Analysis

Polygon [MATIC] steadies near $1.026; Shorting gains limited?

Despite signs of easing short-term selling pressure, MATIC may fluctuate as traders wait for the next Fed announcement on 2-3 May.

![Polygon [MATIC] steadies near $1.026; Shorting gains limited?](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x900-1-1000x600.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- MATIC retraced by 15% before steadying at current levels.

- Selling pressure eased, but short-term bears still had more leverage.

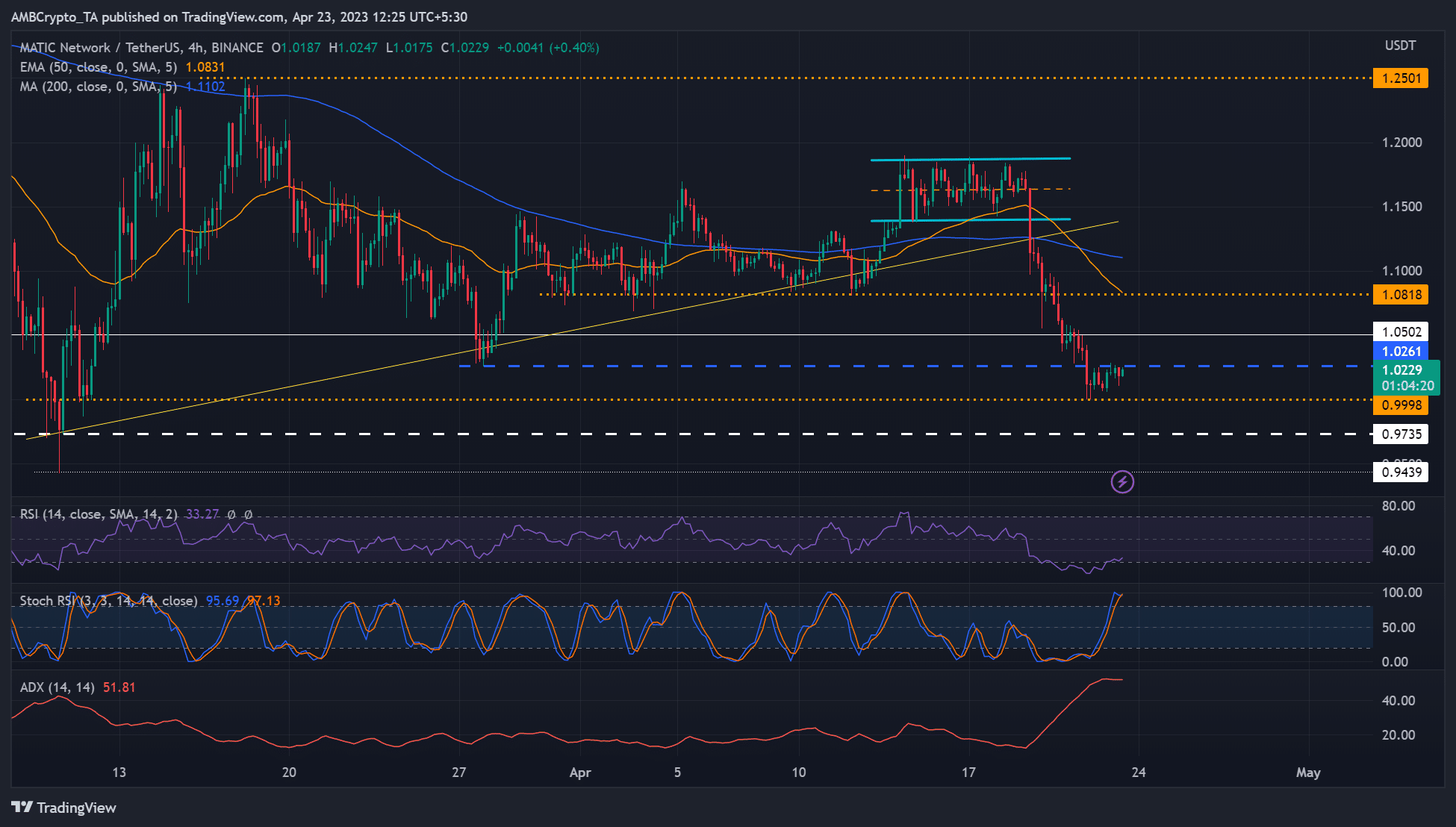

Polygon [MATIC] depreciated by 15%, dropping from around $1.18 to $0.9998. The plunge followed persistent Bitcoin [BTC] correction in the past week. BTC lost hold of the $30k price range and was hovering within $27k at press time.

Read Polygon [MATIC] Price Prediction

2023-24However, MATIC’s price steadied near $1.026, at the time of writing – a trend that may undermine short-sellers’ efforts. Nevertheless, sellers couldn’t be overruled wholesomely, as any hawkish Fed announcement next week (2-3 May) could exert more downward pressure on the crypto market.

A recovery, consolidation, or retracement for MATIC?

BTC’s correction forced MATIC to inflict a bearish breakout from its previous $1.14 – $1.18 range. Sustained selling pressure saw MATIC break below key supports. But the plunge has since steadied within the $0.9998 – $1.0261, at the time of writing.

Notably, the ADX (Average Directional Index) increased but was flat, showing the strong downtrend eased.

Meanwhile, the RSI attempted pullback from the oversold zone, indicating mild buying pressure. But the stochastic RSI hit the overbought zone – meaning buyers could give space to sellers again.

Ergo, MATIC could be constricted within the $0.9998 – $1.0261 range, depreciate to $0.9735, or the March swing low of $0.9439.

The downtrend could be accelerated if BTC drops below the $27k price range. This level could be a good buying level, especially if MATIC retests the $1.18 price ceiling.

Conversely, MATIC could aim at the 50-EMA ($1.0831) without hitting lower supports, especially if BTC reclaims $28k and $29k price ranges. But near-term bears must clear the $1.0261 and $1.05 hurdles to gain little leverage.

Supply on exchanges declined

Is your portfolio green? Check

MATIC Profit CalculatorSupply on exchanges declined significantly from 20 April, indicating short-term selling pressure decreased. In the same period, supply outside of exchanges increased while the exchange flow balance was negative (more outflows) – evidence of a short-term accumulation trend.

However, there was a spike in supply on exchange at press time which implies short-term selling pressure still looms large. As such, traders can track BTC price action for optimized set-ups.