Polygon

Polygon’s new ‘ATH’ – What it means for MATIC

Just a year ago, Polygon had a third of its daily active address count as of this writing.

- The daily active address count has risen 75% on a YTD basis.

- Whales’ accumulation drive has driven MATIC’s surge in recent weeks.

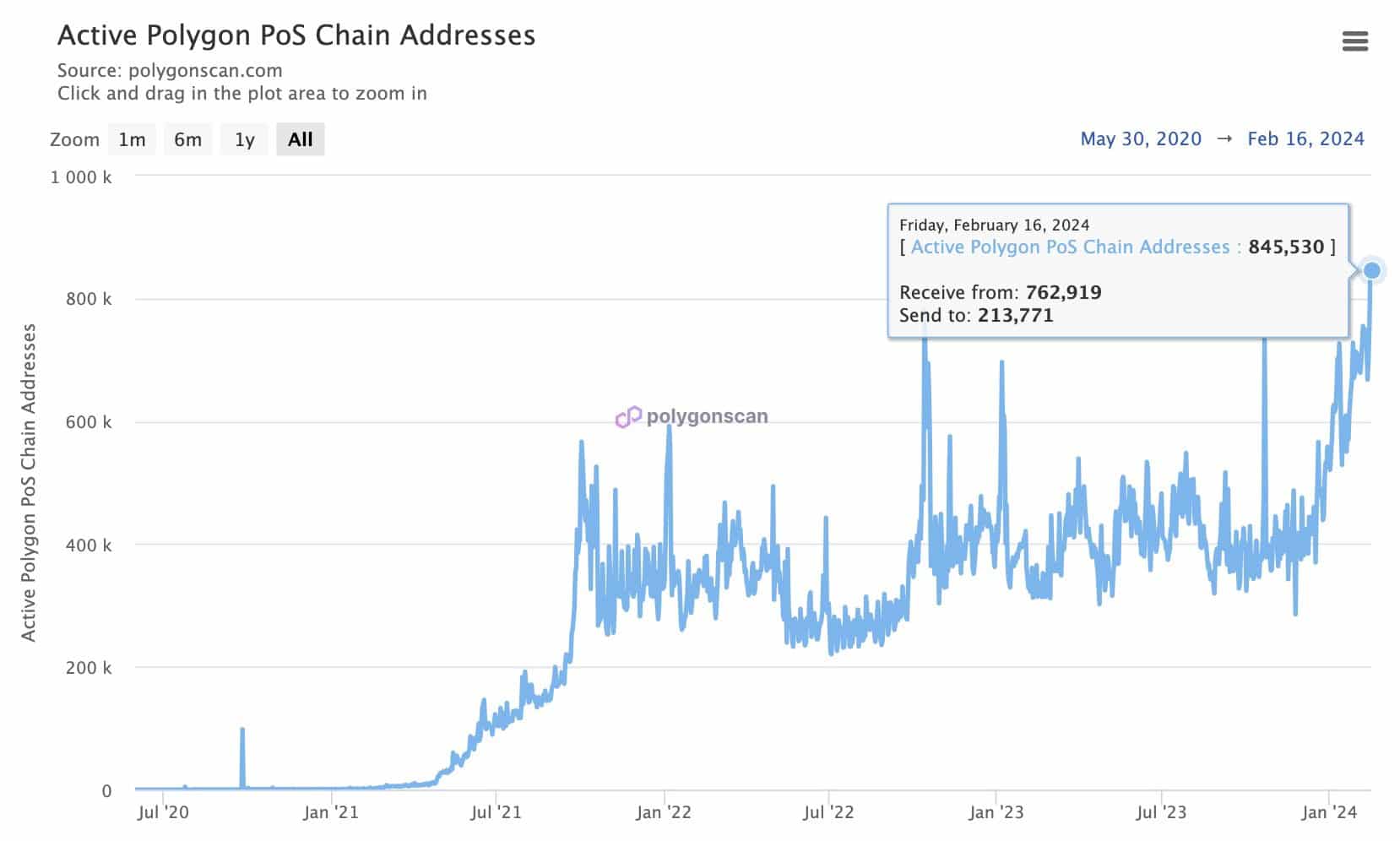

Polygon’s [MATIC] daily active addresses spiked to fresh all-time highs (ATH) as the proof-of-stake (PoS) chain continues to see higher user participation in 2024.

According to a post on social platform X, the number of unique addresses involved in network transactions reached 845,530 on the 16th of February, marking a 7% increase from the previous day.

A parabolic rise over the past year

Polygon’s network utilization started to rise in the dying stages of 2023, and the momentum has continued well into 2024.

The daily active address count has risen 75% on a year-to-date (YTD) basis. On a yearly time frame, the rise has been meteoric to say the least. Just a year ago, Polygon just had 285,000 daily active addresses, nearly a third of Polygon’s count as of this writing.

The other big talking point behind the rising trend was how the layer-2 solution was able to completely outperform the base layer Ethereum [ETH] in daily users.

Both the chains were neck and neck in December, AMBCrypto noticed using Artemis’ statistics. However, the gulf widened in 2024 and Polygon extended a big lead over Ethereum.

On-chain transactions decline

Interestingly, while the user base has expanded, network utilization has not followed the same trend. The seven-day moving average (MA) of Polygon’s daily on-chain transactions plunged 55% since the Inscriptions

frenzy witnessed in mid-December.Futures market bearish on MATIC

The increasing user engagement boded well for the chain’s native token, MATIC, which accumulated gains of 10% over the past month, according to CoinMarketCap.

Notably, whales have been in an accumulation spree over the last month, which might have strongly aided the price rise.

According to AMBCrypto’s scrutiny of Santiment data, addresses belonging to cohorts holding more than 1,000 coins surged significantly over the past month.

Is your portfolio green? Check out the MATIC Profit Calculator

Surprisingly, majority of the derivatives market was still betting against MATIC’s rise.

According to Coinglass, the Longs/Shorts ratio was 0.91 as of this writing, indicating the dominance of bearish leveraged traders.