Polygon: Should you or shouldn’t you hold MATIC in a bear market

One can wonder if rags to riches could be MATIC’s story. The token which barely had a value of $0.09887 in February 2021 reached an all-time high (ATH) of $2.92 in December 2021. At press time, however, it was changing wallets at $1.45, down by 4.59% over the last day. With that, a section of the market has continued to question if MATIC should be a part of your portfolio in a bear market.

Let’s look for an answer

All of Polygon’s announcements and development have had a predictable effect on MATIC. The token that began its victory journey early last year has not had a very bullish ride on the macro-lens.

It has struggled to maintain its sell-and-buy pressure. Investors who bought MATIC in December 2021 out of FOMO might find themselves looking at price charts constantly in anticipation of an upcoming spike.

Well, after the major sell-off on 24 February, the token has been somewhat consolidating on the price chart. The bulls exerted pressure towards the end week of February 2022, following which the price went only to a high of $1.732 on 7 April. Now, due to the lack of demand, the token slid down to $1.42 on 9 April (Press time).

At this point, if the sell-side pressure continues to dominate, MATIC might form a lower low to meet its near-term floor at $1.251. However, the arrival of demand would see MATIC go up to test $2.035. Furthermore, turning this level to support will give the token an edge. But the journey from its two-month-long resistance to its ATH wouldn’t be a child’s play. MATIC will have to bring in enough volume to sustain a rally.

Technical indicators seem to be putting forward a clearer picture. In 2022 so far, RSI has mainly been resting below the 50% level. Although on 28 March, it reached a 61-mark. On the whole, RSI has been presenting a dominance of bearish influence for most of its sessions in 2022. MACD on the other hand hasn’t ruled out the presence of bears in the market.

Also, at the time of writing, MATIC was trading below its 20,50,200 daily EMA lines. In fact, the press time price of the token was on the lower side of the Bollinger Band (BB). Now, since the indicators majorly favored the sellers, it’s clear that the current demand zone would continue to pose challenges in MATIC’s recovery phase.

All said about the price trajectory, now the most pertinent question is- Could MATIC give you the crypto confidence? And, the answer is ‘yes or maybe no.’ While the price chart looks gloomy, metrics, on the other hand, have not been bearish, as it were.

