Polygon wallets: A sign of how declining network TVL impacts more than we see?

- The number of unique Polygon wallets declined as the protocol’s TVL fell.

- DEX performances took a hit while MATIC’s price dropped.

The Polygon [MATIC] network has been consistently making progress in the DeFi space through new collaborations and upgrades. However, despite these developments, Polygon’s TVL continued to decline.

Read Polygon’s [MATIC] Price Prediction 2023-2024

Is Polygon falling behind?

According to Cryptolaxy, a crypto analytics firm, the TVL of Polygon declined by 2.86% over the last week. Whereas other competitors in the L2 space, such as Arbitrum [ARB]and zkSync Era witnessed high growth.

Additionally, the number of unique active wallets on the Polygon network took a massive plunge. According to Dune Analytics’ data, the number of active wallets on the network fell from 430,682 to 316,250 in the first 15 days of April.

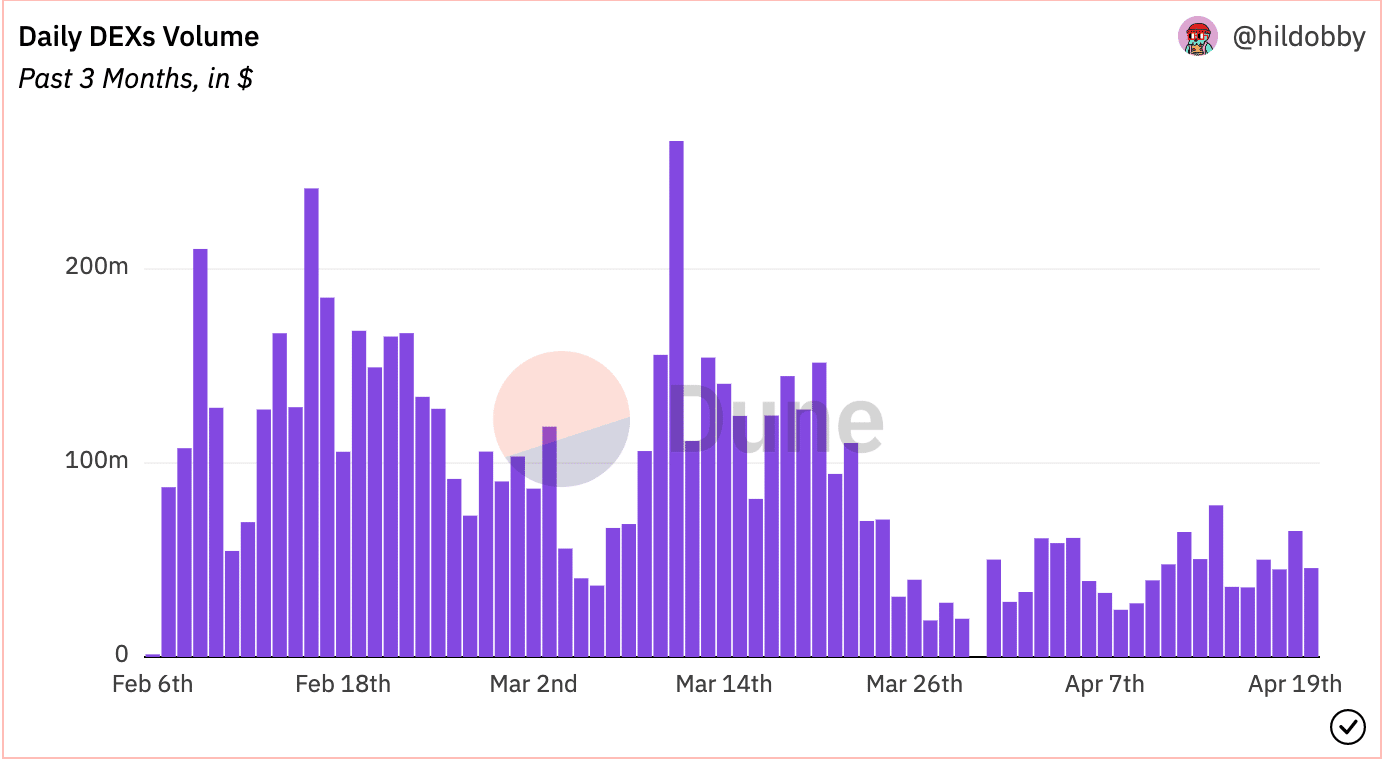

One reason for the same would be the decline in DEX volume on the Polygon network. As per Dune Analytics’ data, the overall DEX volume on Polygon dropped from $218 million to $45 million over the last three months. This implied that interest in Polygon’s DEXs was continuously waning.

