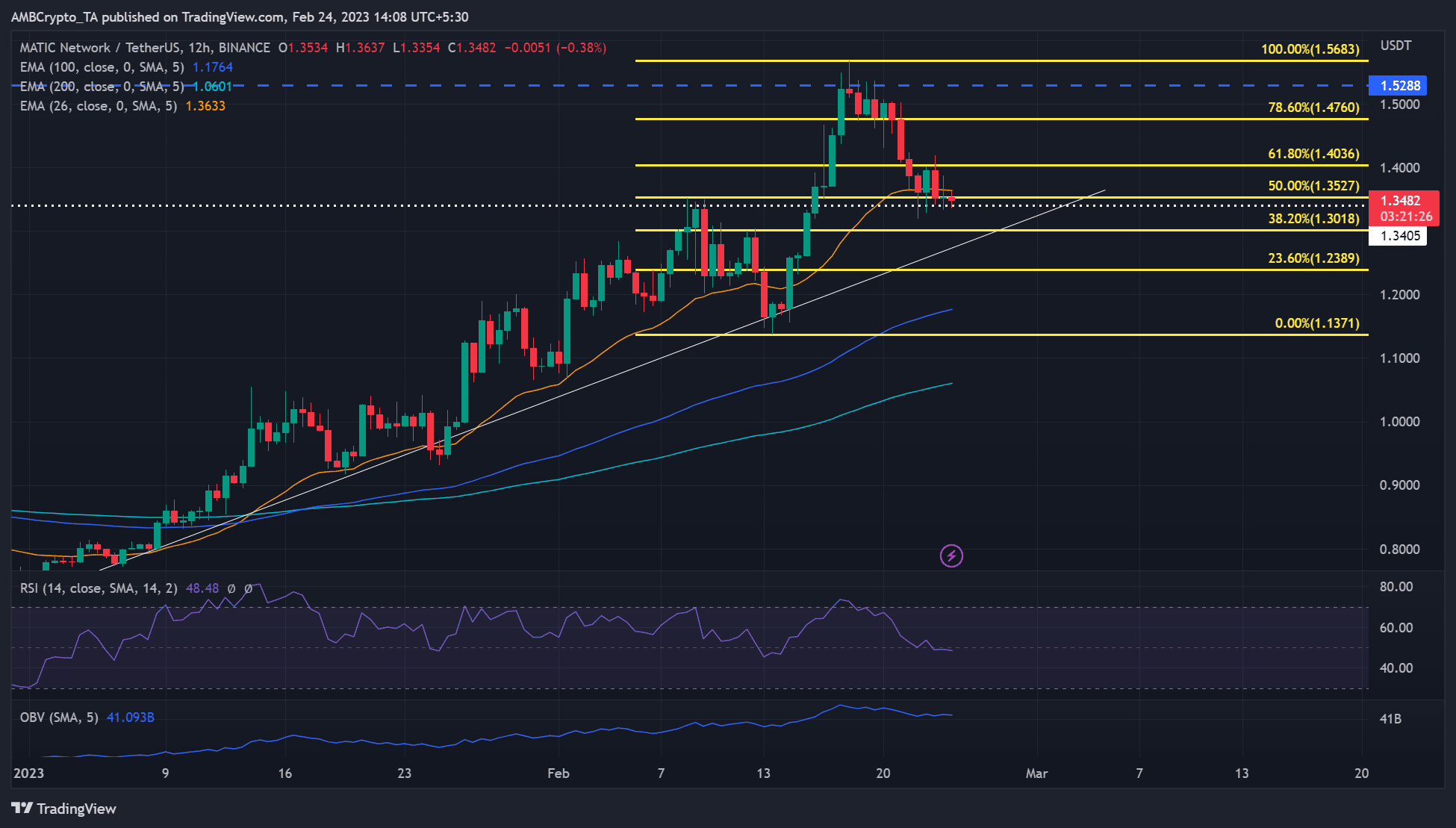

Polygon [MATIC] took a cue from Bitcoin [BTC] and traded in range on Friday. BTC oscillated in the $23.76 – $24.20k range, while MATIC consolidated between $1.3527 and $1.4036.

Read Polygon’s [MATIC] Price Prediction 2023-24

MATIC leaned on the lower range boundary at press time but could offer a market entry for bulls if this support becomes steady.

Can the $1.3405 level offer bulls a steady ground?

