Polygon price prediction – What’s next as MATIC’s recovery gains amount to 20%?

- Polygon has extend its recovery to clear August losses

- However, key hurdles can be found at $0.51 and $0.55

Polygon [MATIC] has been among the top five outliers on the daily and weekly price charts. Since last Friday, MATIC has risen by nearly 20%, while the rest of the market has remained sideways.

That’s not all though as in what is now a new update, Polygon will change its native token from ‘MATIC’ to ‘POL’ on 4 September. The exchange ratio will be 1:1 for MATIC to POL. According to the Polygon team, the transition aims to make POL the gas and staking token for the ecosystem. It could be expanded to cater to Polygon’s aggregation platform (AggLayer).

With these lined-up changes, will MATIC clear its August losses?

MATIC races to clear August losses

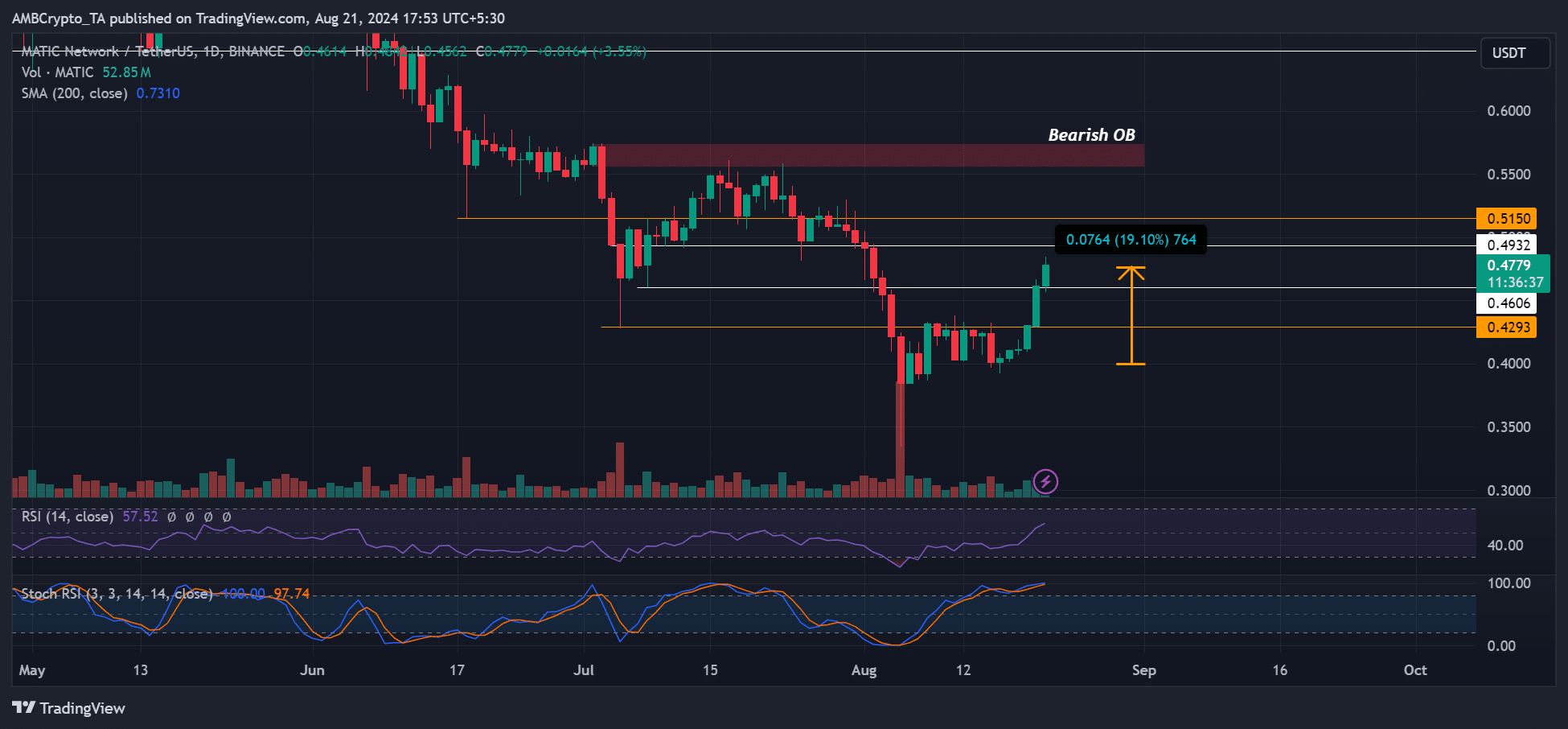

On the daily chart, MATIC was bullish as it mounted above the $0.42-level. Since 16 August (last Friday), MATIC has embarked on an extended recovery that netted almost 20% gains, at the time of writing. This reversed most of its August losses.

MATIC was trading at $0.47, at press time, and had to clear two key resistance levels to hit the supply area at $0.55. The immediate hurdles were at $0.49 and $0.51. Given the massive buying pressure shown by the RSI (Relative Strength Index) cruising above its average level, these targets could be hit.

At the same time, the Stochastic RSI was overheated as it was in the overbought territory. Hence, a cool-off couldn’t be overruled for MATIC’s rally. Also, the $0.46 and $0.42 levels were key short-term supports to consider if the rally cooled off.