This fall could have severe impacts on the overall state of the Polygon network’s DeFi market.

Battle of the DEXs

Taking a closer look at the individual performance of DEXs on the Polygon network can provide a clearer understanding of Polygon’s DeFi state.

One of the most popular DEX’s on the Polygon network, QuickSwap, witnessed a massive decline in terms of unique active wallets. The number of wallets on the platform fell by 23.64% over the last month. Subsequently, there was a decline of 25.89% in terms of volume, and a 26.74% decrease in the number of transactions.

Similarly, other DEXs on the Polygon network, including Balancer [BAL], encountered significant challenges. Balancer is a DeFi protocol that has private pools where a user can add or remove liquidity, join a multi-token pool with a single asset, and adjust weights continuously over time for dynamic strategies.

Over the last week, the unique active wallets on Balancer, along with the volume and transactions, also witnessed a fall.

The persistent underperformance of DEXs on the Polygon network could potentially impact Polygon’s DeFi state in the long term.

However, the introduction of zkEVM and new dApps being built on Polygon could soon capture a larger amount of the DeFi market share.

For instance, Antfarm, which is an AMM (Automated Market Maker) could attract users to the Polygon network due to its technology.

Antfarm’s Band Rebalancing strategy involves high pool fees (1-100%), capturing market volatility to optimize returns while reducing risk. Band rebalancing establishes upper and lower threshold bands for each pool, determined by pool fees, such that profits arise from market volatility rather than trading volume. Antfarm pools have managed to show consistent performance, unlike other popular DEXs.

However, despite the efforts made by Polygon’s ecosystem to add new dApps and updates to the network, the overall outlook of the crypto community towards Polygon remained negative. This was showcased by Santiment’s data, which indicated that the weighted sentiment around Polygon declined significantly since the beginning of April.

Will these efforts boost Polygon wallets?

Polygon’s humanitarian efforts could have a positive impact on the overall sentiment of the crypto community and change its perspective. In a recent tweet, Polygon posted about how it will work to support the development of Nigeria’s blockchain ecosystem.

Other developments on the Polygon network also include the introduction of WIW badges on the Polygon network.

The WIW protocol is a privacy-preserving identity protocol, designed to curate the reputations of Web3 users. It leverages Polygon IDs (Identity Infrastructures) to provide self-sovereign zero-knowledge, and records users’ web3 reputation & validations for various on-chain & off-chain activities.

BlockchainLock has also used Polygon IDs to empower organizations with privacy and security.

Coupled with these developments, Polygon’s founder Sandeep Nailwal hinted at a new collaboration between Stripe and Polygon. For context, Stripe is a popular technology company that provides payment processing software and services to businesses. Stripe has collaborated with Polygon in the past with regards to global crypto payments.

.@stripe on @0xPolygon ! ?? https://t.co/21bS3kgkz7

— Sandeep Nailwal | sandeep. polygon ? (@sandeepnailwal) May 6, 2023

A new collaboration could impact both Polygon and MATIC positively.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

At press time, however, MATIC’s prices were declining. In the past month, MATIC’s price fell from $1.119 to $0.98. Coupled with that, the network growth of the token also decreased. This showed that the frequency with which new addresses were transferring MATC for the first time had fallen.

During this period, the overall velocity of MATIC also fell, implying that addresses weren’t exchanging MATIC as often as before.

![Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!](https://ambcrypto.com/wp-content/uploads/2025/06/Kaspa-Featured-400x240.webp)