The $1.3405 has temporarily checked the ADA’s correction after a price rejection at $1.57 – a 15% depreciation. If it continues to hold, bulls could target the 61.8% Fib level of $1.4036 or the 78.60% Fib level of $1.4760. That would offer a 4.5% or 9% potential rally, respectively.

A breach of the $1.3405 support level could offer shorting opportunities. If ADA breaks below the consolidation range, short-sellers can look to book gains at the 38.20% Fib level of $1.3018 or 23.60% Fib level of $1.2389. Moreover, the ascending trendline (white) could also slow down.

However, an extended drop could settle on the 100-period or 200-period EMAs (exponential moving averages).

The Relative Strength Index (RSI) retreated to the mid-range, moved sideways, and was at 48, indicating that the market weakened and was almost neutral. Similarly, the OBV (On Balance Volume) dropped, underlying the bearish sentiment at the time of writing.

Although these fundamentals could undermine a strong rebound, investors should track BTC’s price action before making moves.

MATIC saw short-term accumulation, but …

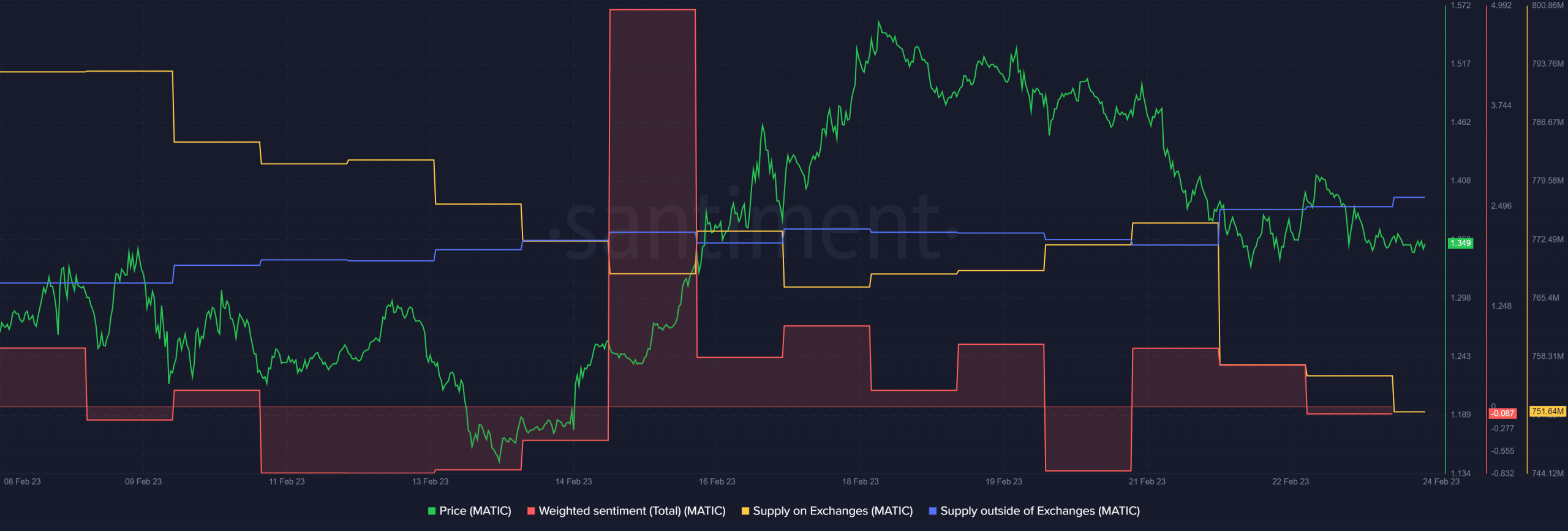

According to Santiment, MATIC’s supply out of the exchanges spiked, indicating a short-term accumulation for the trend. The amount of MATIC sitting on exchanges for sale also dipped significantly, as shown by the declining Supply on Exchange metric.

Is your portfolio green? Check out the MATIC Profit Calculator

Simply put, there was a short supply and more demand for MATIC in the near term, which could positively influence an uptrend in the long run if the trend continued.

However, the weighted sentiment has not reached the positive levels recorded after the FOMC meeting. At press time, the sentiment dropped and flipped into negative, indicating a bearish outlook for the asset amidst increasing macroeconomic uncertainty. Hence, caution should be exercised.