Short-term MATIC holders up 8%

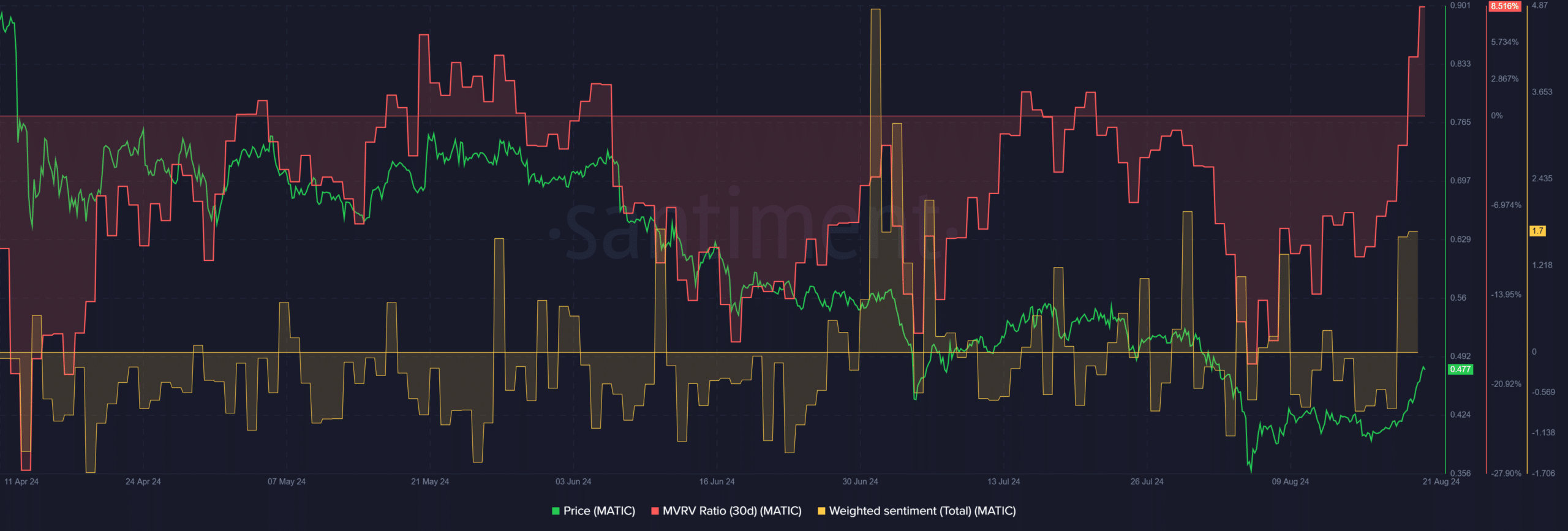

Interestingly, MATIC was among the few tokens that had a positive market sentiment at the time of writing, as demonstrated by the uptick in weighted sentiment. Simply put, speculators have been bullish on the token’s potential.

However, after the most recent pump, the 30-day MVRV (Market Value to Realized Value) was up +8%. This meant that MATIC holders who had bought the altcoin in the past 30 days had 8% unrealized profits.

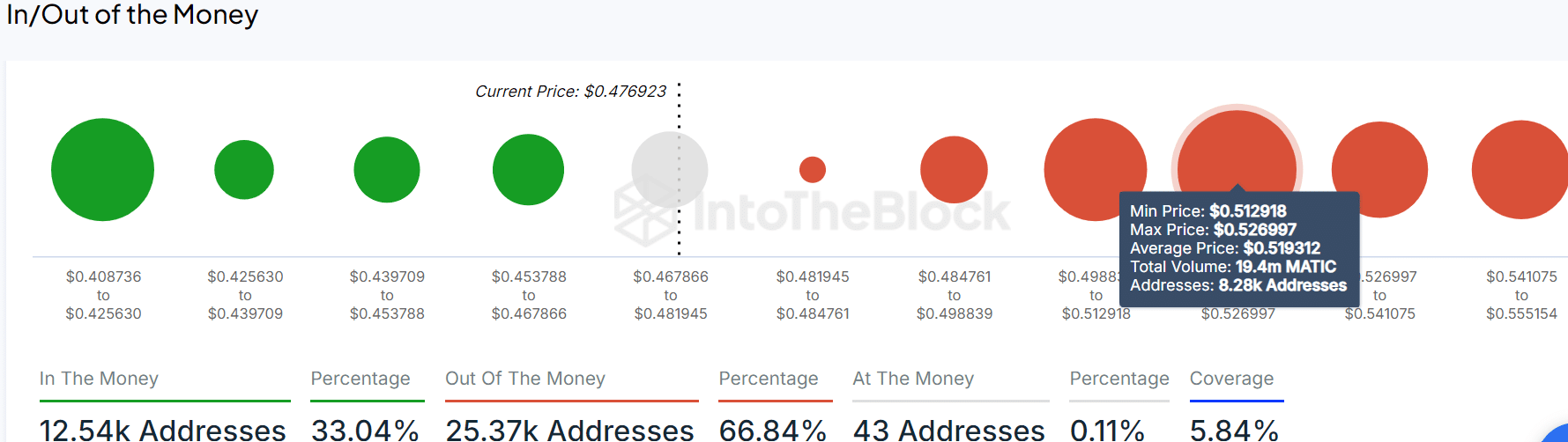

This also meant that the altcoin was relatively overvalued and could attract profit-taking. Hence, the overhead resistance levels would be crucial for a likely reversal. In fact, as per IntoTheBlock data, between $0.40 and $0.55, only 33% of addresses were in profit after the upswing.

The bulk of addresses between $0.51 and $0.52, about 8K users holding nearly 20M MATIC, were in losses. So, they would’ve broken even if prices hit these levels, which might tempt them to sell off their holdings.

So, MATIC’s extended recovery could face headwinds at $0.51 or $0.55, key resistance levels which could attract sell pressure.