Polygon reverses July gains, what’s next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC gained over 30% in the first half of July.

- Retracement in the second half of July cleared most of the gains.

Polygon’s [MATIC] impressive performance and price gains in the first half of July were under risk amidst uncertainty around Bitcoin [BTC]. The altcoin posted over 30% gains in early July, rising from $0.65 to $0.90. However, the pullback that followed threatened to retest July lows.

Is your portfolio green? Check out the MATIC Profit Calculator

In the meantime, BTC was below the previous range-low of $29.5k, exposing the king coin to a >3.5% monthly loss as of the time of writing.

Will the 50% Fib level hold?

The RSI struggled to climb above the neutral level of 50 from mid-July, underscoring sellers’ conviction in the second half of July. Over the same period, capital inflows into MATIC’s market fluctuated, as illustrated by wavering Chaikin Money Flow (CMF).

The price pullback from mid-July eased at the 50% Fib level of $0.70. In the last few days, bulls and bears fought to control the 50% Fib level ($0.70). Given the bearish price chart indicators and weak BTC, the support and 50% Fib level could crack.

So, a drop to 38.2% Fib level ($0.655) could be feasible in the coming hours/days, especially if BTC drops below $29.0k.

Conversely, MATIC could target immediate resistance levels of 61.8% Fib level ($0.75) and 78.6% Fib level ($0.81) if BTC reclaims $29.5k.

How much are 1,10,100 MATICs worth today?

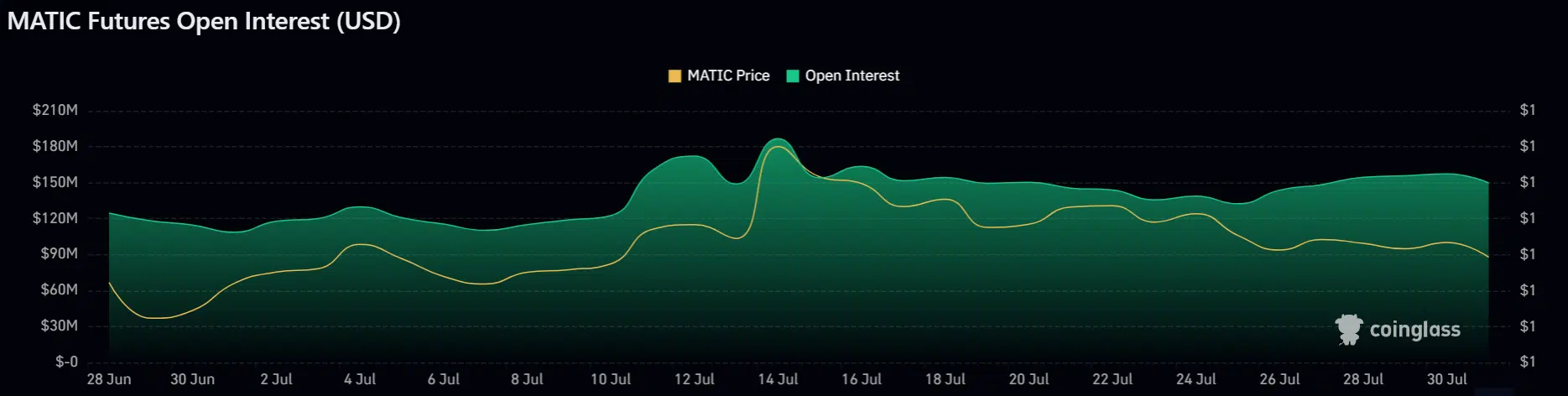

Open Interest rate dipped

According to Coinglass, MATIC’s open interest rate hit a high of >$180 million at the price peak in mid-July. But the metric declined to around $150 million at the time of writing, illustrating bearish bias and a drop in demand in the futures market over the second half of July.

But, liquidation data flashed mixed signals on the lower timeframes as of the time of writing. So, bulls should wait for a definitive BTC price action before bidding at the 50% Fib level ($0.70).