Polygon: One more roadblock before crossing $0.80

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC’s H4 structure was bullish at the time of writing.

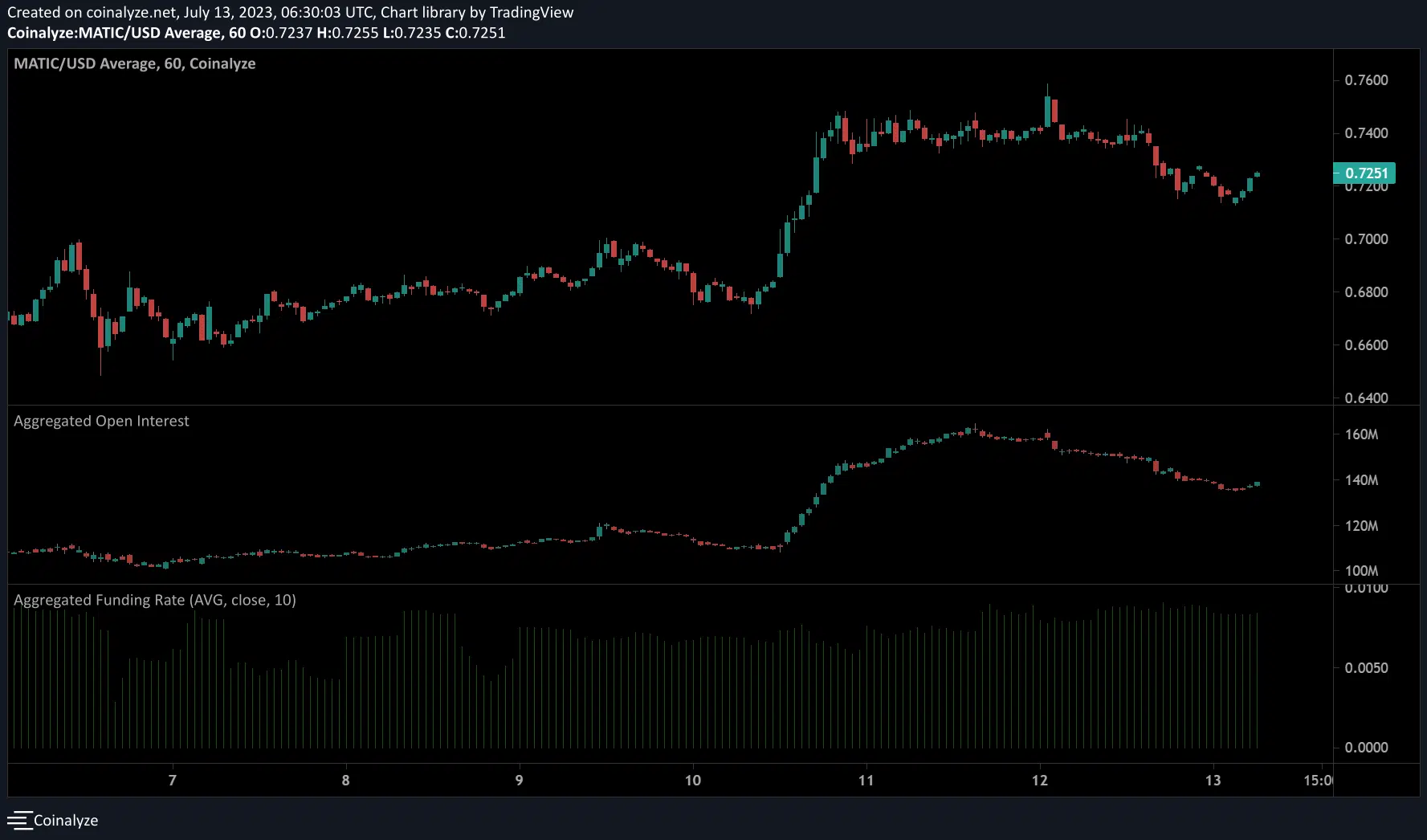

- The funding rate was positive, but Open Interest rates eased.

Polygon [MATIC] fronted an impressive recovery, reversing losses incurred in early June. The altcoin dropped below $0.90 after the US SEC categorized it as a “security” and sustained enormous selling pressure, but rebounded near $0.55.

Is your portfolio green? Check out the MATIC Profit Calculator

At the time of writing, MATIC’s recovery hit a key roadblock comprising a bullish order block on the lower timeframe and a previous support level in October-December 2022.

In the meantime, Bitcoin [BTC] firmed up near $30k, with potential re-accumulation at the current level.

Can bulls bypass the roadblock?

On the 4-hour chart, the ascending trendline (white) has been a crucial support level for bulls. If BTC continues consolidating above $30k, there is a likely scenario of MATIC constricting further between the ascending trendline and the overhead roadblock.

The white zone, $0.75 – $0.82, is a previous bullish order block (OB) on the weekly chart formed on 26 Dec. 2022. But the extensive drop in early June invalidated the bullish OB.

Nevertheless, the zone was a crucial support in October- December 2022/May 2023 and encompassed a bearish OB ($0.77 – $0.79) on the 4-hour chart. So, this makes it a sticky roadblock and a pain for bulls.

The inference on further price constriction between the overhead roadblock and the ascending trendline could hold if BTC consolidates above $30k.

A breach of the ascending trendline will weaken the H4 market structure, especially if BTC drops below $30k.

Meanwhile, the RSI dropped but steadied near the neutral level, suggesting eased buying pressure and a likely rebound at the ascending trendline. The CMF (Chaikin Money Flow) trended southwards, reinforcing eased capital inflows.

Futures Market: Overall bullish, but …

Based on the 1-hour chart on Coinalyze, the futures market was bullish overall, as shown by the positive aggregated funding rate. However, the eased Open Interest rates painted another picture. It shows most players were covering short positions.

How much are 1,10,100 MATICs worth today?

In addition, more long positions were liquidated in the past 24 hours than short positions, further capturing a short-term bearish sentiment and the stickiness of the overhead roadblock.

However, the conflicting signals call for close tracking of BTC price action for better clarity and market direction.