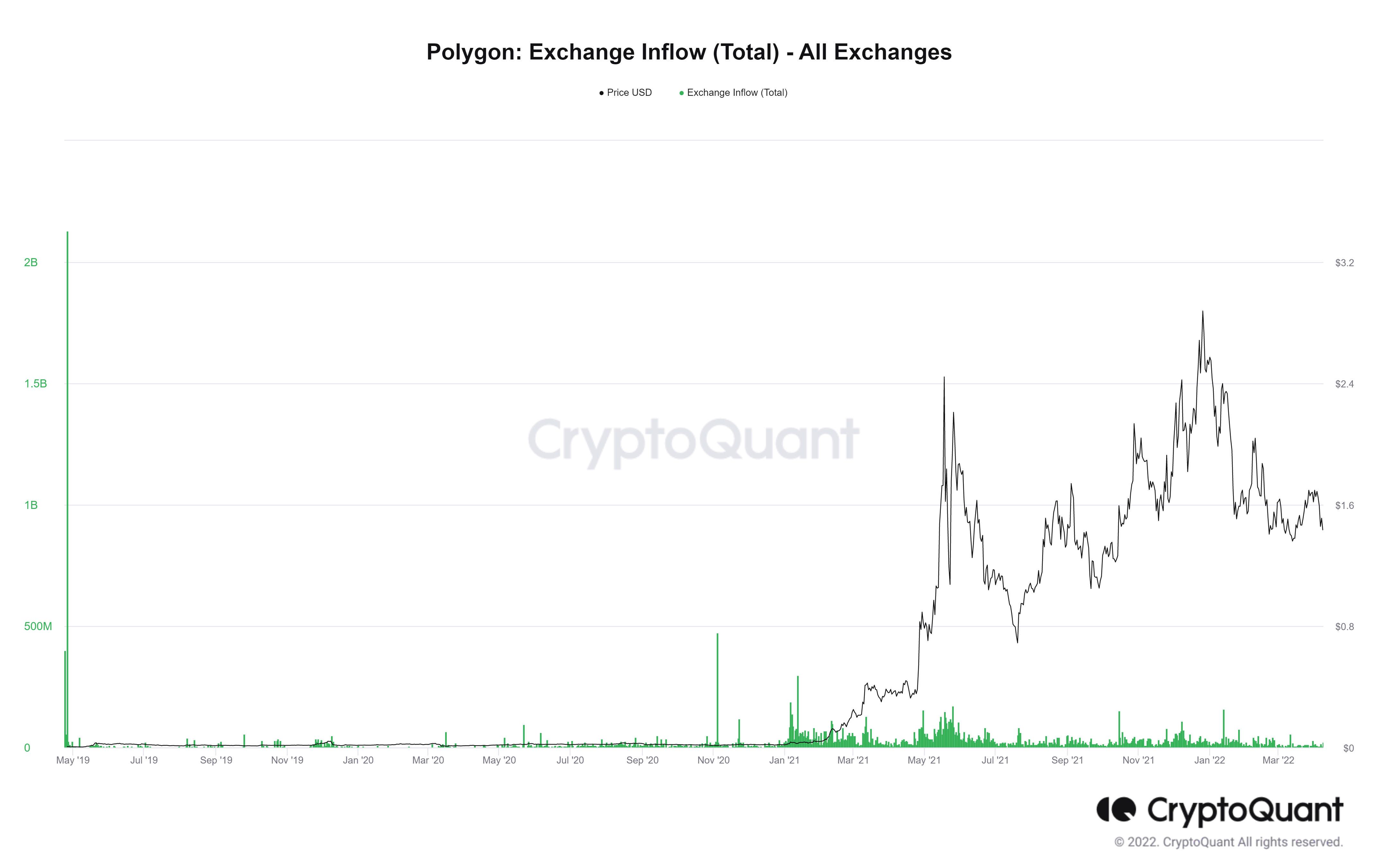

Since January 2022, exchange inflows have been decreasing even though volume remains a concern. It’s crystal clear that MATIC holders are not ready to sell at the moment, they are resorting to HODL.

