Polygon: Why $0.37, $0.38 support levels are key for POL to rally

- Polygon whales have accumulated 140 million tokens worth $56 million.

- POL has surged by 17. 45% over the past month.

Over the fortnight, Polygon [POL] has experienced a strong upswing. Since hitting a low of $0.28, the altcoin has surged to hit a high of $0.47.

In fact, as of this writing, POL was trading at $0.4348. This marked a 2.89% increase on daily charts, with the altcoin gaining by 17.45% on monthly charts.

However, POL has seen a decline on weekly charts, dropping by 0.92%. Even though POL has witnessed a price pump, it remained 66.07% below its ATH of $1.29.

Therefore, these market conditions raise questions about the sustainability of the uptrend. Inasmuch, the popular crypto analyst Ali Martinez has posited that POL can make higher high, citing key support levels.

Polygon’s market sentiment

In his analysis, Martinez cited Polygon’s $0.375 and $0.386 supports, arguing that POL must hold these levels for a sustained rally.

According to him, these are the most important ranges and if they hold, POL will make higher highs since the resistance at these levels is insignificant.

In context, when we say resistance seems insignificant it means that at these levels, the prices are unlikely to encounter strong selling pressure.

Above these support levels, there’s weak resistance and sellers can’t dominate. Without selling pressure, POL could see a strong upsurge until it reaches a mark where it will encounter strong resistance.

What POL’s chart suggest

Since POL was trading above these levels at press time, it implied that the altcoin was safe from selling pressure in the short term.

When we looked at Polygon’s Advance Decline Ratio (ADR), it has surpassed 1 to settle at 1.47 after a sharp drop. With ADR above 1, it reflects a growing optimism among investors, leading to widespread buying activity.

This increased buying pressure was evident from the fact that Polygon’s Relative Strength Index (RSI) surged from 49 to 60. When the RSI rises, it shows that buyers are entering the market, thus increasing buying pressure.

Additionally, the increase in buying pressure was further supported by rising whale accumulation. Polygon’s whales have bought around 140 million POL tokens over the past four days, worth $56 million.

The whale activity coincided with a rising buying activity, suggesting that large holders were highly bullish and actively accumulating.

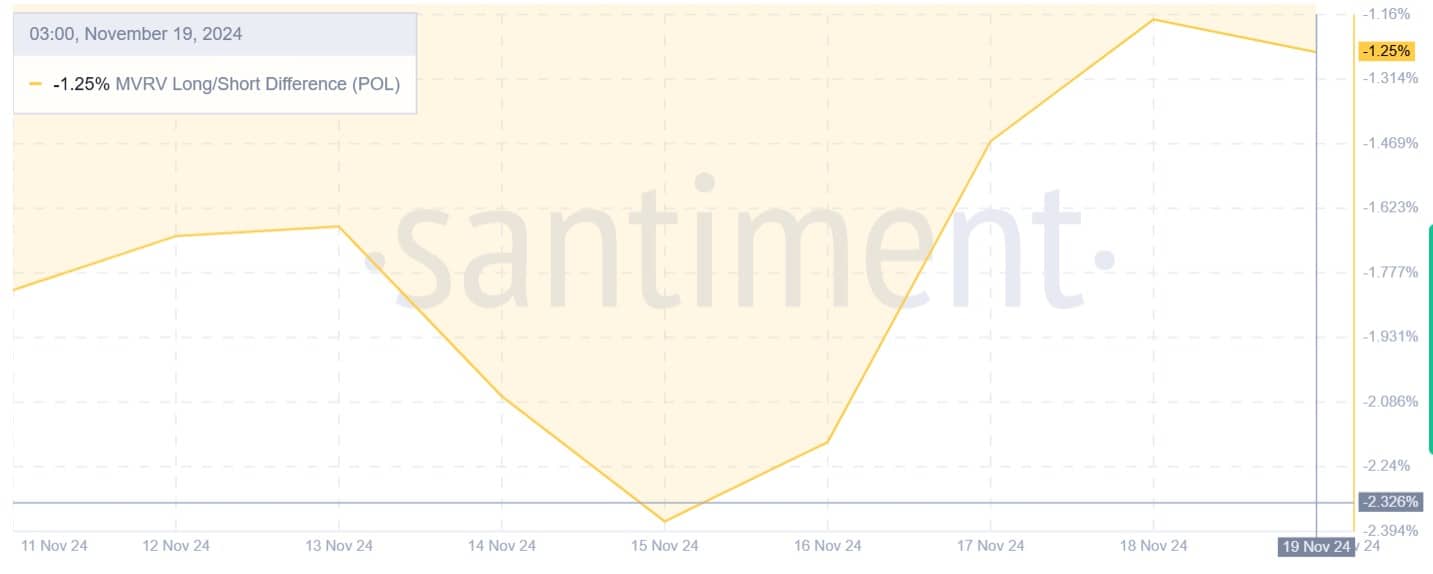

Large holders’ confidence in POL can be further seen in the rising MVRV long/short difference. This has risen from -2.37 to -1.25.

When the ratio rises, it suggests that long-term holders are in profit and are confident with the altcoin’s future value.

Is your portfolio green? Check out the POL Profit Calculator

Simply put, POL is currently experiencing strong buying activity, especially among large holders. Such market conditions tend to drive prices up through a supply squeeze.

Therefore, these conditions point towards further gains on POL’s price charts. As such, if these positive market sentiment hold, POL will reclaim $0.47 levels and find the next significant resistance around $0.57.