Polygon provides clarity on zkEVM’s relevance; how did MATIC react to it

- Polygon zkEVM met most of the criteria for EVM-equivalence as suggested by Vitalik Buterin.

- zkEVM’s new users declined considerably, and MATIC’s price also plummeted.

Since the launch of Polygon’s [MATIC] much-awaited zkEVM mainnet, several questions have been raised regarding its equivalence to EVM. Interestingly, in a 19 April blog, Polygon addressed those concerns and presented its response.

Polygon #zkEVM and EVM-equivalence:https://t.co/ZPFXqwsVEo

— Polygon (@0xPolygon) April 18, 2023

Read Polygon’s [MATIC] Price Prediction 2023-24

Concerns about EVM-equivalence

According to Polygon, EVM-equivalence refers to a zkEVM that executes EVM bytecode directly. This suggests that zkEVM and EVM do not have an interface, such as a recompiler or LLVM.

The next concern was then, why not refer to Polygon zkEVM as a bytecode-compatible ZK rollup? In response to this, Polygon said,

“Some ZK rollups may prefer this phrasing. But that’s a stylistic decision, like capitalizing the word internet, not a substantive one.”

Vitalik’s take on EVM-equivalence

According to Vitalik Buterin, EVM equivalence is about a few characteristics. They include support for all of EVM’s opcodes and precompiled smart contracts as well as identical gas pricing as the EVM.

Luckily, Polygon zkEVM meets most of these standards. For instance, zkEVM’s gas price is similar to EVM’s, and it also supports all of EVM’s opcodes.

However, zkEVM currently supports only five out of nine EVM’s precompiled smart contracts. But Polygon mentioned that zkEVM will soon support the remaining four.

zkEVM’s performance remains a question

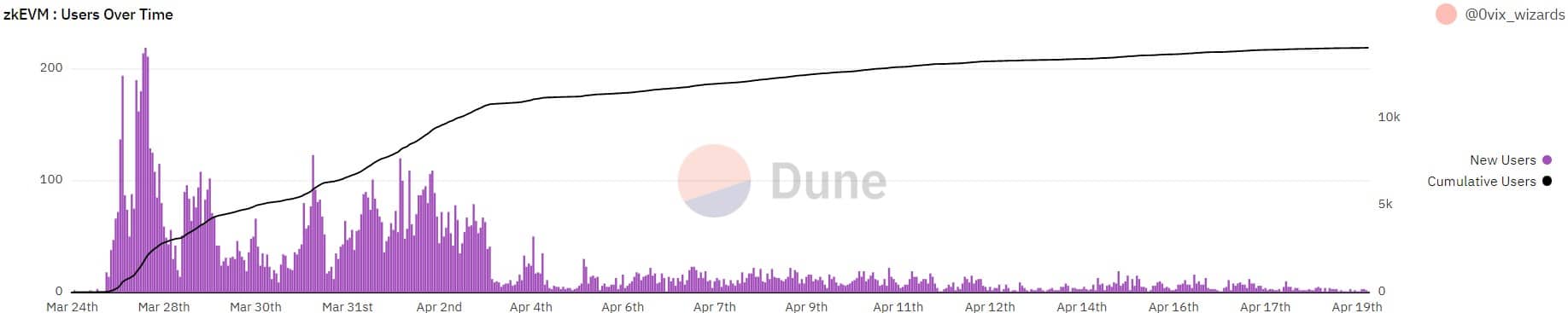

Though concerns regarding zkEVM’s EVM-equivalence were addressed, the solution’s output was not up to par. Dune’s data revealed that though zkEVM’s cumulative transactions continued to rise, its daily transactions declined. A similar trend was also registered in its number of users, as the metric plummeted quite significantly in April.

Is your portfolio green? Check the Polygon Profit Calculator

MATIC under the bearish influence?

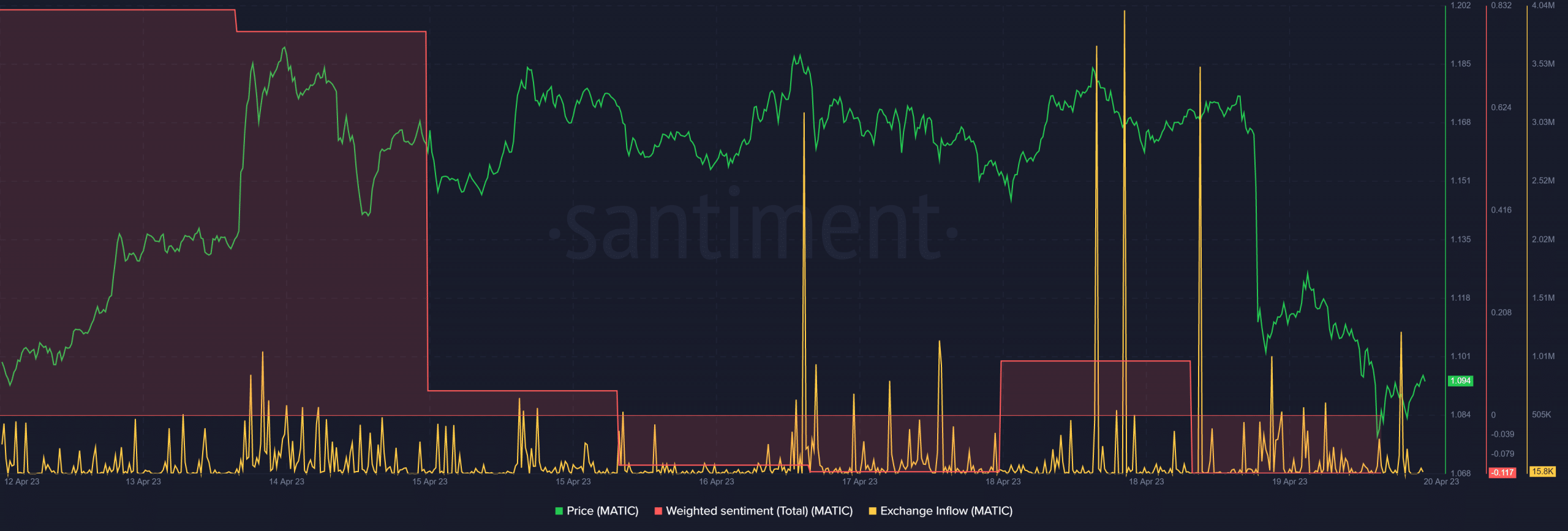

It should be noted here that the crypto market turned bearish on 19 April, causing prices to fall further. At press time, MATIC was down by nearly 7% in the last 24 hours and was trading at $1.09 with a market capitalization of over $10 billion.

The price drop caused a surge in negative sentiment around MATIC, something that was pretty evident from the weighted sentiment metric’s readings.

In fact, MATIC’s exchange inflow also spiked considerably, suggesting an arrival of selling pressure, which could strengthen a downtrend.