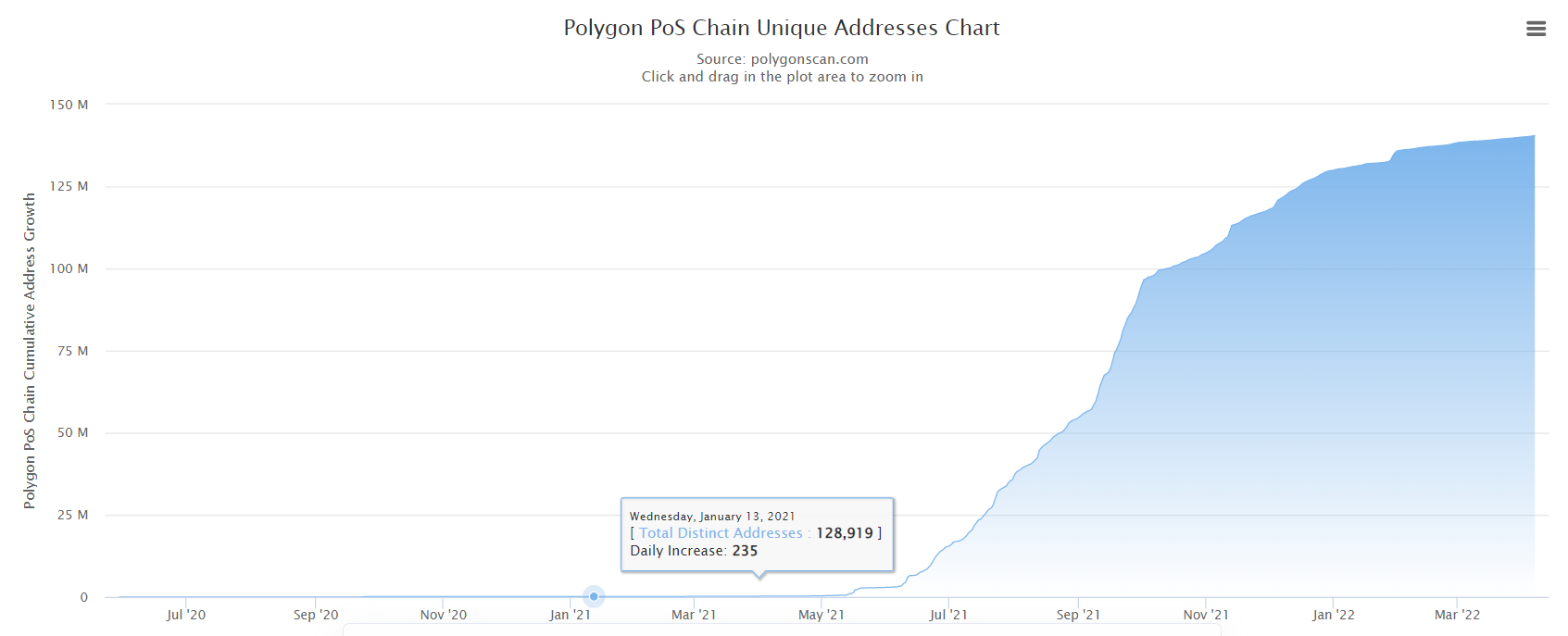

Likewise, in order to understand the investors’ interest, a look at Polygon PoS chain unique addresses chart is a must. Well, to a pessimist, it might seem like a ‘no good story’ situation.

However, an opportunist will see the daily increase of PoS chain unique addresses after 29 January 2022. Even though the prices are dwindling, some of the early investors who know MATIC’s market have preferred HODLing in their second-time MATIC investment.

Another important metric that has been very bullish for MATIC is its development activity. Irrespective of price fluctuation, development activity has been strong; it has been increasing on a macro-frame.

This gives high hope to investors who have been lulled by MATIC’s performance of late.

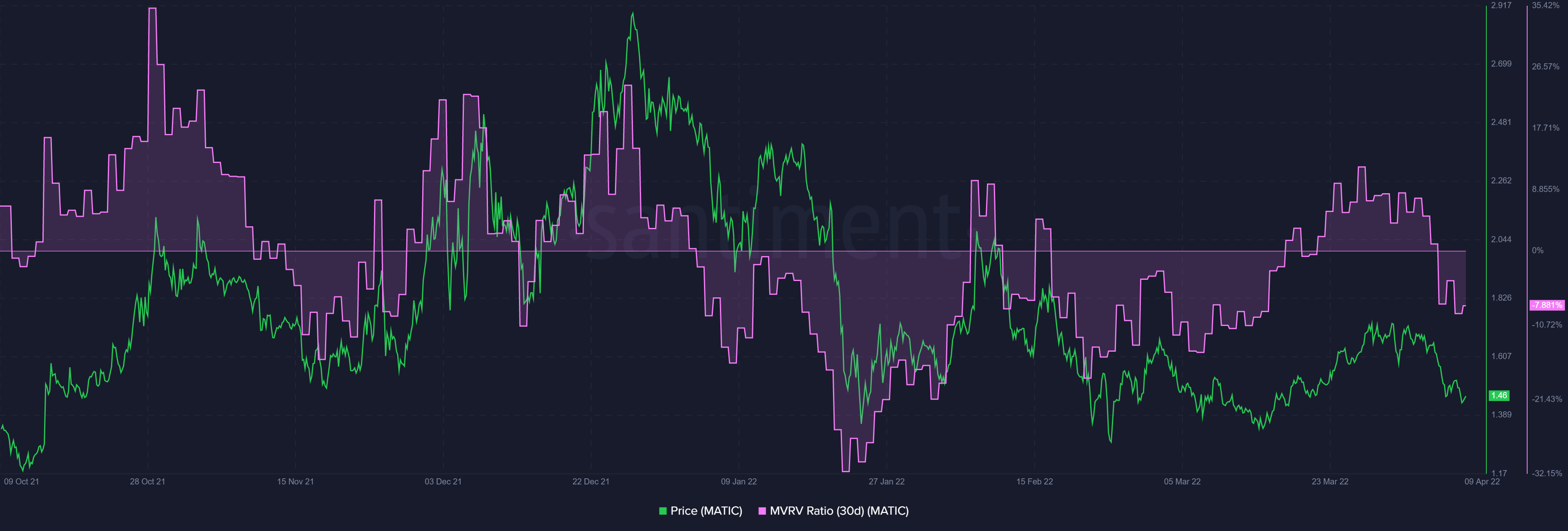

Furthermore, a look at MVRV (30-Day) might reveal if it’s the right time for investors who are planning to enter a position. The MVRV ratio for MATIC has moved into the negative territory after 5 April.

At press time, it stood at 1.795. Thereby, stating that the asset is not yet in the undervalued zone. Investors hoping for prices to fall might open a short position here.

Now, if your risk appetite is strong and you enjoy taking on challenges, you shouldn’t miss out on buying (read holding) MATIC in a bear market.